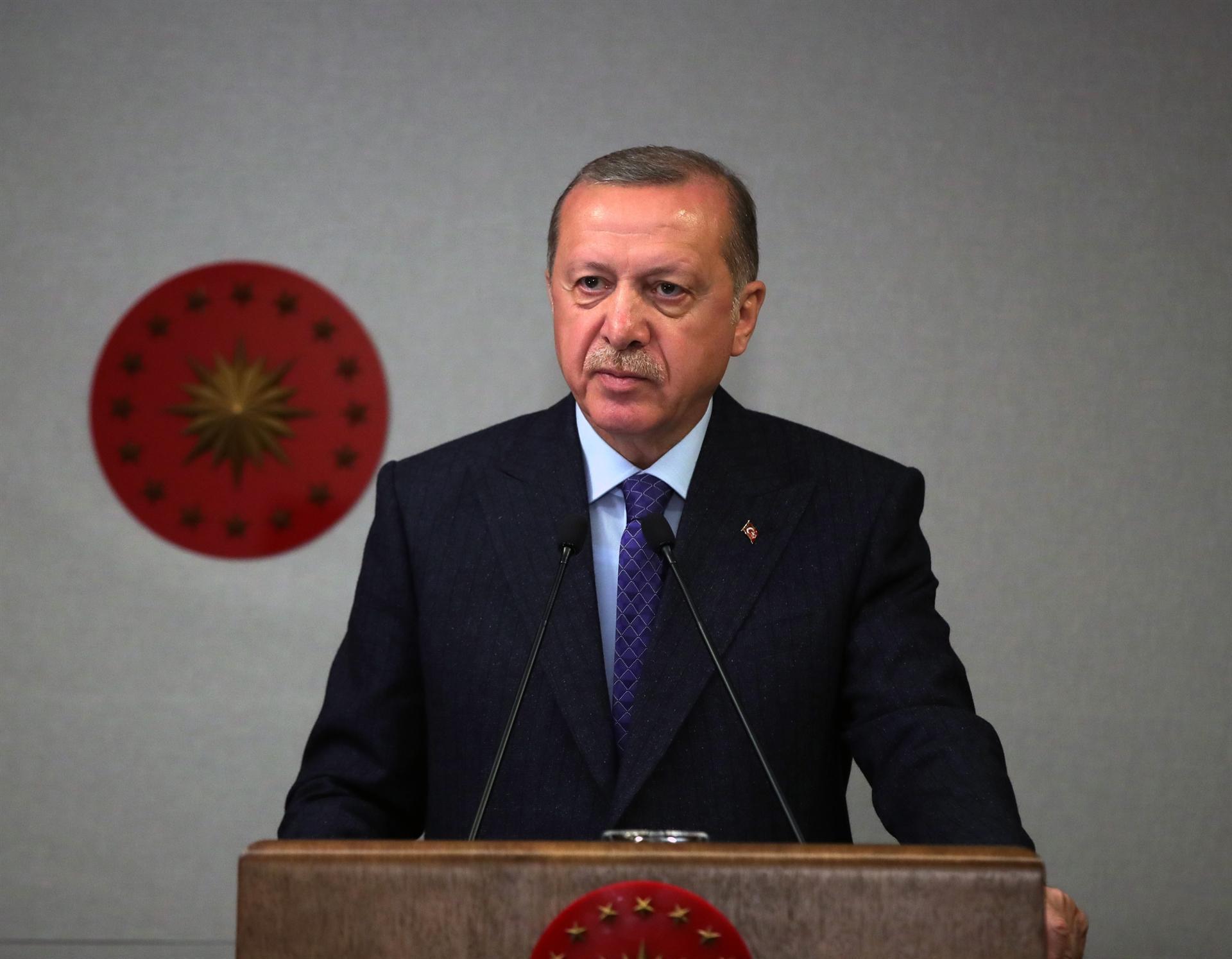

Erdoğan criticizes private banks for ‘not doing enough’

ANKARA

President Recep Tayyip Erdoğan has said that state-owned banks have taken a number of measures to help businesses amid the coronavirus outbreak, however, private banks are “failing the test.”

The country’s lenders, mostly state-owned banks, have deferred the debt payments of companies to the tune of 21 billion Turkish Liras (some $3 billion) and eased their pains from the fallout from the pandemic, Erdoğan noted.

State-owned banks similarly deferred the housing, car, and personal loan payments as well as credit card debt payments of around 800,000, which amount to 41 billion liras, the president added.

“While we have mobilized all our resources to support all sectors, private banks are doing very well in this test. We are expecting private banks to play their parts at a time when our country and our nation are going through a difficult time,” Erdoğan said following a three-hour virtual cabinet meeting on April 13.

The president also ruled out any borrowing arrangement with the International Monetary Fund (IMF) during the pandemic.

Erdoğan’s remarks followed the criticisms by Treasury and Finance Minister Berat Albayrak and the head of the banking sector regulator (BDDK) directed at private banks.

“While our state banks are standing by our citizens with all the resources they have, we are utterly saddened by the attitude of the privately held banks, Albayrak said earlier this week.

“I, once again, invite private banks to be a part of our unity and solidarity during these times with their attitude,” he added.

State-owned lenders have created an extra credit volume of 27.5 billion liras in the last 10 days, private banks’ credit poll contracted by some 5 billion liras in the same period, said BDDK head Mehmet Ali Akben on April 13.

“Important responsibilities have fallen on our banks to minimize the impacts of the period we are going through on production and employment,” Akben said.

“I’m inviting all the banks to act customer-oriented, keep the credit channels open and abide by the decisions taken by our agency and the sectoral associations,” he added.