Brazil and Turkey, two countries with a common fate…

Mustafa Sönmez - mustafasnmz@hotmail.com

AFP photo

While the world is watching the “emerging” periphery countries, the most fragile ones are Russia, Brazil and Turkey. South Africa is sometimes considered as well.

Russia is a country unique to itself. Even though it is an energy exporter, because of the drop in energy prices as well as the Ukraine and Crimea issues that strained its relations with the West, it was subject to embargoes. Its currency, the ruble, lost enormous value against the dollar; its growth went all the way down to 0.6 percent in 2014. Its estimated growth is no more than 0.7 percent for 2015.

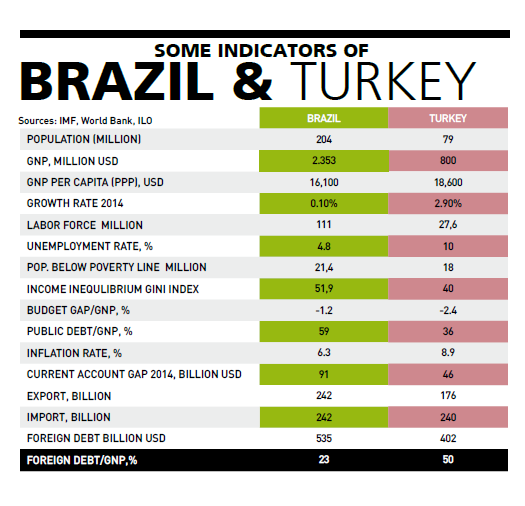

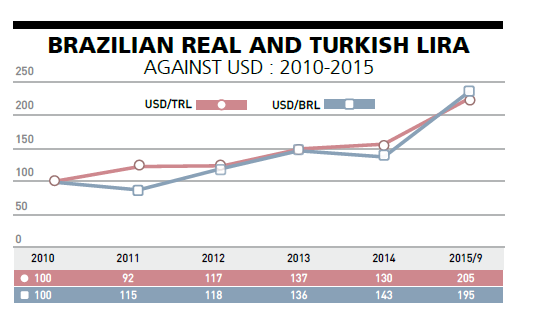

On the other hand, Brazil and Turkey, among the fragile periphery countries, are two that seem more likely to be compared with each other; they are two countries that have similarity and parallelism in their experiences. So much so that, recently, efforts are being made to predict the trends in Turkey by monitoring what is going on in Brazil. For instance, the foreign exchange rate. There is a huge similarity when the Brazilian real and the Turkish Lira are compared at the IMF database as of September 2010.

Dollar, 3.50 liras?

If we consider September 2010 as 100, the real became 205 at the end of September 2015. In other words, it devaluated 105 percent against the dollar in six years. The lira lost 95 percent value during this period. Especially in the 12 months following September 2014, the devaluation in both countries was fast. It was 59 percent in the real and 37 percent in the lira. Several analysts, taking into consideration this speed, are stating the dollar will reach 3.50 liras depending on domestic and international economic and political developments.

Similarities

Despite the difference in their histories, Turkey and Brazil are similar in the style they joined the world economy and the roles that they have taken. That makes comparison possible. There is also a thesis written on this subject within the Central Bank. Expert Emre Yalçın wrote it.

Brazil: From yesterday to today

For about 300 years, Brazil was exploited through its cut veins as Portugal’s colony and was independent in 1822. Slavery was lifted only in 1888. It then moved from colonialism to neo-colonialism. For years, it was again a country the raw material resources of which, its coffee, soy bean, cotton, iron ore and oil, was extracted by multinational companies and taken away.

With global roles re-distributed in association with the level the accumulation of capital, just as it happened in Turkey, after 1960, Brazil was first industrializing with import substitution then, starting in 1980s, an export-oriented model was dominant. Brazil was ruled under a military tutelage for many years until becoming “civilian” in 1985.

Brazil adopted and rapidly harmonized with neoliberal policies and the 2000s became leader Lula’s Labor Party era. The one-party rule of the Justice and Development Party (AKP) in Turkey corresponds to Brazil’s Labor Party era.

Again, just as in Turkey, with intense foreign capital inflow, Brazilian economy, like during the AKP era, was able to grow at a rate of 6 to 7 percent annually. Also, just like Turkey’s capitalism, as of mid-2013, with the possibility of Fed’s interest rate increase, foreign hot money started to exit. From that day on, then real started losing value against the dollar, actually faster than the lira.

In the capital outflow in Turkey, political risks, especially the “Palace factor” is important. In Brazil, foreign capital is exiting mostly because of the increase in economic risks. Brazil is sending 20 percent of its exports to China. With the falling of demand, its economy started shrinking, its foreign currency income decreased and its foreign currency equilibrium started having deficits. Nevertheless, even though its current account deficit is $91 billion, it has not yet reached 4 percent of its national income.

Shrinking

Brazil is at the seventh place in the world in terms of national income; its population is three times of Turkey’s at 190 million. Its growth was 1.8 percent in 2012, 2.7 percent in 2013 and went down to 0.1 percent in 2014. This year almost 2 percent shrinkage is expected. The IMF can predict only a 0.7 percent growth for 2016 for Brazil. Its economy has shrunk for two quarters consecutively in 2015 and entered recession.

In terms of bribery and unjust income distribution, there are similarities between Turkey and Brazil also. In 1992, former Brazil President Fernando Collor de Melo was accused of bribery and was released from duty.

Today, all the advisors of President Dilma Rousseff’s are involved in the bribery scandal of Petrobas Company.

Income inequality is another common aspect of Brazil and Turkey. Even though Turkey claims it has curbed the inequality, it is again one of the countries in the world together with Brazil where income distribution is most unjust. Indicator of the inequality, the Gini coefficient is 52 in Brazil. In Turkey, this coefficient was 40 last week for 2014.

Despite all the anti-poverty measures the Brazilian Labor party has undertaken, the population below the poverty line is nearing 23 percent. In Turkey, the population living below the poverty line is 18 million.

Better chances for Brazil

Brazil’s indicators show that it is not very difficult for it to come out the current recession. Its raw material and export power of its manufacturing industry are much better than Turkey. Its outstanding external debt is $535 billion but this is only 22 percent of its national income. Turkey’s outstanding external debt is around $400 billion and this is near to 50 percent of its national income. Thus, Brazil’s is manageable; moreover, 40 percent of Turkey’s external debts are due in less than 12 months.

Brazil’s public finance indicators are no better than Turkey’s. Brazilian state’s internal debt burden is near 60 percent of its national income and its budget deficit is around 1.5 percent of national income. They are in accordance with norms.

Brazil’s annual inflation is 6 percent, about 3 points below Turkey’s. Brazil has 111 million in its workforce and its unemployment is around 5 percent; in other words, it is below Turkey’s fixated 10 percent.

Alongside with these economic indicators, it is the major political risk that differentiates Turkey from Brazil.

The political risk, which is intertwined with geopolitical risk in Turkey, takes the country into lower international ratings. The credit rating cut Brazil experienced last month is expected to repeat for Turkey in a short while.

Nevertheless, it is observed that Brazil has a better chance to overcome its recession, whereas it is very difficult for Turkey to solve its ball of problems unless it reduces its political risks to have a stable government.

This ball has many knots in it and its solution is painful.

In the last two months of 2015, it looks as if all eyes will be turned on Turkey…