Braveheart ROCs Central Banking

During

a speech on Friday, Central Bank Governor Erdem Başçı underlined that it would

take a (brave) heart to implement the Bank’s latest tool, Reserve Option

Coefficients (ROCs).

Commercial

banks have been allowed to keep some of the lira reserves they are required to maintain

at the Central Bank in foreign currency (FX) for a while. At the end of

May, the Central Bank increased the upper limit of this option to 45 from

40 percent of total required reserves. It also noted that this last 5 percent

would have to be multiplied by a coefficient of 1.4. So 100 liras of reserves

could be replaced with 140 liras worth of euros or dollars.

Since

then, the Bank has not only increased the upper limit gradually to 60 percent,

it has also introduced different ROCs at different tranches. While it

cut its lending rate by 1.5 percent at the latest rate-setting meeting on

Tuesday, the Central Bank also increased all

ROCs by 0.2, which now vary between 1.3 in the first tranche of 0-40

percent to 2.2 in the final tranche of 55-60 percent and have emerged, along

with the interest rate corridor, as the primary policy tool.

You

might wonder why banks would want to keep more money as reserves that don’t pay

out any interest- the simple answer is that it is cheaper to borrow FX than

lira. In fact, you can find the threshold FX interest rate for each tranche by

dividing the cost of Central Bank funding by the ROC. Since that rate is

currently 6.1 percent, banks would want to utilize the option in full for the

first tranche as long as they can borrow in FX at lower than 4.7 (6.1/1.3)

percent.

Of

course, this is only a very rough calculation, which assumes banks can get as

much foreign funding as they want. But the more interesting question is why the

Central Bank would want to implement such a scheme. For one thing, it would

take some pressure off the lira if the country is exposed

to strong capital inflows resulting from the global

easing by the major central banks.

In

fact, ROCs can work both ways. When this hot money stops or reverses, banks

could tap their FX reserves at the Central Bank. In this sense, the Bank sees

its new tool as an automatic stabilizer. While it could indeed decrease FX

volatility, I am not sure if this novel system could withstand a major crisis. Besides,

I wonder if it is making Turkey more vulnerable by encouraging foreign

borrowing.

Başçı

noted that that having FX parked at the Central Bank makes it easier for banks

to borrow from abroad, and they have indeed resumed getting foreign loans.

That’s when I started getting confused. I thought the Bank did not want dollarization

and currency

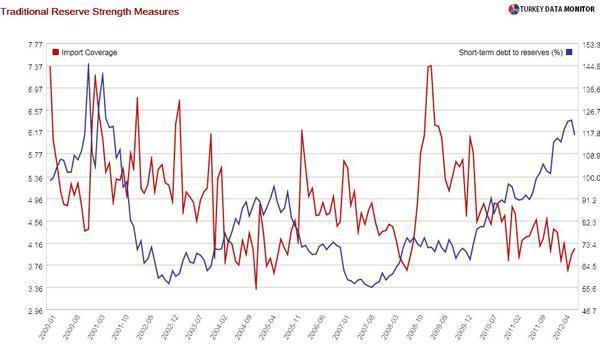

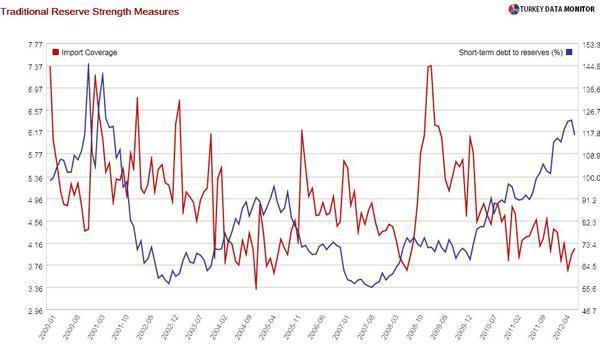

mismatches in the first place. The ratio of short-term debt to reserves,

one of the Bank’s reserve strength indicators, is already above one.

My

confusion grew when he emphasized that only central banks not paying interest

on reserves could implement ROCs, and that required guts, or a brave heart. I

could not figure out the relationship, so I consulted a Turkey economist as

well as a couple of central bankers. They could not, either.

The Central Bank’s new tool indeed ROCs. I hope adding another layer to the already-complex set of policies does not make us also roll.