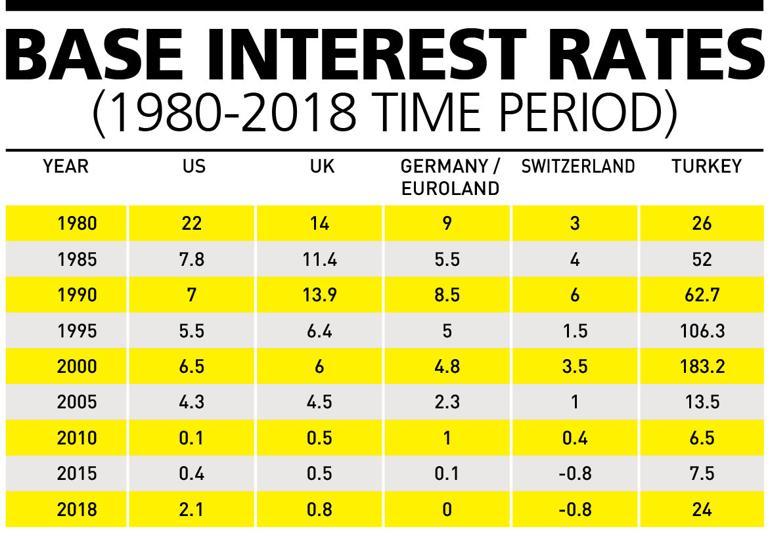

In the last 10 years, the whole world has been experiencing exceptionally low interest rates. This is largely due to Central Banks acting globally to offset the effects of the great recession of 2008. Fortunately, programs such as quantitative easing and short-term rate cuts have been effective in avoiding a major disaster in the last decade. Interest rates in the Western world have also been on a downward path for the last 30 years as may be seen in the table below.

For instance, the interest rate in the U.S. was 22 percent back in 1980 and has remained below 2.5 percent since 2010. Similarly, the interest rates in the U.K., Germany, and Switzerland are below 1 percent. Turkey’s case is somewhat different in that interest rates only decreased once the country’s economy became more integrated with international markets following 2001’s economic reforms.

While the long-term financial implications of living in such a “low-interest” rate environment remain to be seen, we can discern whether there will be Central Bank policy changes in the meantime. There are some signs now that we’re in a rising rate environment both in the U.S. and globally. If the FED (American Central Bank) hikes rates in December as expected, it’ll be the fourth time that the Central Bank pushes rates up this year. The FED is likely to further increase rates in 2019 if it is allowed to pursue its independent policy.

If the interest rates gradually start to increase over the next decade, what kind of implications would this have for Emerging Market (EM) economies like Turkey? This hypothetical question merits serious consideration as it might help our country better prepare for new possible macroeconomic configurations.

Most importantly, increases in interest rates will have implications for the credit cycle. The relatively low interest rate environment of the last decade has been good news for loan-takers and spenders in Turkey alike. It also helped mortgage holders get good rates from banks. Turks spent more money on discretionary consumption and also welcomed the increase in mortgage activity, which they saw as a practical path towards home ownership.

Therefore, potential interest rates increases would have major (and offsetting) impacts. Firstly, it would encourage people to save more and borrow and consume less. Since consumption and housing sectors have been key drivers in Turkish GDP growth, economy policy makers would need to rely on other dynamics, such as industrial production, to drive economic growth. Moreover, while the Turkish debt is low by international standards (around 30 percent of the GDP), the private sector has most increased its foreign-currency denominated debt in the last decade (around $285 billion at the end of 2017).

In a rising interest rates context, banks are therefore generally likely to be very selective vis-à-vis private sector loan-takers. They would now be likely to limit or deny credit demands more frequently and require tougher conditions. Simply put, the private sector companies’ access to credit will be more modest and therefore fewer but more profitable projects will be funded. In terms of growth, the private sector is likely to contribute less than it did in preceding years.

While this scenario is pessimistic and undesirable for private companies, it would not be the first time that Turkey faces such challenges. During 1930s (following the Great Depression) and 1970s (following the 1973 Oil Shock), Turkey managed to grow and even industrialize under the economic leadership of the state. So in following years, while the private sector focuses on debt-reduction, the state, with its relatively stronger financial standing, could allocate more resources and develop programs to stimulate and grow the economy. While it is national stakeholders that choose the state intervention, one way could be through closer cooperation between state institutions and tech companies to grow faster through technology and industrial sectors (see November 5th’s “Reinforcing the Turkish entrepreneurial state” for examples).

Anticipating 2019’s macroeconomic context, where FED interest rates could be as high as 3 percent, it is fair to stay that it would be harder for EMs to attract international capital. Not only would international investors demand higher risk premium from EM countries, but they would also likely favour issuers with strong and close communication with the investment community. In this sense, it will be beneficial for our economy if we can all focus on communication and public relations in order to communicate our country’s economic potential and success. This will certainly help attract more investment flows.