Audit put Greek banks losses at 30 bln euros

MADRID - Agence France-Presse

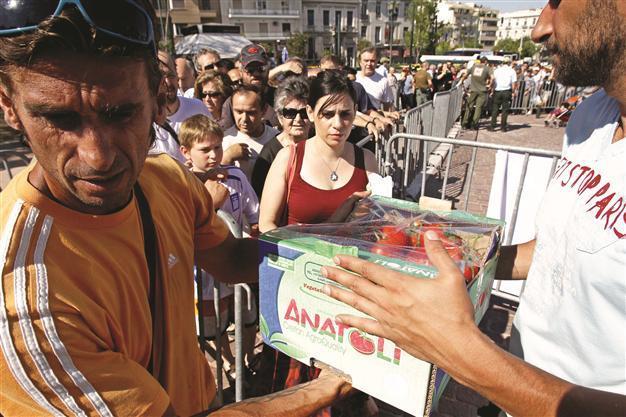

A woman is seen receiving a packet of free vegetables as the others were waiting in the line in Athens yesterday. The crisis has hit the daily lives of Greek citizens. AP photo

An audit of Greek banks by U.S. investment group Blackrock last year that was not published estimated their loan losses at 30 billion euros ($38 billion), a Piraeus Bank executive said on June 19.“Expected losses from risky credits have been evaluated by Blackrock... at 30 billion euros over the next three years,” bank vice president Panayotis Roumeliotis was quoted by a press statement as telling a conference organized by an association of Greek managers.

Blackrock had carried out an audit of Greek banks to determine how much they would need in

recapitalization funds, but the result, which was initially to be released in January, was never published. The result was used however to determine how much money should be made available to Greek banks to compensate for losses linked to a debt writedown negotiated by Athens with private creditors.

The amount available for the four biggest Greek banks, National Bank of Greece, Alpha Bank, Eurobank and Piraeus Bank came to more than 23 billion euros.

The European Union agreed to provide up to 50 billion euros to Greek banks via the European Financial Stability Facility.

Meanwhile, Roumeliotis also said that Greece would likely need more aid, in part because its recession is worse than expected, and there have been few revenues from privatization of Greek assets.