85 percent of Turkey’s foreign investors still from West

Mustafa Sönmez - mustafasnmz@hotmail.com

HÜRRİYET photo

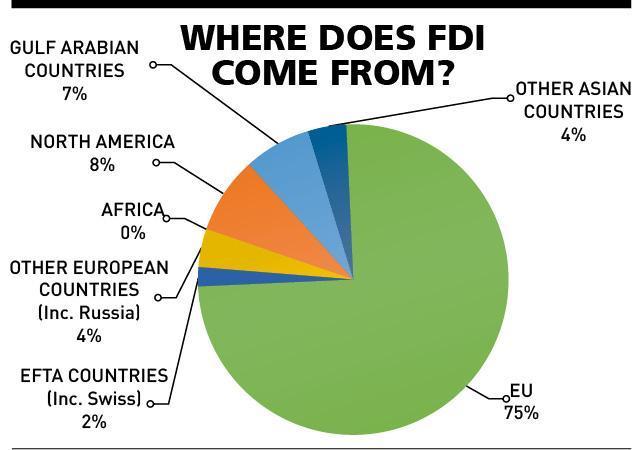

Despite increased recent attention to relations with Gulf partners such as Qatar, Turkey remains overwhelmingly dependent on Western sources for foreign direct investment (FDI), according to data from the Central Bank. Data shows that 85 percent of FDI came from the EU, other European countries, and the U.S. Only around 15 percent came from Asian sources, with Gulf countries having a share of only 7 percent of total FDI.

Qatari storyIn recent years it has been Qatari capital that occupied the headlines of Turkey’s economic news, with particular attention drawn to rising FDI. Qatari capital bought one of the most important private Turkish banks Finansbank, which had been previously been owned by a Greek group. It was also revealed that the Qataris were about to strike a $3-$4 billion deal with one of the top private banks in the sector to become strategic partners. That would have made three banks with which Qatar was strategic partners with in Turkey.

Before that, the Qatar-based Mayhoola for Investments Fund invested 885 million Turkish Liras in the Boyner Group, buying 30.7 percent of its shares. A Qatari partner came in 2014 to Ethem Sancak’s BMC company, operating in the field of military vehicles. After the deal, the Qatari Armed Forces Industry Committee bought 50 percent of BMC’s shares. Again, the Commercial Bank of Qatar paid $460 million to another Turkish bank, Alternatifbank, stepping into the Turkish banking system.

Even though the sale price was never announced, rumors are that the Qataris paid $1-$1.2 billion for the media platform Digiturk. For Finansbank, the word is that there was a deal of approximately $3 billion, in other words 2.7 billion euros. Based on these talks, except for small purchases, total direct Qatari investments in Turkey stood at $6 billion. If they buy shares from a private bank, it would exceed $10 billion.

Even if this figure is true, what does it mean for overall FDI in Turkey? What is the share of petrodollar rich Gulf countries, including Qatar, which are known to be ideological and diplomatic allies with the Justice and Development Party (AKP) regime?

The big picture Turkey has long needed the inflow of foreign resources and has been trying to attract FDI and find foreign loans. These efforts have been particularly crucial since 2002. In earlier years, Turkey’s high public deficits, fragile banking system, high inflation, and political risks, were not attractive to foreigners. The radical reforms carried out with the International Monetary Fund (IMF) after the 2001 crisis, which cost the coalition government of the time dearly, increased the appetite of foreigners. There was already a surplus of liquidity internationally and when they were looking for an address to go to, Turkey came into the picture.

This inflow became a golden opportunity for the AKP, which first came to power in November 2002.

Unprecedented FDI inflows came through, as well as purchases of shares in the stock market and loans to companies. We saw from the Central Bank balance of payments data that the foreign resource flow in 2002 was only $7.5 billion, but had risen to $37 billion in 2005. Privatization of public enterprises, the sale of certain private banks to foreigners and foreign loans were effective in this increase.

Foreign capital flow continued and increased. In the period between 2002 and 2015, it reached an annual average of $37.3 billion. Every year an average of one-fourth of the foreign capital was as FDI and 27 percent was for operating in the stock market, while the remaining was for short- and long-term loans, mostly for the private sector.

According to countries Some 85 percent of FDI, which exceeded $130 billion in the 2002-2015 period averaging $9.3 billion annually, came from the EU, other European countries, and the U.S., while 15 percent came from Asian sources. The Gulf countries, which are in the Asian group, had a share of only 7 percent in total FDI.

Loans from the West While 85 percent of the direct investments to Turkey came from Western capital, 48 percent of the foreign “loaning” flow also came from Western sources.

Again, according to Central Bank data, the private sector, which has nearly 70 percent of the outstanding debts, predominantly borrows from Europe. It was determined that 56 percent of the private sector’s long-term loans, which reached $188 billion as of the end of October 2015, came from Europe, while 12 percent came from the U.S. This also shows that loaning from Western financial sources has reached 68 percent. Asia’s share was 15 percent.

The United Kingdom (London banks) is the financial market from which the private sector loans the most, followed by Germany, the U.S., the Netherlands and Luxembourg. Only oe Gulf country, Bahrain, has a share of 6 percent in loans from this channel.

Some 30 percent of Turkey’s outstanding foreign debts, some $120 billion of the total $405 billion, toward the end of 2015 were made up of short-term loans and even though there are no sources showing where these came from, it is estimated that they were predominantly from Europe and U.S.-based financial institutions.

Public’s creditors It was observed that from foreign finance sources, those which financed Turkey’s public sector, gave loans to the public or invested in government bonds were predominantly made up of official institutions. According to the data provided by Turkey’s Treasury, the country’s outstanding foreign debt is $405 billion, and $115 billion of this belongs to the public sector.

Public institutions have loaned a $17-billion portion of this from private establishments as short-term loans. The main part of public loans was long-term and from them about $8 billion was loaned from private institutions (with $27 billion from international official institutes). The IMF was the creditor of $1.3 billion; however, the World Bank’s credits reached $10.3 billion. Several government institutions were main creditors and EU members constitute the most. The public’s $62 billion debt was in government bonds and the markets.

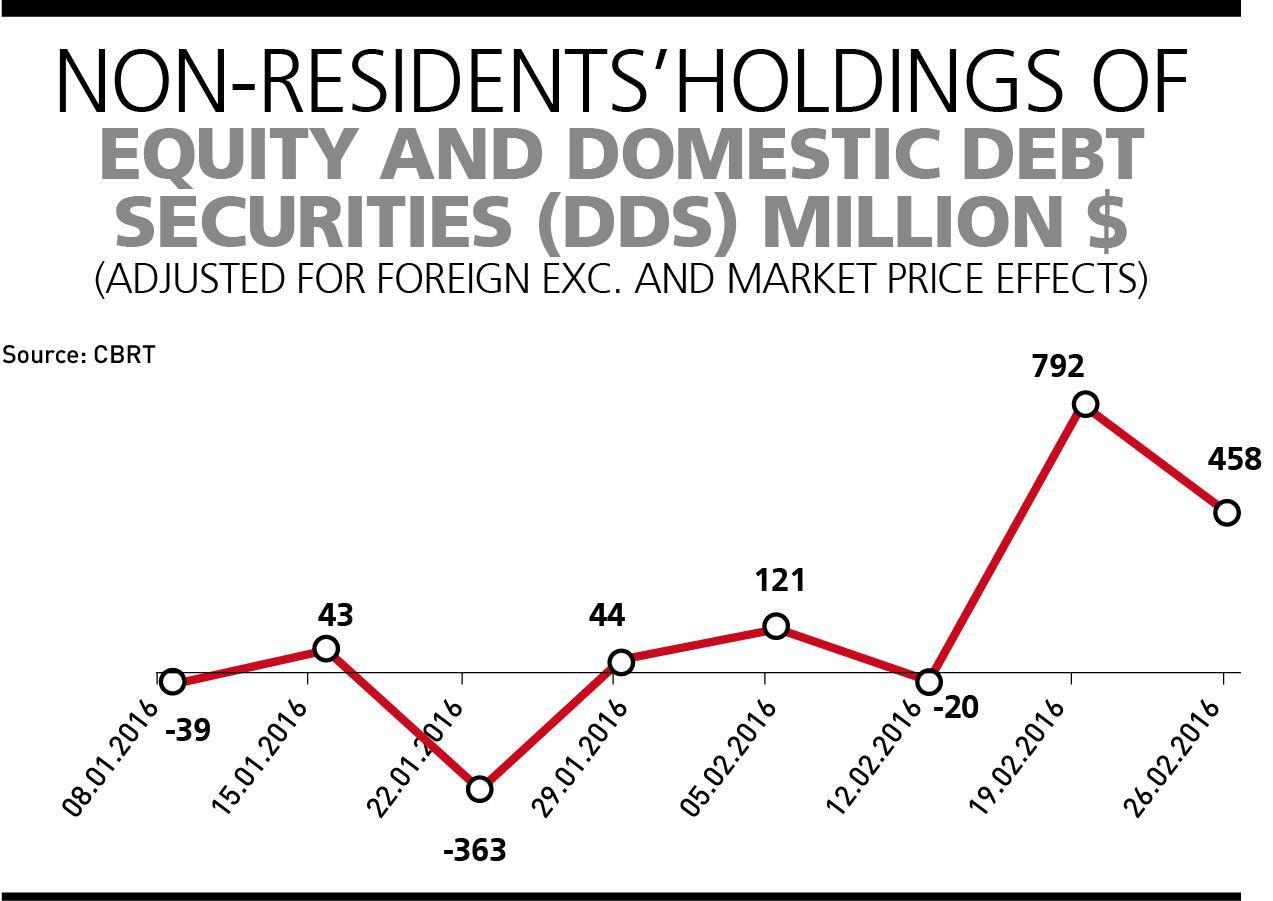

Foreigners in the stock market

Some 27 percent of foreign investors in Turkey came for the stock market, investing in stocks and government bonds. Even though there were withdrawals this year, at the end of 2015, the foreign investment stock in Turkey’s bourse was $72 billion.

Out of this, $40 billion was made up of stocks. The U.S.’s share in investments reached 40 percent, the U.K.’s was 22 percent, and Luxembourg funds had a 10 percent share. Saudi Arabia had a share of 2.4 percent in the portfolio.

Some 70 percent of foreigners who have invested in government bonds, stated to amount to $32 billion, come from European countries and 23 percent were of U.S. origin. The share of Asian investors was 5 percent.

In sum In summary, about 70-75 percent of FDI to Turkey in the AKP era since 2002 is European in origin. The U.S. has a share of about 15 percent, while Asian investors - including Gulf countries, have a 15 percent share. The shares of Gulf countries such as Qatar, Bahrain and Saudi Arabia remained at around 5 to 7 percent. Even though the political closeness of these countries with the AKP regime has a share in their investment preferences in Turkey, it seems that profit prospects and already existing build-up are more important.