Why can’t you just be a good boy and die?

Every once in a while, I get the urge to emulate my more illustrious colleagues by making bold predictions on markets. I almost always end up humbled.

Every once in a while, I get the urge to emulate my more illustrious colleagues by making bold predictions on markets. I almost always end up humbled.

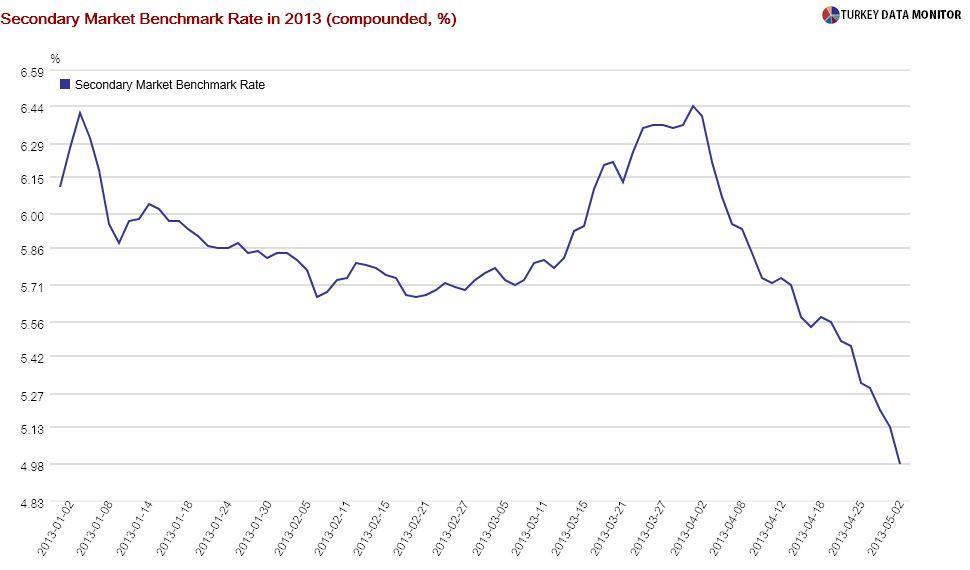

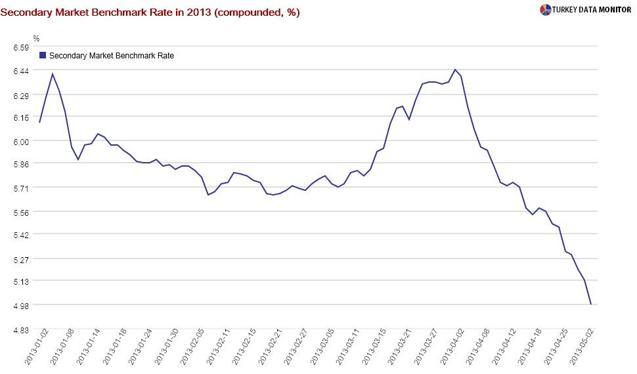

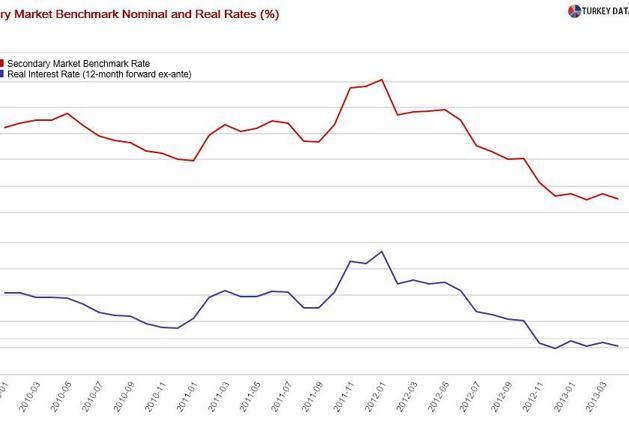

I wrote on January 13, after the Turkish two-year benchmark government bond yield fell below 6 percent, that like James Bond villain Auric Goldfinger, I was expecting Mr. Bond to die. For a while, I seemed to be right: After hovering around 5.8 percent for a couple of months, the benchmark started rising in March, reaching 6.5 percent in early April. It has been in free-fall since then, closing below 5 percent for the first time ever on Friday.

The factors that caused the rally back in January are in action again. Turkish bonds were again supported by a favorable inflation print and developed country central banks, which resulted in record flows to other emerging market (EM) bonds as well. According to fund-tracker EPFR Global, flows into EM bond funds hit a 15-week high last week. There were also rumors of an upgrade to Turkey’s sovereign credit rating.

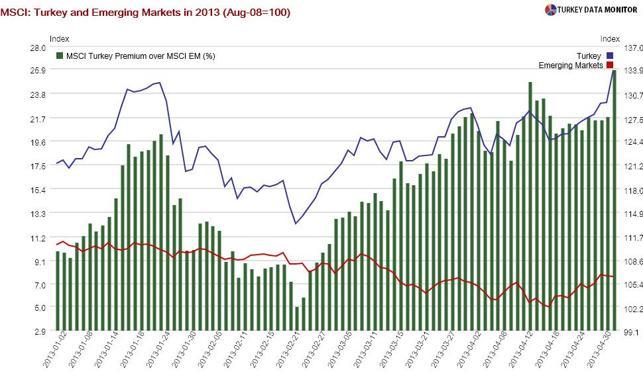

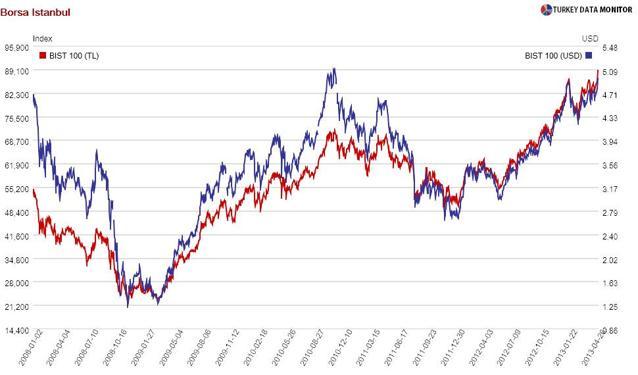

But this is definitely not the whole story. For one thing, if EMs were responding to signs that the Federal Reserve would not exit its quantitative easing soon, you’d expect EM stocks to sell off after strong U.S. labor data on Thursday and Friday. They indeed did, with one notable exception. Borsa Istanbul (BIST) rallied, hitting an all-time high on Friday.

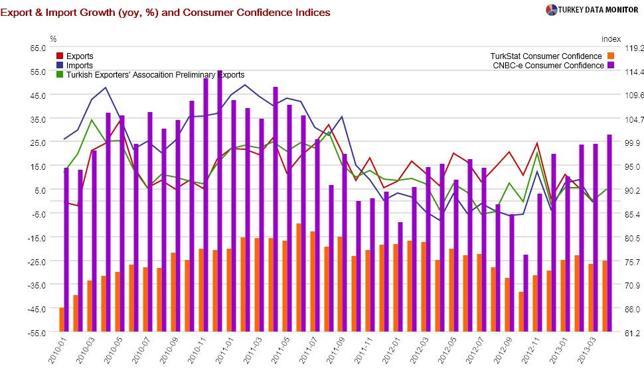

This is more puzzling when considering that recent Turkish data have been pointing to an unfavorable growth outlook. While confidence indices released last week somewhat improved, actual March and preliminary April trade figures are hinting that the economy is unlikely to rebound quickly. On the contrary, April purchasing managers’ index, while still showing growth in economic activity, is suggesting a broad-based deceleration in growth.

The answer lies in monetary policy. Among the many points Governor Erdem Başçı made during his introduction of the Bank’s latest Inflation Report, one theme stood out: The Bank will focus on reviving growth. Başçı went as far as to underline that we “have to learn to live with negative real interest rates.” This once sentence, which almost guaranteed negative rates for the near future, was the key driver of last week’s equities and bond rally.

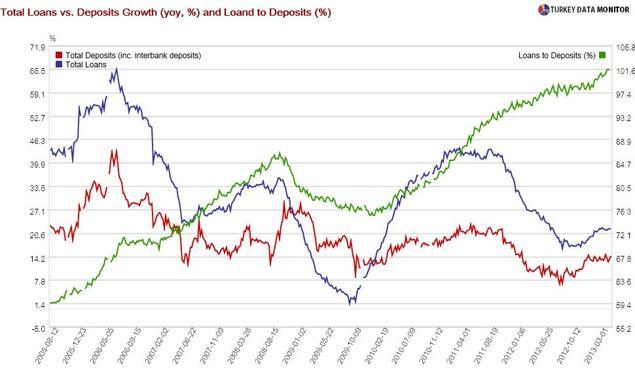

The Bank argues that low oil prices will keep inflation and the current account deficit at bay, while negative rates will curb credit by lowering deposit growth. Almost all Turkey economists buy this “high five” scenario of 5 percent (of GDP) current account deficit, inflation, interest rates and growth. I’d argue that credit growth will not slow down this way, negative rates are not sustainable for Turkey and inflation dynamics could force the Bank to become hawkish sooner than expected, even if a sudden stop in capital flows doesn’t cause this gameplay to crumble first.

If you are wondering, as another villain asked 007, “Why can’t you just be a good boy and die?”, that will be the day our good old friend Turkish Bond dies for good.