What’s driving the rise in oil prices?

The price of Brent Crude, the benchmark based on North Sea oil, fell $ 35 between April and June, but increases since then have taken about $ 25 of that back. According to many, reports that Israel will bomb Iran’s nuclear facilities are behind this surge. But do markets believe that this event is now more likely to occur?

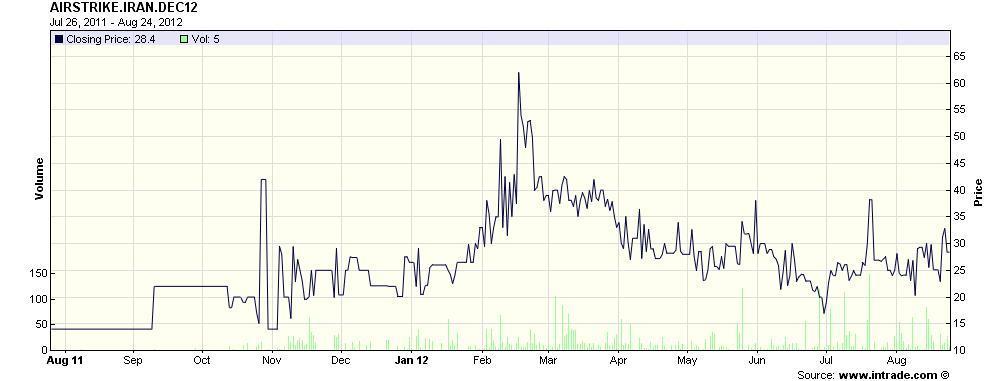

Prediction markets allow anyone to bet on real-world events, anything from who will win the U.S. Presidency to whether Bashar al-Assad will still be President of Syria at the end of the year. Intrade, one of the largest of such markets, has a contract on whether Iran will be hit before year’s end. The price of that bet has pretty much stayed constant, not only in the last couple of weeks, but also during oil’s sharp fall from April to June and its strong rebound afterwards.

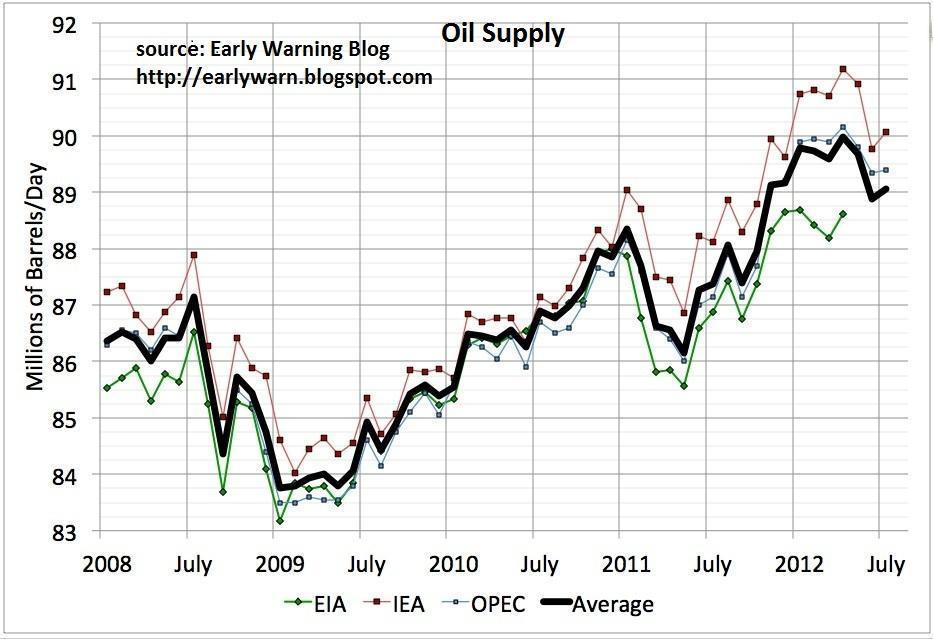

Supply fears are probably the second most popular reason cited for the rise in oil prices. Markets could be worried that Iranian oil sanctions would cause a disruption in supply, but everyone had six months to prepare before the sanctions came into play.

Regional supply shortages have been balanced by more production elsewhere. While there are maintenance-related cuts in the North Sea, the U.S. has increased output. As a result, the wedge between Brent and West Texas Intermediate, the other benchmark, has grown. Iraq has stepped in to fill the shortfall crated by Iran, and Saudi Arabia has been pumping record amounts. Overall, production fell about 1 million barrels per day in June and did not recover in July, but this cannot account for the entire jump in the oil price.

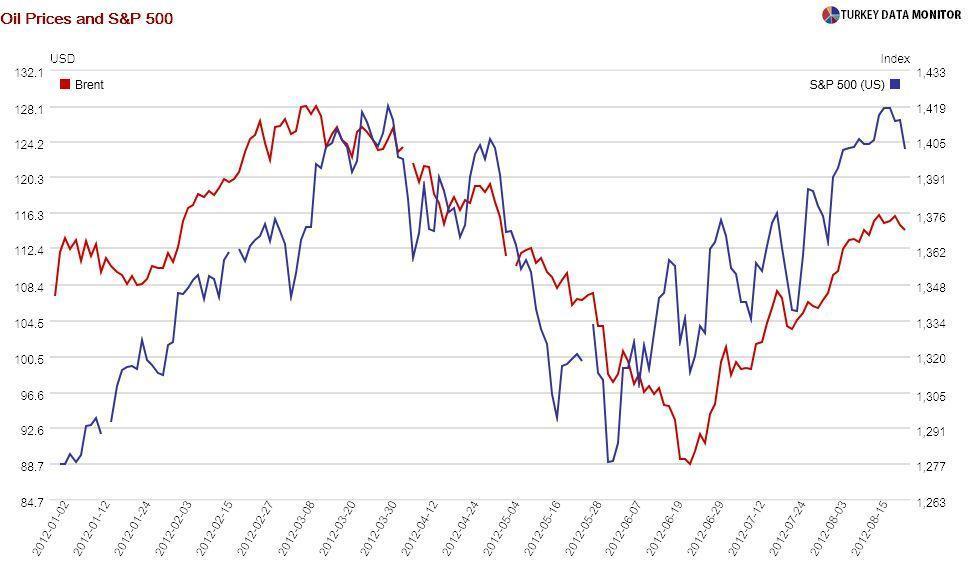

After going through similar arguments, James Hamilton, professor of economics at University of California, San Diego and oil expert, concludes that “the most important factor driving oil prices recently has been changing assessments of how strong the world economy will perform over the next 6 months.” He notes that the decline in oil prices from April to June and the subsequent rebound have mirrored stock indices.

But economic data since June have been mixed at best. I’d argue that oil has been supported of late by expectations of easing by the American, European and Chinese central banks. Those expectations got a boost this week, first with the publication on Wednesday of the Fed's recent meeting minutes, which suggested that quantitative easing may come soon, followed by remarks from People’s Bank of China Governor that adjustments to interest rates and banks' reserve requirements were still possible.

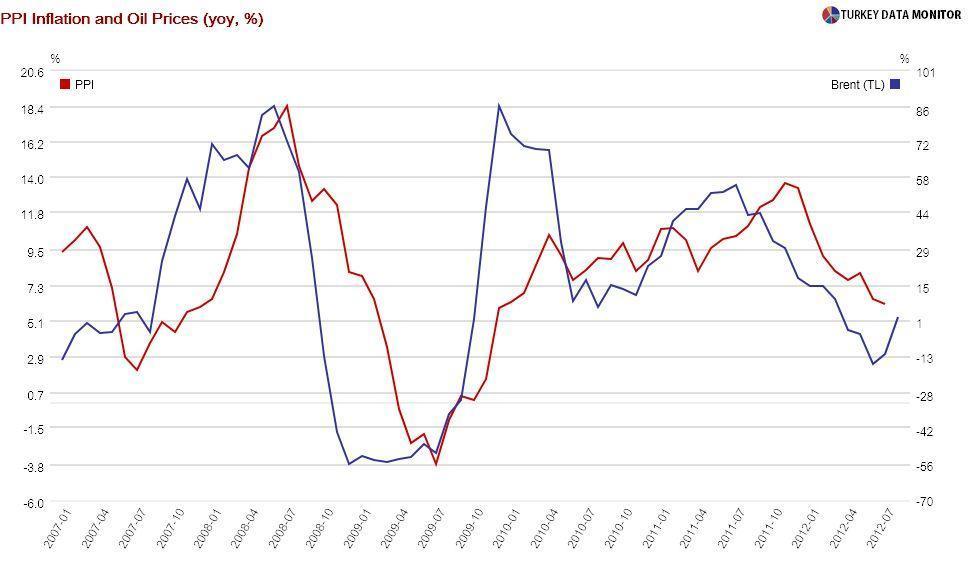

This discussion may help you understand whether or not the recent surge in prices will be temporary, which could have important local implications. Every Turkey economist knows that a $ 10 rise in the price of oil increases the country’s current account deficit by $ 4.5-5 billion. The Central Bank recently noted that the same $ 10 causes a 0.4 percent rise in yearly inflation.

Much is at stake here. In its latest assessment of the Turkish economy on Thursday, ratings agency Fitch noted that it could upgrade the country to investment grade if the current account deficit and inflation improve. The likelihood of this happening will partly depend on the path of oil prices.