Western pension funds eye Turkish projects

Hülya Güler ISTANBUL- Hürriyet

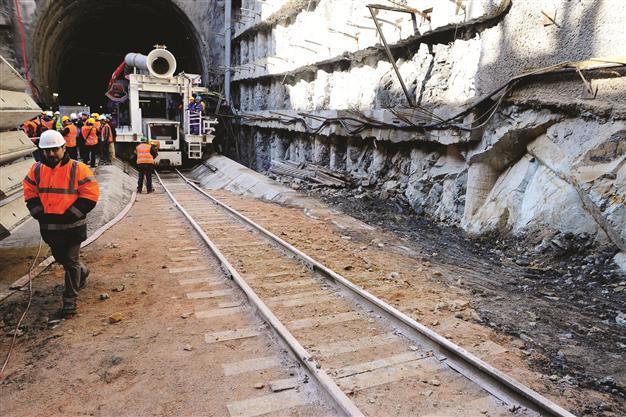

Western pension funds are looking to make investments in Turkey’s infrastructure projects,the head of Turkey’s investment agency has said. DHA photo

Western pension funds are seeking investment opportunities in Turkey’s major infrastructure projects, as they have been hit by financial crises in their countries since 2008, the head of Turkey’s Investment Support and Promotion Agency has said.İlker Aycı stressed that pension funds from Western countries, which had previously mostly been invested in exchange and bond markets in Turkey, are now looking for long-term investments. Aycı noted that Turkey’s notch upgrade to “investible degree” by Fitch in November 2012 had led to more attention being drawn to pension funds, particularly from the United States, Canada, Sweden and Norway.

“American firemen and Canadian teacher’s pension funds, for instance, are looking to make investments in Turkey’s infrastructure projects,” he said, adding that they aimed to be a financial partner in infrastructure projects like the construction of the third Bosphorus bridge and the third airport in Istanbul, as well as hospital privatization.

Aycı stated that pension funds in developed countries that have large portfolio investments spare a part of their portfolio for infrastructure investments, underlining that such funds coming to Turkey was important because they usually stayed for more than 10 years. He added that China, Singapore and some Gulf countries that had recently posted current account surplus’ were also considering getting involved in Turkey’s infrastructure projects.

Project boom

At a conference held in London last week, Turkey invited global investors to take shares in its $250 billion of infrastructure projects over the next 10 years, mostly in the transportation and energy fields, which are set to elevate Turkey’s position as an energy transfer hub in the region. These included the third airport and third bridge to be built in Istanbul, railway projects, the under-Bosphorus Marmaray project, and road projects. Aycı said that as around $80 million of the projects’ cost was estimated to be financed with local resources, the remainder needed to be financed by foreign resources.

He also added that the consortium of Koç Holding, Gözde Girişim and Malaysia’s UEM Group Berhad, the winner of Turkey’s canceled highways and bridges privatization tender, were interested in the third airport project in Istanbul.