US vendors near monopolies in Turkey’s arms acquisitions

ANKARA - Hürriyet Daily News

A group of Sikorksy-made Blackhawk helicopters arrives in Iraq’s Baghdad in this file photo. Sikorsky has recently won a Turkish contract with a version of its S70i Blackhawk. REUTERS photo

U.S. arms makers are re-establishing themselves in the narrower but still lucrative Turkish market, where European rivals appear to have lost their competitive edge. Defense analysts said political disagreements with countries whose arms makers Turkey once favored have earned U.S. contenders a “near-monopoly” position in off-the-shelf purchases.“This is not the first time Ankara used blacklisting as a foreign policy tool,” said one analyst here. “Recent disputes with Israel and France and the transformation of ties with Italy from excellent to just normal dictate that U.S. firms could enjoy a favorable competition condition they have not enjoyed for several years.”

U.S. companies recently won two contracts and are viewed as front-runners in two others. In April, Sikorsky Aircraft defeated Italy’s AgustaWestland in a multibillion-dollar competition to lead the co-production of more than 100 T-70 utility helicopters, a Turkish version of the U.S. company’s S-70i Black Hawk International.

And earlier this month, in selecting a producer of light police helicopters, Turkey’s top procurement decision-making body chose Bell Helicopter Textron over AgustaWestland and Eurocopter Deutschland, the German arm of Eurocopter.

But between 2000 and 2010, U.S. companies tried but failed to secure several Turkish contracts.

In 2000, for example, Bell Helicopter was selected for the Army’s multibillion-dollar attack helicopter deal, but the deal was never signed because of disagreements over price and the mission computer’s provider.

In general, U.S. companies won only U.S. foreign military sales-related contracts and single-source deals in Turkey in the 2000s.

Italy, Israel, France lose ground

Until 2011, units of Italy’s Finmeccanica were the top foreign players in the Turkish market. In fact, Italian firms won every Turkish contract between 2006 and 2007.

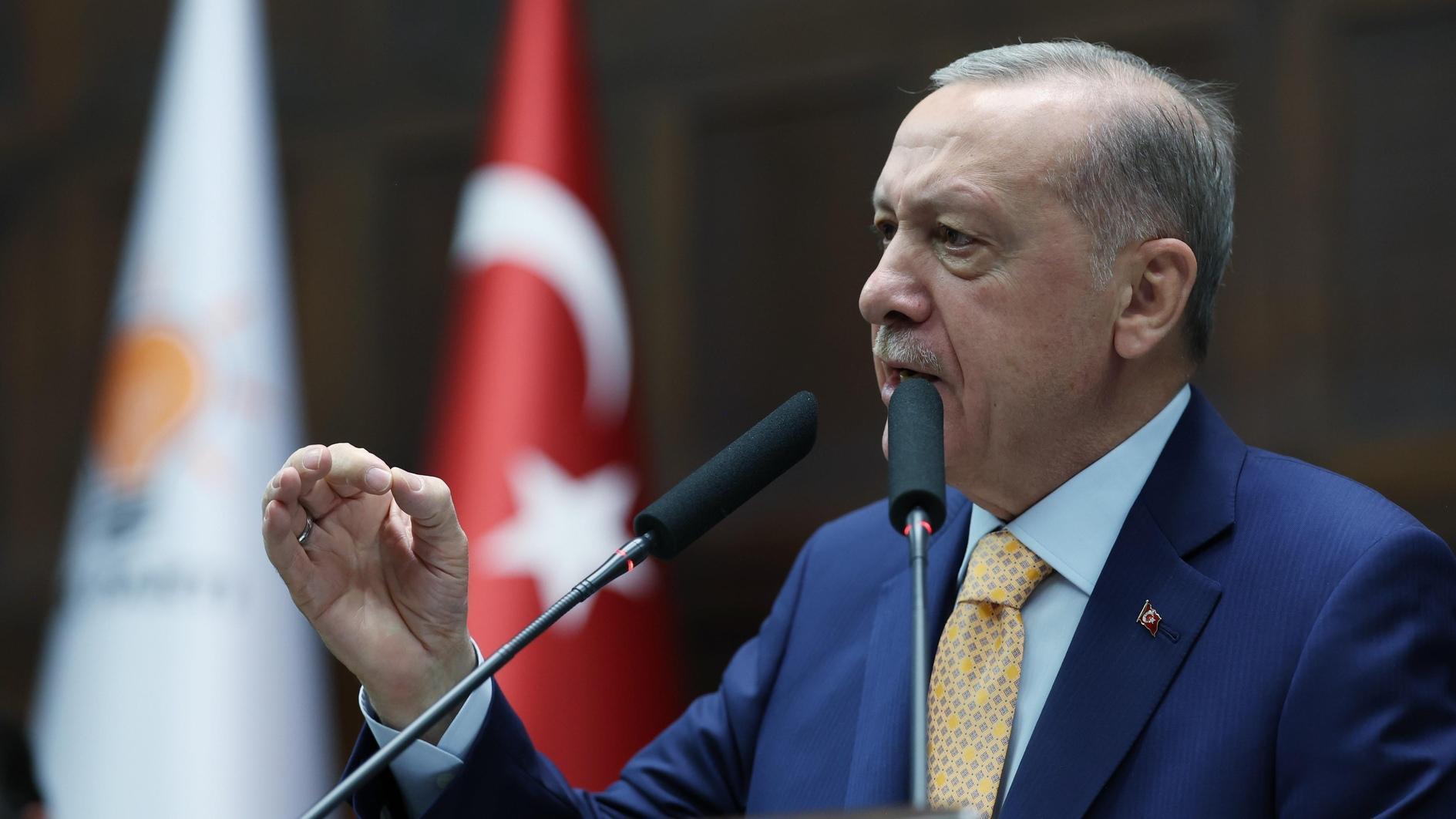

But the two countries’ defense relationship suffered as political ties weakened between Turkish Prime Minister Recep Tayyip Erdoğan and his former Italian counterpart, Silvio Berlusconi, whose government fell in November last year.

Another major non-U.S. competitor was Israel. But procurement and military cooperation between Turkey and the Jewish state came to a standstill after the former allies froze their diplomatic relations last year. Turkey and Israel fell out after Israeli commandos killed nine Turks aboard an aid flotilla bound for Gaza in 2010. The last major contract that went to an Israeli company was a 2004 deal for the sale of 10 Heron UAVs.

Recently, another major player on the Turkish market, France, has fallen from grace. Last month, the French Parliament’s Lower House passed a bill criminalizing the denial of World War I-era Armenian “genocide” by the Ottoman Empire, modern Turkey’s predecessor. In response, Turkish government officials unofficially said French bidders, and those who partnered with them, would be blacklisted in Turkish procurement competitions.

The largest upcoming Turkish contest, the procurement of long-range missile and air defense systems, is valued at about $4 billion. Competitors include U.S. partners Raytheon and Lockheed Martin, Eurosam, Russia’s Rosoboronexport and China’s CPMIEC. Eurosam’s shareholders include MBDA – jointly owned by British BAE Systems, Italian Finmeccanica and pan-European EADS – and France’s Thales.

“France can forget about this project in the event the [Armenian genocide] bill passes [in the French Senate],” a senior Turkish procurement official said. “I agree with the view that this would be very good news for the Americans.”