Uppsss: The IMF recommends doubling rates

I thought I was misreading something when I saw that the International Monetary Fund (IMF) was recommending doubling interest rates in the concluding statement of their Mission for the 2013 Article IV Consultation, which was released late Friday.

I thought I was misreading something when I saw that the International Monetary Fund (IMF) was recommending doubling interest rates in the concluding statement of their Mission for the 2013 Article IV Consultation, which was released late Friday.After all, I had an emotional and physical hangover. Not only had I way too much rakı at my graduate school housemate’s wedding the night before, I could not sleep with the excitement of knowing that Prime Minister Recep Tayyip Erdoğan was eight floors above me.

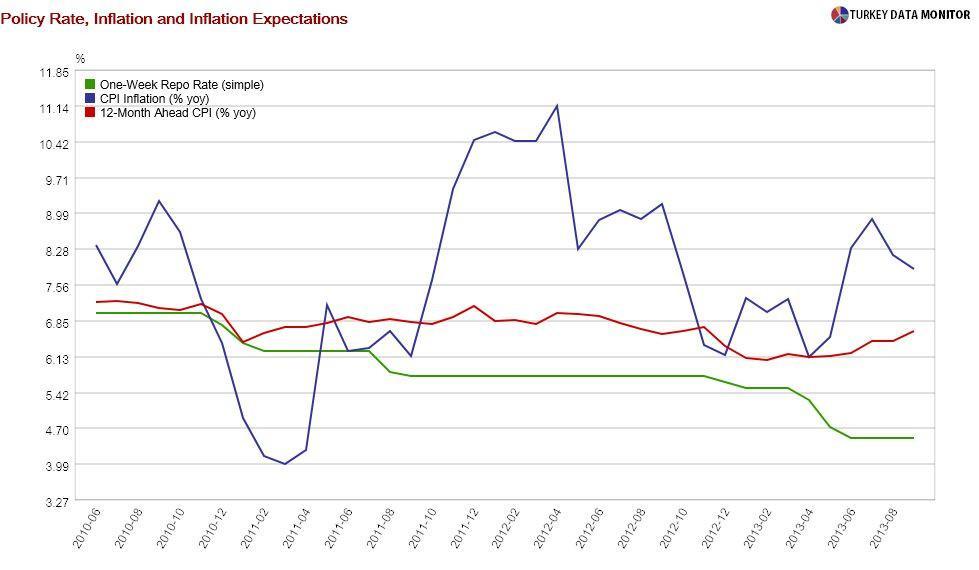

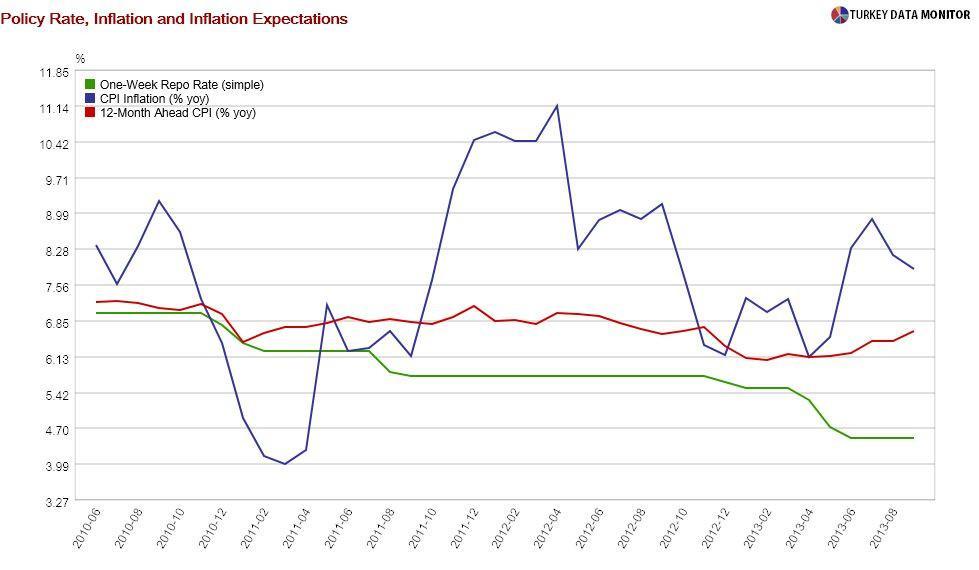

But the math was right: The Fund is arguing that “high credit growth, inflation (both headline and core) well above the end-year target of 5 percent, and the high and widening current account deficit, all warrant positive real policy rates, in particular the one week repo rate,” which is the policy rate.

Assuming a 0.1 percent real policy rate and using 12-month ahead inflation expectations of 6.6 percent, the policy rate, which is now 4.5 percent, turns out to be 6.75 percent. Using the latest headline inflation of 7.9 percent instead yields a one week repo rate of 8 percent. A real rate as 1 percent results in policy rates of 7.7 and 9 percent under the two methodologies.

The actual number does not matter; the point is that global interest rates are normalizing, and it is better to be in front of the curve in this process, as the Fund sees serious risks in Turkey’s current account deficit and inflation. They feel that the “the monetary stance and framework should focus squarely on inflation to provide a nominal anchor.” The Fund believes that the current complex framework, with its too many objectives, is reducing the Central Bank’s credibility and causing communication problems.

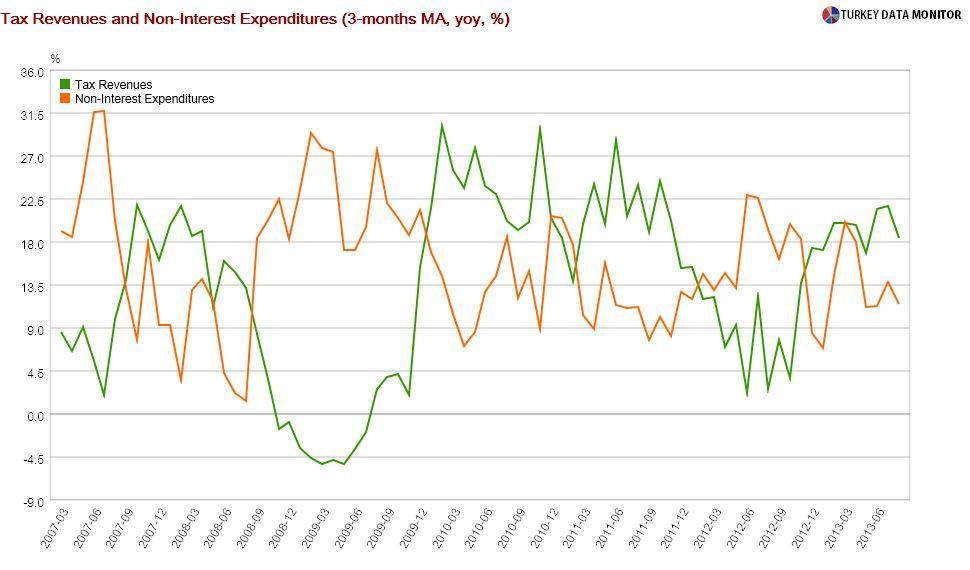

As for the external balance, the Fund is recommending tightening fiscal policy by restraining expenditures. They agree with me that the headline budget numbers are misleading by noting that “buoyant revenues have led to large nominal expenditure increases.” Unlike me, they think the economy is doing well, so they see no growth tradeoff. They also emphasize that decreasing the budget deficit will help the government in its goal of raising the country’s low savings rate.

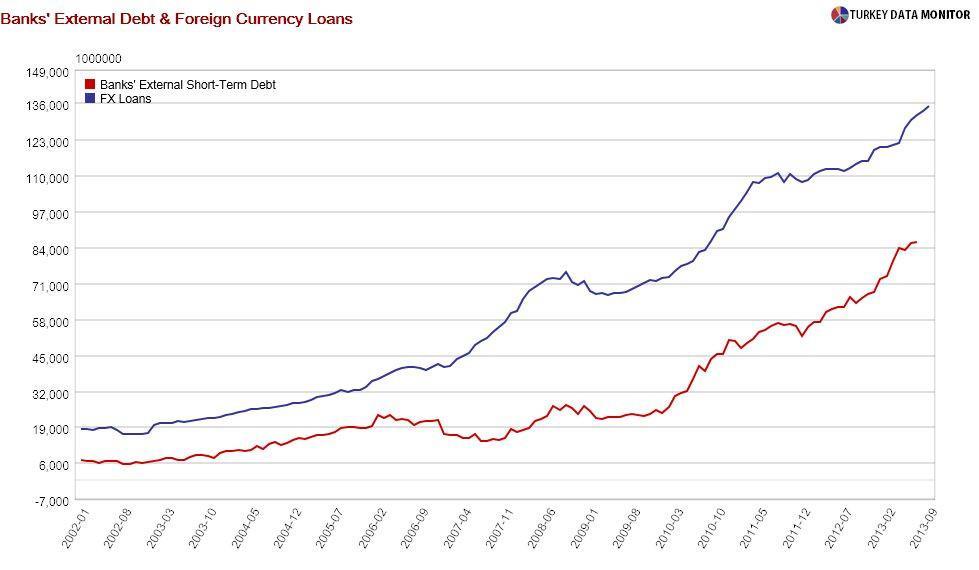

The Fund is also worried about the rise in foreign currency (FX) lending by banks to corporates, “as FX-induced liquidity or solvency problems in the corporate sector can quickly lead to rising non-performing loans.” Of course, there is the other side of the coin: Banks are relying on a lot of short-term FX funding, which could easily dry up if the global environment deteriorates.

But maybe, you would be wise to disregard their views. After all, I was partying with a dozen Fund economists over the weekend, although none worked on the concluding statement. They could as well be part of the interest rate lobby if they are hanging out with a chapull-Jew (çapulcu). Maybe, that’s why they are asking for higher rates. And maybe, the wedding was a decoy; they came to Adana to assassinate the PM via telekinesis.