Turkish lenders post declining profits in first quarter

ISTANBUL

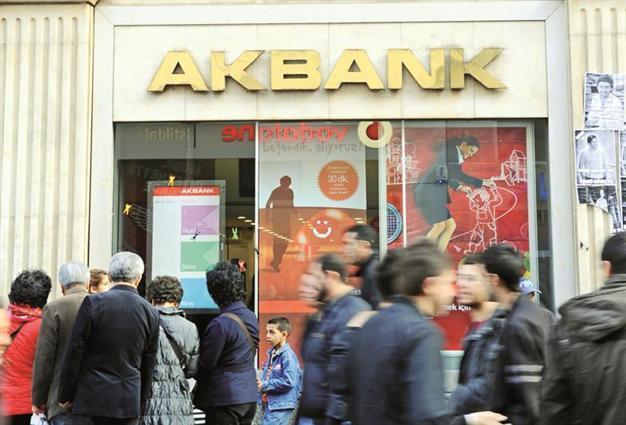

Turkish lender Akbank’s net profit fell by 25 percent in the first quarter.

Two large private lenders, Akbank and Yapı Kredi, have become the latest Turkish lenders to record plunging profits for the first quarter, as high interest rates and the weak currency have begun to kick in.Akbank, controlled by Istanbul-based Sabancı Holding, posted a net profit of 651.5 million lira ($307 million) for the first quarter, marking a 25 percent decline from the same period a year ago, but nonetheless beating market expectations.

Meanwhile, its counterpart Yapı Kredi announced its net profit declined by 10 percent on the previous year to 487 million Turkish Lira ($230 million) in the first quarter, also beating forecasts. The result was lower than the net profit of 541 million liras one year ago, but still came in above the poll forecast of 459 million.

Tough times for banks

“High volatility in leading indicators, such as interest rates and exchange rates, affected the first quarter of 2014 in Turkey as many emerging economies experienced similar developments,” Akbank CEO Hakan Binbaşgil said in a written statement.

“Despite the adverse market conditions in the first quarter, we grew our total assets compared to previous year-end and our assets exceeded 200 billion liras,” Binbaşgil said, stressing that his bank had begun to receive positive economic signals in March.

“In addition, our support to the Turkish economy via our cash and non-cash loans reached around 150 billion liras in the same period. In order to help firms further grow their businesses, Akbank increased its support to the real sector through its loans that topped 77 billion lira,” he added.

Yapı Kredi CEO Faik Açıkalın also opted to see the bright side, in a statement released after the announcement of first quarter results.

He said Yapı Kredi had managed to “grow over the sector average in loans and savings, despite the volatility experienced in the economy for the past three months.”

“I want to record that while gaining market share in many fields, we attained a 10 percent upsurge, particularly in Turkish lira company loans, 9 percent in small-medium enterprise loans, and 6 percent in individual loans,” Açıkalın also said.

“Yapi Kredi recorded 1,938 million lira in revenues (up five percent, year-on-year), driven by net interest income and collections performance,” the statement added.

“The net interest margin expanded by 13 bps on a quarterly basis and reached 3.4 percent thanks to re-pricing approach on both loans and deposits following the significant rate hike in January 2014,” it said.