Turkish data marathon: In Fed’s hands now

August 15 was a busy day in terms of Turkish economic data.

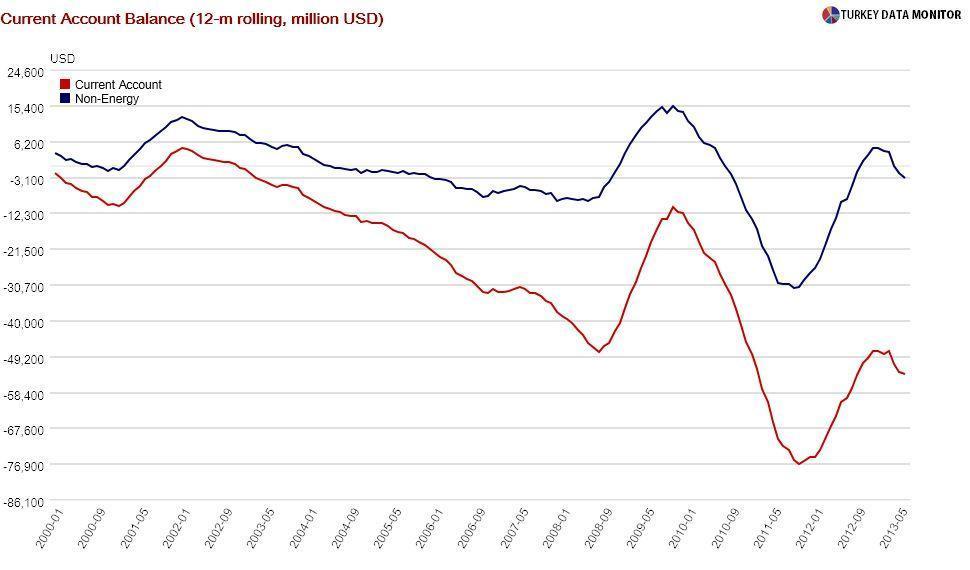

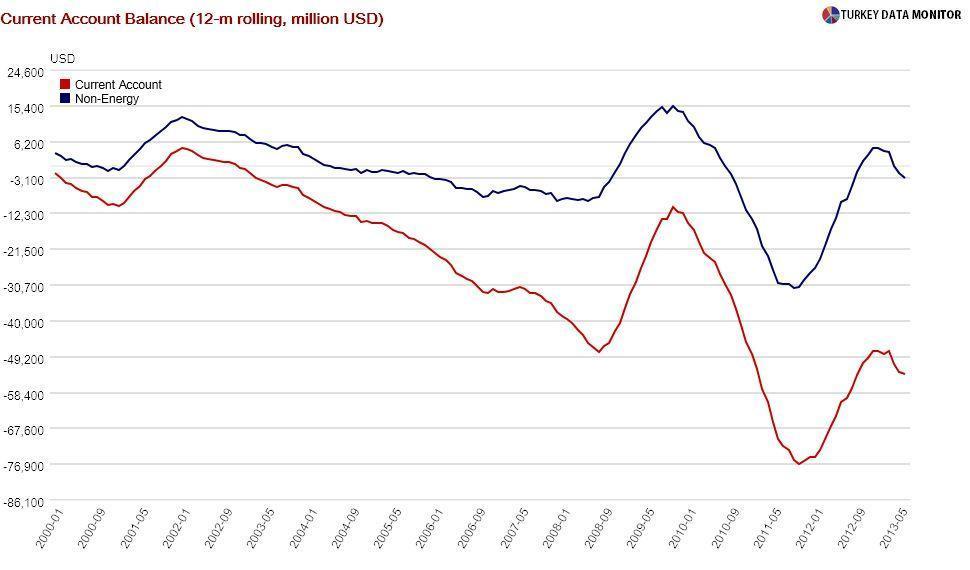

August 15 was a busy day in terms of Turkish economic data.At $4.4 billion, June’s current account deficit turned out to be significantly lower than expectations of $5.1 billion. However, the lower-than-expected figure is because of strong shuttle trade and tourism revenues rather than weak imports, which would imply that the economy is weaker than envisaged.

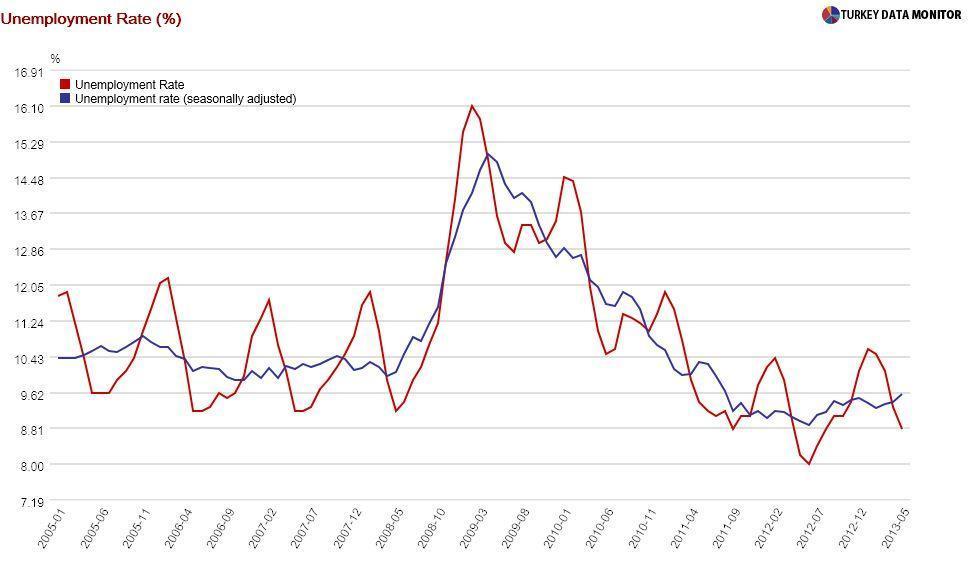

I don’t mean to say that the economy is not slowing down – just that I did not see any signs of slowdown in the current account data. But if you ask me about May labor force statistics, that’s another matter. Seasonally-adjusted unemployment edged up compared to the previous month while non-farm employment fell. Analyzing job applications from employment agency Kariyer.net, also released on Aug. 15, Istanbul think-tank Betam concludes that unemployment is likely to rise further in June.

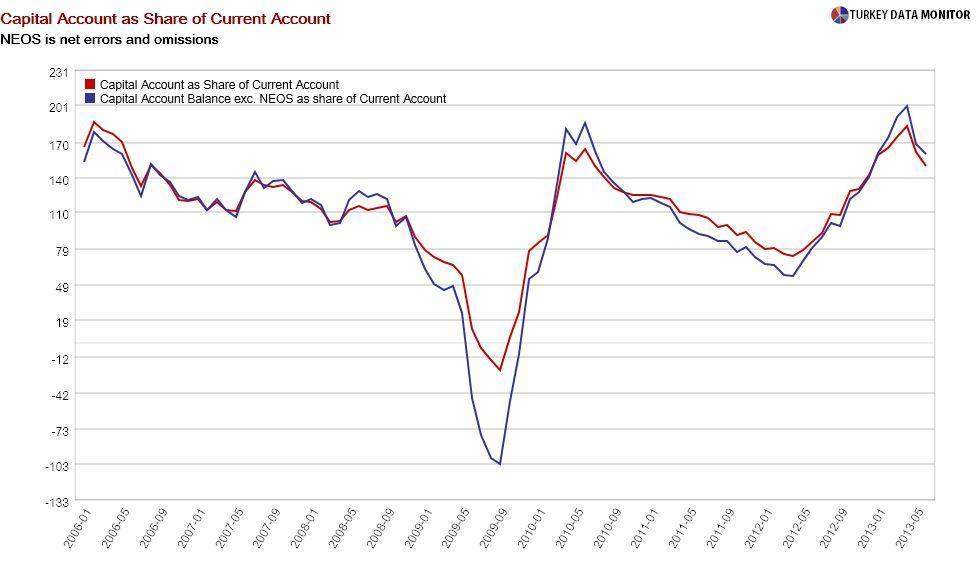

Coming back to the Balance of Payments, I am more worried about the financing side than current account deficit. At $3.5 billion, capital inflows were less than half of the $8.9 billion figure registered in the same month of last year. As a result, annual capital inflows declined to $80.3 billion in June from $85.7 billion in May.

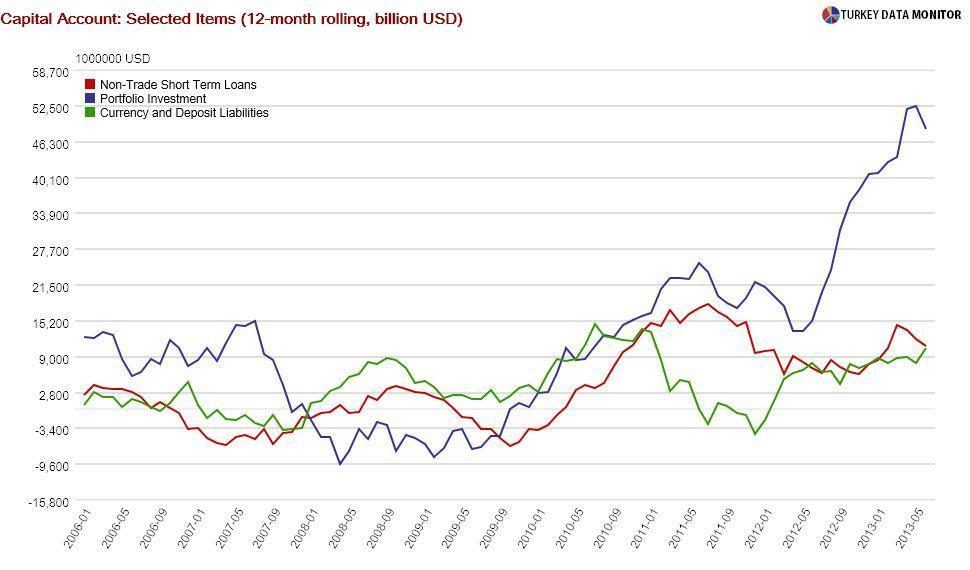

To make matters worse, almost all these capital flows are short-term. EkpresInvest’s Özlem Derici calculates the share of portfolio investments (excluding government Eurobonds), short-term loans and non-residents’ currency and deposits in total financing to be 92.3 percent, up from 89.5 percent the previous month.

No wonder Turkey is listed in research reports as one of the emerging markets most vulnerable to the Federal Reserve’s (Fed) tapering of its bond purchases. Therefore, if you are expecting a smaller-than-predicted current account deficit to strengthen the lira or delay rate hikes, as Deutsche Bank suggested in its interpretation of the data, think again. The capital account is likely to neutralize any stabilization of the current account.

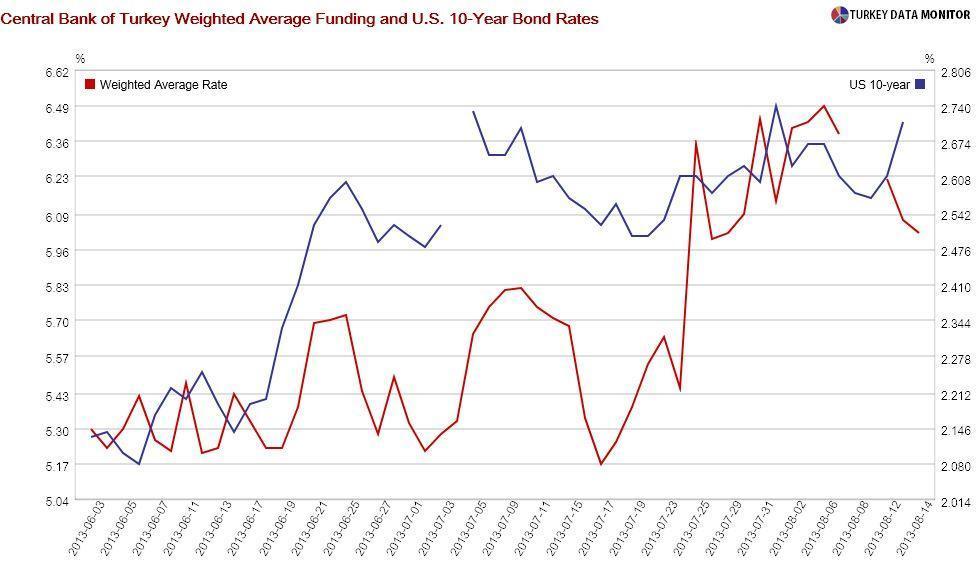

In any case, monetary policy is all but focusing on U.S. economic developments. The Central Bank announced additional monetary tightening on Aug. 15 to reduce exchange rate volatility, but there wasn’t much volatility in the morning. The bank was probably acting to the surge in U.S. 10-year bond rates as well as the afternoon’s important American data releases. Unfortunately, we are seven hours ahead of the Eastern U.S., and so the Central Bank has to guess American data.

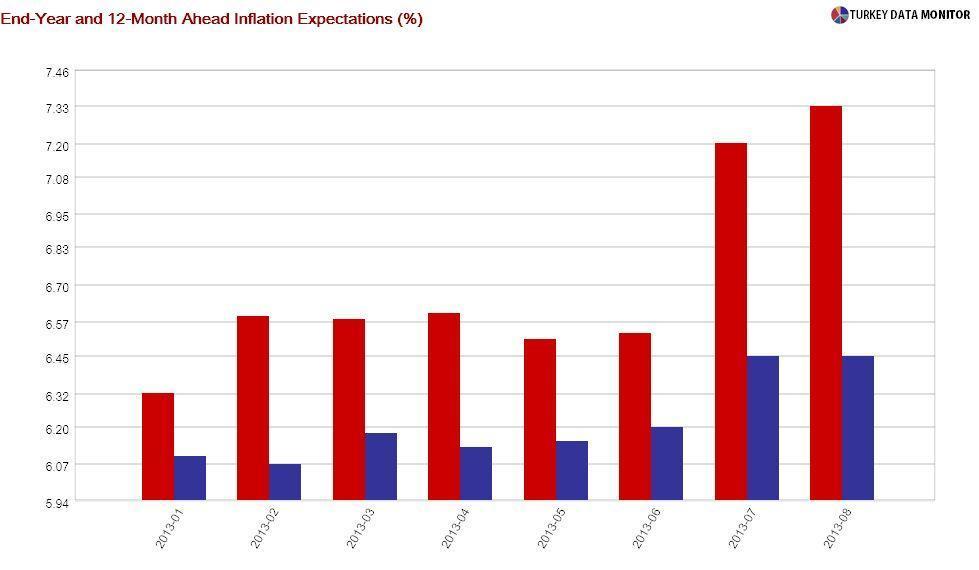

Therefore, although inflation expectations continued to rise in the Central Bank’s monthly survey, which was released on Aug. 15 as well, I don’t think it will be a factor in the Central Bank’s rate-setting decision on Aug. 20. While the Bank recently committed to not hiking the policy rate unless the Fed raised its own rate, only volatility emanating from U.S. data could lead the Bank to widen its interest rate corridor.

Some traders like to change the official U.S. motto “In God we trust” to “In Fed we trust.” By the same token, I guess we are in Fed’s hands now.