Turkish Central Bank trims benchmark interest rate for third month

ISTANBUL - Reuters

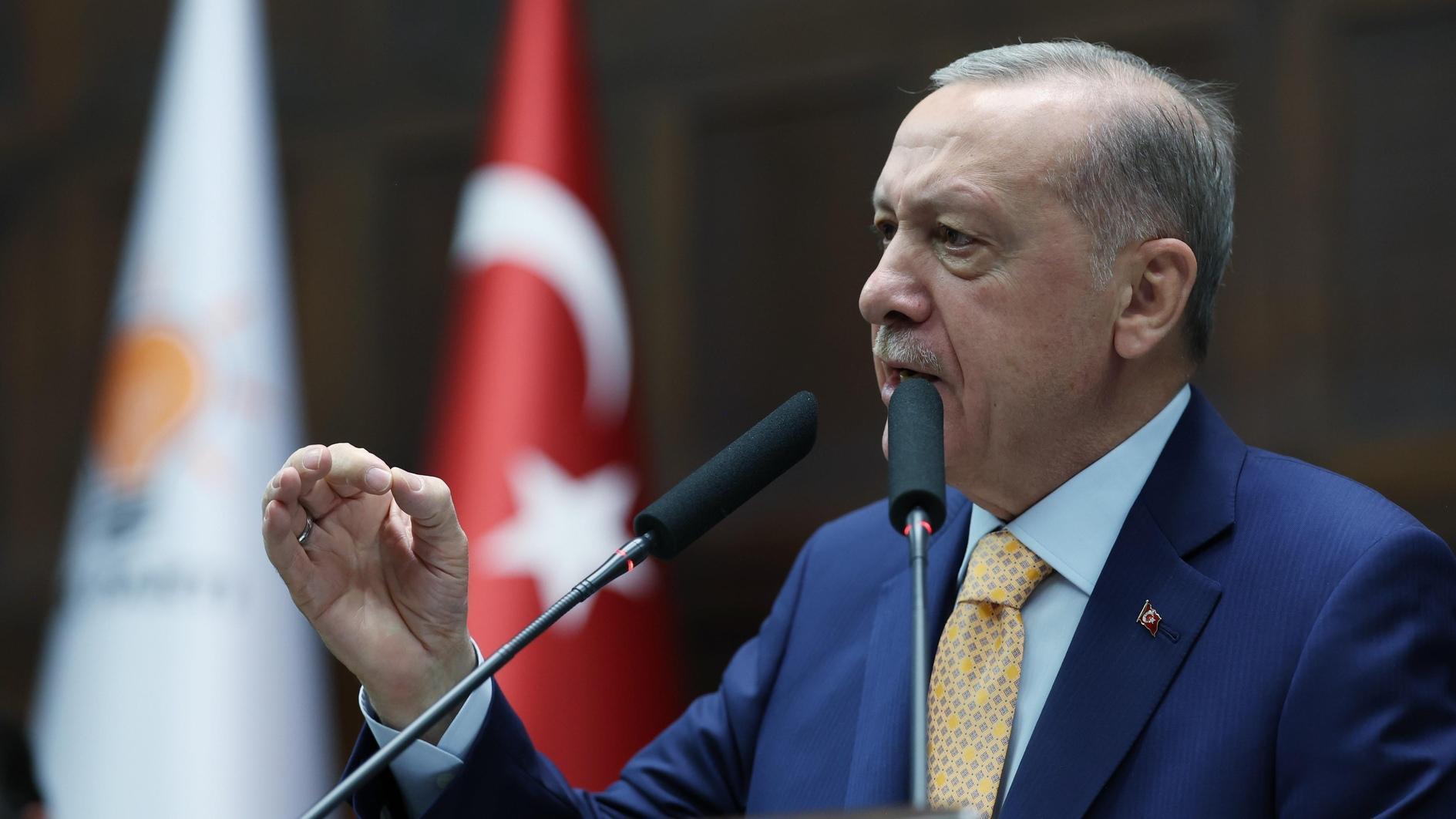

Turkey's Central Bank trimmed its main interest rate for a third consecutive month but resisted the sort of deep cuts sought by Prime Minister Tayyip Erdoğan weeks ahead of a presidential election.

Turkey's Central Bank trimmed its main interest rate for a third consecutive month but resisted the sort of deep cuts sought by Prime Minister Tayyip Erdoğan weeks ahead of a presidential election.The Bank cut its main one-week repo rate by 50 basis points to 8.25 percent, saying global liquidity conditions were improving and the impact of lira fluctuations on inflation was moderating. The bank had already cut the rate by 125 basis points over the past two months.

It kept its overnight lending rate at 12 percent but cut its overnight borrowing rate to 7.5 percent from 8 percent.

Erdoğan is keen to maintain growth before the August election, in which he is a strong candidate, and parliamentary polls next year.

Wedded to the idea that high interest rates cause high inflation, he has repeatedly called for sharp cuts to reverse the Central Bank's massive rate hike in January, when it was struggling to defend a tumbling lira.

He has accused a foreign-backed "interest rate lobby" of trying to undermine him and the Turkish economy.

His Economy Minister Nihat Zeybekci said again this month that the central bank should cut rates to support investment and production.

Political pressure

The lira firmed slightly after the rate cut to 2.1240 against the dollar from 2.1290 beforehand, apparently on relief that the bank had not yielded to political pressure and cut rates more sharply.

The market had been pricing in a moderate cut. All 16 economists in a Reuters poll forecast a cut in the one-week repo rate, with 12 predicting a 50 basis point cut, three a 75 basis point cut, and one a 25 basis point cut.

Economists had said that looser monetary policy from the European Central Bank and a continued accommodative stance from the U.S. Federal Reserve would give the Turkish central bank room to cut rates further.

But some economists said the inflation outlook did not justify a rate cut and warned that easier monetary policy could hinder the fight against rising prices and undermine the stability of the lira in the event of an adverse shock.

The Central Bank's latest monthly survey of business leaders and economists indicated little improvement in medium-term inflation expectations, with headline inflation still seen at around 8.3 percent at the end of the year.

Consumer prices climbed 0.31 percent in June month on month, although on an annual basis inflation fell to 9.16 percent from 9.66 percent a month earlier.