Turkish auto sector worried over tax hike and loan curbs

ANKARA

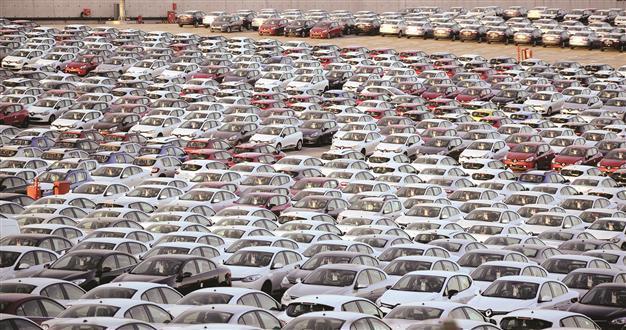

The sales forecast for 2014 stands at 800,000-860,000 units, but the consumer tax hikes and banking watchdog’s loan-curbing measures are expected to affect sales, sector representatives say. AA Photo

The recent consumption tax hike and curbs on car loans may be fatal for the automotive sector, which is already expected to have a tough year, prominent sector representatives warn.“After today’s [Jan. 1] surprise hike, all brands in our sector need to revise their targets and strategies set for 2014,” Automotive Distributors Association (ODD) Chairman Mustafa Bayraktar has said.

The Turkish government has raised the special consumer tax (ÖTV) imposed on a number of goods including new passenger cars, the country’s Official Gazette announced on Jan. 1.

The consumption tax on passenger cars has been ramped up between 5 and 15 percent, depending on the size of engine, bringing it to the range of 45 to 145 percent.

The country’s banking watchdog BDDK also announced the details of its regulation introduced for raising the down payment on car loans.

The watchdog said curbing consumers’ use of credit cards to pay for goods such as cars with monthly installments will be effective as of Feb. 1, as a step to raise the domestic savings rate and reduce the nation’s dependence on foreign capital to finance consumption.

According to the BDDK’s draft legislation, car loans will be limited to 70 percent of the total amount for vehicles that cost less than 50,000 Turkish Liras. The draft also foresees the restriction of consumer credit to a 36-month loan and car credit loans for 48 months.

Moreover, the increase in exchange and interest rates, which took place in the second half of 2013, are expected to have an adverse impact both on the consumer side and investments, particularly in the first half of 2014, sector representatives have said.

‘Contraction unavoidable’

The sales forecast for 2014 stands at 800,000-860,000 units, but the timing and content of BDDK measures is expected to affect sales.

Renault Mais General Manager İbrahim Aybar said the sector’s reaching even 700,000-unit levels would be optimistic after the unexpected tax hike. He recalled the companies were predicting a 10 percent diminish for 2014 and the latest move would definitely extend the losses.

“It is a known fact that all kinds of tax hikes will naturally cause a contraction in the sector due to macroeconomic balances,” he said in a written statement.

ODD head Bayraktar said the hike came as surprise, as the sector was expecting the government to take action in the opposite way after hearing months of complaints from the sector.

A report released by the ODD and Ankara-based Economic Policy Research Foundation of Turkey (TEPAV) in the beginning of December showed the total tax an owner of a 43,000-lira car pays amounts to a car price in five years.