Turkey's trade shrinks with war-torn neighbors Iraq and Syria

Mustafa Sönmez - mustafasnmz@hotmail.com

Turkey’s hopes of ramping up trade with its neighbors have been scuppered by the civil war in Syria. The recently erupted turmoil in Iraq has also added to Ankara's regional economic headaches. DHA photo

Turkey’s foreign trade with its two southern neighbors, both engulfed in violent conflicts, does not look good. There is a decline in the Iraqi market, which is Turkey’s second most important market with an annual trade volume of $9 billion. In Syria, on the other hand, where there was much hope in 2010, war has inflicted a heavy blow on commerce.The Iraqi market is very important for Turkey, and its shrinkage causes major concerns. Exports to Iraq in the first seven months of the year were $6.4 billion, a 2 percent decrease from those of the first seven months of 2013. It is a bitter probability that this shrinkage will continue until the end of the year.

We have seen the war against the Islamic State of Iraq and the Levant (ISIL) gangs create a major recession and a decline in demand in Iraq’s economy, both in the north and south. There is a high probability that even larger sale and transportation problems will be experienced in the coming months, particularly in exports from Turkey to Iraqi Kurdistan.

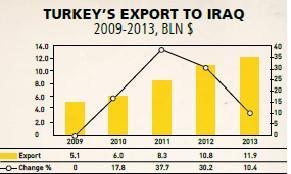

We have seen the war against the Islamic State of Iraq and the Levant (ISIL) gangs create a major recession and a decline in demand in Iraq’s economy, both in the north and south. There is a high probability that even larger sale and transportation problems will be experienced in the coming months, particularly in exports from Turkey to Iraqi Kurdistan. Turkey’s exports to Iraq, especially to the Kurdish region, have risen significantly in recent years. Exports, which reached $5 billion in 2009, accelerated in subsequent years to hit $12 billion in 2013. This

marked an average increase of 24 percent, but exports started to decline in 2014. In the first seven months of 2013, it was nearly $6.6 billion, going down to $6.4 billion in 2014, a decrease of 2 percent.

marked an average increase of 24 percent, but exports started to decline in 2014. In the first seven months of 2013, it was nearly $6.6 billion, going down to $6.4 billion in 2014, a decrease of 2 percent. The products that have seen a decline in exports are those used mostly in construction and other investments. While iron and steel exports declined nearly 30 percent to $624 million in the first seven months of this year, there have also been significant decreases in exports of products such as cement, ceramics, glass, machinery, equipment and other inputs.

Various industry products have a share of 27 percent in exports to Iraq. While live animals and food products make up 24 percent of total exports, the share of machinery and transportation vehicles makes up 15 percent.

Tanks, armored vehicles

The details of exports to Iraq reveal more interesting facts. Exports of tanks and armored vehicles reached $441 million in the first seven months of last year. This year, this figure was $447 million. It is not known whether these sales are to the Kurdish region or to the central government.

Grains, especially flour, lead in Turkey’s exports to Iraq, holding an important place in the total exports of southern provinces, primarily Gaziantep. Other important exports include vegetable oil, fruits and vegetables, poultry and sugary products.

Several products are exported to the Iraqi market, from clothing to home textiles, not only from southeastern provinces but also from everywhere in Turkey. The unrest in the country has negatively affected all exporting sectors.

Is this a recovery?

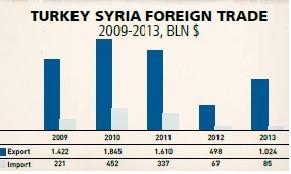

Turkey’s foreign trade with Syria was full of hope before the war, with discussions of the annual bilateral trade volume with Syria reaching $5 billion. However, reality confounded expectations. The bilateral trade volume, which exceeded $2.3 billion in 2010, plummeted with the civil war. Turkey managed to continue exporting to Syria, if only at a snail’s pace, but buying from Syria plummeted.

According to the Turkish Statistical Institute’s (TÜİK) foreign trade data, exports to Syria stood at around $1 billion in the first seven months of this year. Hopes have been renewed because the exports of seven months surpassed the seven-month exports of the past two years. In the first seven months of 2012, when relations with Syria were exceptionally strained, exports had declined to $333 million. Exports remained at $498 million at the end of 2012.

Despite the relative recovery experienced in 2014, imports from Syria still lag quite behind their previous level. While $294 million of imports were received from Syria in the first seven months of 2010, imports from the first seven months of this year remained at $52 million.

Trade with Syria had reached its peak in 2010, with over $1.8 billion in exports and $453 million in imports: A total trade volume of $2.3 billion. With the war, however, bilateral trade hit bottom, and in 2012 it plunged to as low as $550 million.

Trade with Syria recovered slowly in 2013. In 2014, however, there are hopes that it could reach its pre-war level.

Syrians and unregistered trade

It looks as if the efforts of Syrian businessmen have been effective in increasing trade with Syria to its former level, with Syrians revitalizing trade through companies they have set up in Turkey.

According to data from the Turkish Union of Chambers and Commodity Exchanges (TOBB), companies formed by Syrians operate in several different lines of work.

A number of Syrians have set up business along the Syrian border, especially in Gaziantep, Kilis and Mersin, conducting trade between the two countries. These Syrians are exporting goods from Turkey that are urgently needed in Syria, such as wheat, flour, potatoes, onions, pasta, gas bottles and baby diapers. They also import products that are cheaper in Syria to Turkey, although this is quite a limited trade.

Meanwhile, nobody denies the existence of unregistered trade with Syria, of significant size. It is often discussed that various firearms and chemical substances are sold from Turkey while smuggled diesel enters from the other side, but the volume and the players in this trade remain vague.