Turkey’s risks likely to increase after election

Mustafa SÖNMEZ - mustafasnmz@hotmail.com

CİHAN Photo

Everybody in Turkey is focus on the upcoming general election. What about after the election? Those economic, political and even geopolitical risks, will they lessen with the results of the June 7 vote? Will Turkey have a more predictable future? Will the uncertainty and fog disperse? Will foreign investors return? Will the dollar exchange rate relax? Will the wheels of economic growth start turning again?Even though the last three years have not been so bright, the Justice and Development Party (AKP) has generally lived “la dolce vita” during its 12-year reign. But what lies ahead of us is not easy for the AKP, the main opposition Republican People’s Party (CHP), or any of the other parties. Actually, we are entering a “grinder-backbreaking” period.

Fed decision

Everybody knows that either in June or September, the Fed will increase interest rates. Even just mentioning the word “increase” was enough to shake up the environment.

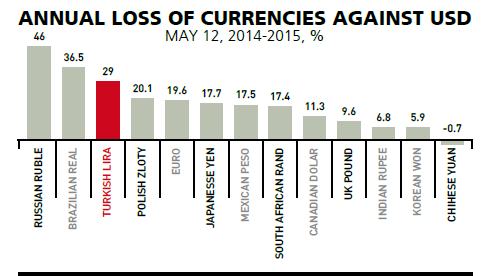

To see what has happened to global currencies, let us first look at the currencies of central countries. From May 12, 2014 to May 12, 2015, in one year the euro lost 19 percent of its value against the dollar. The Yen lost 17.7 percent and the Canadian dollar lost 11 percent. The Scandinavian countries and Switzerland adjusted their currencies against the strengthening dollar, also not to lose their exporting powers.

Losses against the dollar were more striking in the “emerging countries,” including Turkey. The Russian ruble, also hit by the effect of political sanctions, lost 46 percent. The Brazilian real lost almost 37 percent.

The Turkish lira is nearing a 29 percent loss. The lira was valued at 2.09 dollars on May 12, 2014; it was 2.70 liras on May 12, 2015.

What has happened to Russia is obviously different to what has happened to Brazil and Turkey. However, the currencies of other emerging countries such as Poland, Mexico, South Africa and India have lost much less against the dollar.

In this differentiation, political vulnerabilities as well as economic vulnerabilities are key. Matters such as doubts over the separation of powers, the independence of the judiciary, an executive that seeks to gather all other powers, illegal practices, and covering up of corruption, are especially keeping foreigners away from Turkey. This gives the lira not opportunity to recover against the dollar. On the contrary, the current account deficit data in the first quarter show that reserves are shrinking and even unregistered foreign currency stocks are rapidly eroding.

First quarter current account deficit

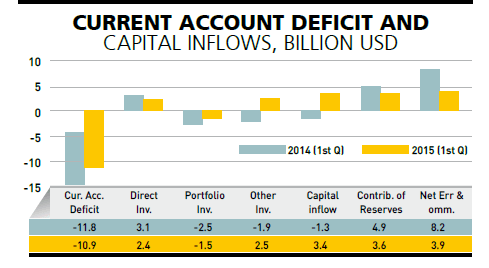

First quarter data shows that the problem that already exists in providing the supply of foreign currency needed for the current account deficit is growing. According to Central Bank data, in the first three months of 2014, capital inflows were replaced by capital outflows, reaching $1.3 billion. When foreign inflows decreased, the foreign currency that was abroad or unregistered (net error and omissions) was provided by Central Bank reserves. In the first quarter of 2014 around $5 billion from the reserves and $8 billion from the unregistered items were released. Only with them and the result of increased interest rates was the dollar exchange rate average of 2014 able to be held at 2.20 liras.

In the first quarter of this year, the current account deficit was nearly $11 billion, but capital inflows could not finance the deficit. It remained at $3.4 billion. It is understood that around $4 billion from “unregistered” sources and $3.6 billion from the reserves have been released to the markets. Even this can barely hold the dollar exchange rate within the corridor of 2.65 and 2.70 liras.

The burden on Turkey comes from both the non-decreasing current account deficit and also the foreign debt payments due. This need would erode the reserves and unregistered accumulated foreign currencies, but again it looks as if these would not be sufficient to pull the dollar below 2.80 liras toward the end of the year.

What will happen now?

What has happened up to now is only a hint of what will happen in the future. For instance, speaking about the lira, the 29 percent devaluation in 12 months does not stop there, it continues. Things will not calm down with June 7 election. If anyone believes that foreigners will bring dollars in abundance to Turkey and pull the prices down after the election, then they are wrong. There are domestic reasons as well as international reasons for this.

First of all, the United States is recovering. The U.S. had two major deficits: The current account deficit and the budget. Before the 2008 crisis, its current account deficit reached 6 to 7 percent of the national income. The economy shrank and the current account deficit also shrank. Now it is around 2.7 percent. The public deficit was 10 percent of national income in 2009-2010. In 2015, it went back to 2.8 percent. The growth rate is also recovering.

Those similar to Turkey

When the U.S. was in a crisis, the foreign capital that poured into countries such as Turkey helped them live “la dolce vita.” Countries like Turkey were indebted $4.5 trillion in six years. While the interest rate of the dollar was “zero,” foreign capital rushed to the interest offered by peripheral countries. Now they are returning to the dollar due to rising interest rates in the U.S.

How will the peripheral countries that have lost around 20 to 30 percent against the dollar manage with this heavy burden? For instance, Turkey has a foreign debt of $402 billion and 40 percent of this has to be paid back within 12 months. Is that easy?

The overall foreign debt of emerging countries is calculated at $9-10 trillion. This is a concern to the IMF, which is asking the U.S. to be moderate. If the crash is too hard in other places then it will be difficult for the world economy to recover.

The Fed will make the expected increase in June or September. The problem is how will Turkey, which has been pampered with “la dolce vita” survive in the new climate?

S&P rating

International credit rating agencies are also cautioning against the risk after June 7. Standard & Poor’s (S&P) issued a criticism of Turkey at the beginning of May. Even though it did not change Turkey’s rating and outlook, it lowered the rating for the Turkish Lira from BB to BBB-.

Foreign investors do not focus too much on the rating about local currency transactions. The bad rating of S&P for the Turkish Lira did not shake the markets but this was an up-to-date and important signal, telling them that the political authority was putting pressure on the Central Bank, restricting its operational independence.

Another credit rating agency, Moody’s, in its “Global Macro Outlook” report, also highlighted the risks concerning Turkey. Moody’s report said countries such as Turkey and South Africa were more vulnerable to the strong dollar and capital movements.