Turkey’s real real estate boom

Rachel Ziemba, regional director at my blog’s host Roubini Global Economics, was in town to meet up with market participants last week, so I invited her and a few finance professional friends to dinner on Wednesday.

Just as we sat down, the Fed announced that it was expanding its Operation Twist, where it is extending the maturities of assets on its balance sheet. This would be a natural way to start our conversation, but it didn’t get mentioned until later. Similarly, the morning’s Turkey ratings upgrade by Moody’s came up after the food arrived at the table. Instead, we spent the first half hour discussing the Turkish housing boom.

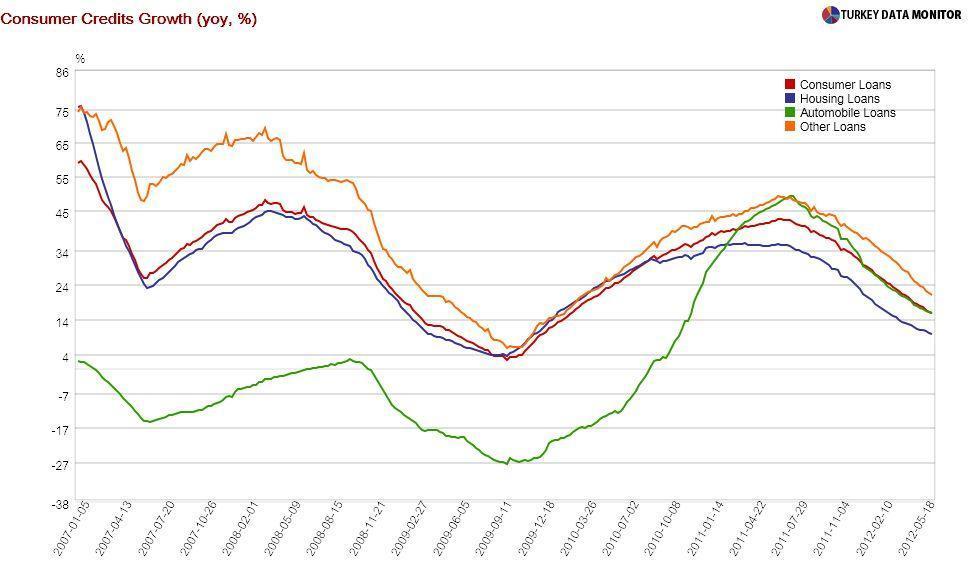

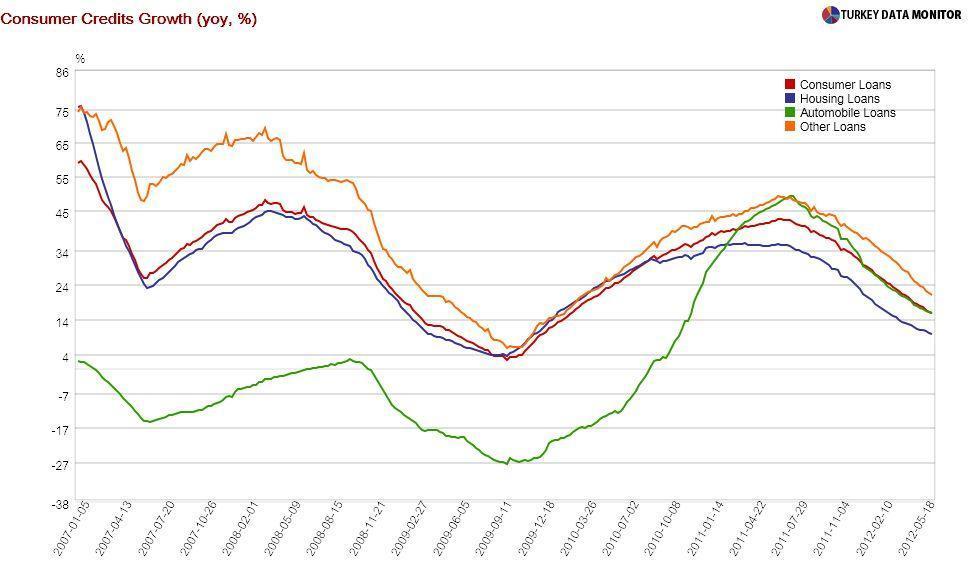

At first look, there doesn’t seem to be a real estate bubble in Turkey, at least not in the scope of Spain or the U.S. before the crisis. Home loans have been rising at a lower rate than other consumer loans, and their yearly growth is now around 10 percent. However, as a recent World Bank report has emphasized, many Turks see buying a home as a form of savings and choose to finance it out of their deposit accounts.

Similarly, while the Central Bank’s house price index rose by 23 percent since the beginning of 2010 until March of this year, inflation was 17 percent in the same period, so the real return on homes is not that high. But the headline figure masks regional differences. For example, according to the same index, prices in Istanbul increased 27 percent during this period. A quick look at REIDIN residential property price indices reveals quite a bit of variation in Istanbul as well.

One

of those in our dinner group dismissed the Central Bank’s methodology

for calculating these indices, but even if it is accurate, prices could be kept

suppressed because of the huge supply of housing. Even a casual tourist will

not help but notice the residence ads in the media as well as the cranes all

around Istanbul.

In fact, it is the nature of this supply boom that worries me more than anything else: A construction company will borrow from a bank to start a new project. The same bank will then lend to consumers so that they can buy their dream home in the project. The bank ends up double-exposed this way. I was made aware of this scheme back in 2008 by a senior retail banker.

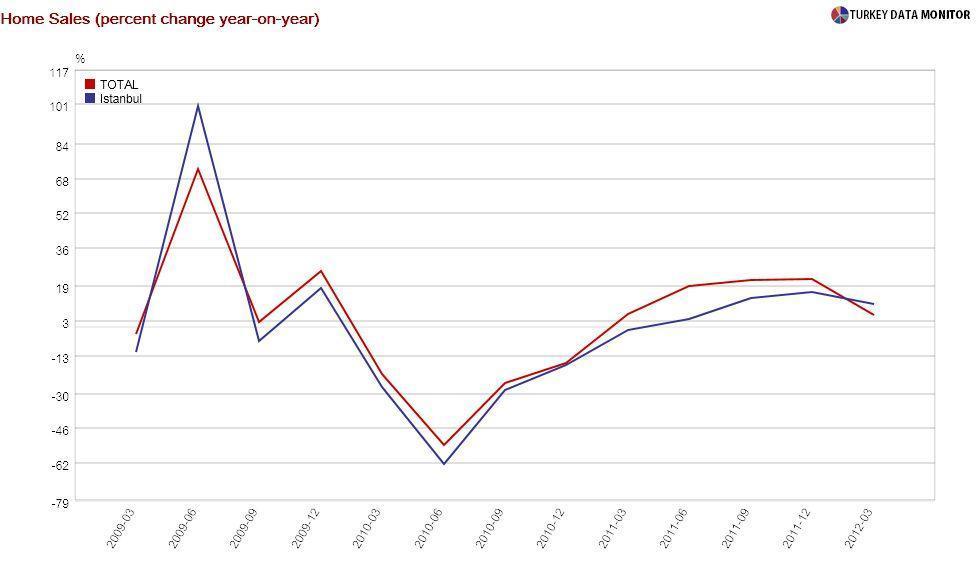

The same banking professional recently told me that the major companies are starting new projects as soon as they sell a small share of existing ones- just enough to get the basic cash flow going. And interestingly, each project is bigger than the last. This strategy is bound to fall apart when sales grind to a halt. While the official figures are lagging behind, home sales are currently 20-25 percent lower than last year according to the Association of Real Estate Investment Companies.

The

IMF had voiced

similar concerns at the end of 2010, but those were not mentioned in more

recent documents, probably because the difference between residence and

occupancy permits, a gauge for the supply-demand gap, has fallen since then.

But when their Turkey team was in town early in the month for Article IV

pre-meetings, they paid a visit to Ali Ağaoğlu, the eccentric contractor

famous for his supercar collection. That somehow made me real jittery.