Turkey’s IMF debt to be paid off, foreign debt stock still on increase

Mustafa SÖNMEZ

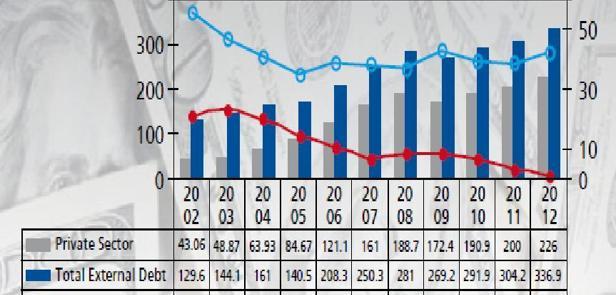

Turkey’s IMF debt was $4 billion and the total external debt was $119 billion in 2000 as the external debt reached $340 billion by the end of April 2013. The private sector owed $226 billion last year, which is two-thirds of the total foreign debt. AFP photo

Turkey will wipe off its International Monetary Fund (IMF) debt this month by paying its last installment. Turkey will also be one of the countries which contribute financially to the IMF with a $5 billion contribution. Turkish Prime Minister Recep Tayyip Erdoğan mentions such developments with pride. The relations with the IMF, however, are only a small portion of the big picture.The actual foreign debt portrait that also contains the IMF debts is quite different.

Turkey’s debt to the IMF is a very small portion of the total public debt. The IMF debt was $4 billion, while the total external debt was $119 billion in 2000. Two-thirds of the debt was public debt. At the beginning of the 2000s, high inflation was the biggest issue in the Turkish economy. What the IMF had suggested, the prescription of taming the inflation by fixing the exchange rate, was applied but in vain. At the end of 2000 the fixed exchange rate boosted imports, consequently the current account deficit; foreign investors ran away, the American dollar went up and so did inflation following it. Thus, the 2001 economic crisis erupted. Kemal Derviş, Ph.D., was brought from the United States to steer the economy in his capacity as the deputy prime minister.

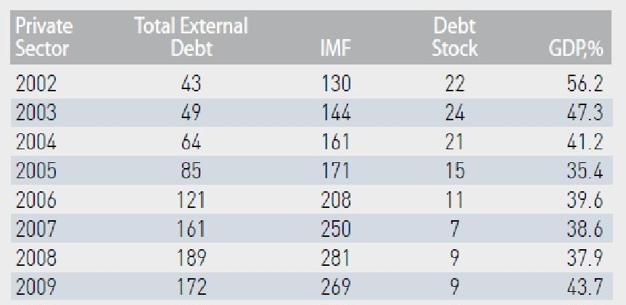

Derviş and the IMF joined hands. The IMF opened the credit taps to overcome the crisis but prescribed the bitterest pill to Turkey ever in history. It tamed the Treasury with “fiscal discipline,” eliminated bankrupt banks and tamed the system. It cleared the road for privatizations, etc. With the credits it gave, its total credits reached $24 billion. This corresponded to 17 percent of Turkey’s total debt of $130 billion in 2002.

Debts explode

The outcome of the IMF pill came after 2002. The IMF prescription, however, shook people. That was brought to account at the ballot box in the Nov. 3, 2002 elections. The coalition parties – Democratic Left Party (DSP), Motherland Party (ANAP) and Nationalist Movement Party (MHP) – could not even pass the election threshold. The Justice and Development Party (AKP) found itself in the position of being able to form the government alone. The party also found a recovered economy in its lap. From the road the IMF had opened, foreign credits flowed in streams. The economy grew with the foreign credit that started flowing in the AKP era; tax and privatization incomes increased; and the IMF debt started being paid with these. Meanwhile the public sector and especially the private sector borrowed swiftly from markets and the economic wheels were turned with this loan.

External debt as of the end of April 2013 neared $340 billion. This is almost 43 percent of the national income. During the 2003-2012 AKP term, $210 billion of new foreign loans have been taken; foreign debt has increased by 162 percent. One-third of the foreign debt, that is $110 billion, belongs to the state and the Central Bank. Thanks to the system of indirect taxes and unlimited privatizations, the public debts (except CB) remained at $103 billion. Public debt stock, including domestic debts, is 40 percent of the national income. The same rates in the EU, in the eurozone, reach 70 to 80 percent. The Maastricht criterion was 60 percent, but those that could achieve this were rare. When viewed from this point of view, Turkey’s public debt burden is better than the EU in general. But, the problem lies in private sector loans.

Private sector debts

As of the end of 2012 the private sector owed $226 billion, which is two-thirds of the total foreign debt. As a matter of fact, this figure was $50 billion when the AKP stepped into power and it was one-third of the foreign debt. The AKP government has opened wide the road to loans for the private sector. The exchange rate was pressed down so much, nobody shied away from borrowing; foreign creditors were elevated. Many firms took the risk and used foreign loans. Even the privatized Public Economic Enterprises (KİTs) were bought with foreign credits. Moreover, such high amounts were reached in the outstanding external debt that in order to be able to pay the installments, it became necessary to opt for short-term borrowing with heavy interest and in the end, the share of the short-term ones in the total foreign debt reached 30 percent. However, it is not only that; the Central Bank announced that as of February 2013, the total of debts due in less than 12 months was $150 billion. This is truly an alarmingly high amount.

Who borrows?

Construction and real estate firms, which are in a cutthroat competition to have shares in the income Istanbul is to bring, borrowed for skyscrapers, housing complexes, shopping malls and hotel investments. These debts approximated $18 billion by the end of February 2013. The debts of the transportation sector, including civil aviation firms such as Turkish Airlines and Pegasus, reach about $13 billion, while the energy sector has long-term debts above $9 billion.

Information and communication firms, especially GSM operators, are under the burden of $7 billion of external loans. External loans are not generally taken in the manufacturing industry. The food industry has used $4 billion of foreign credits while the textile sector has used $3 billion worth of external loans. The main metal industry owed $4 billion of external loans. The Central Bank is trying to prevent the rise of exchange rates by accumulating reserves by constantly borrowing in order not to be caught unprepared in foreign debts.