Turkey reveals Iran gold-for-gas trade off

ANKARA - Hürriyet Daily News

Turkey’s gold sales to Iran jumped in the first seven month, before the United Arab Emirates became the top market.

Turkish Deputy Prime Minister Ali Babacan has revealed a critical detail about a widely discussed Turkey-Iran gold trade boom, disclosing that the Islamic republic was transferring payments made for gas into Turkish gold.Iranians are buying Turkish gold with the Turkish Lira, which is deposited into their bank accounts in exchange for Turkey’s natural gas purchases, the deputy prime minister said at midnight Nov. 22 during a parliamentary session. Iran cannot transfer monetary payments to Iran in U.S. dollars due to U.S sanctions against the country’s alleged nuclear weapons program.

“As Iran could not transfer the payment to [its own banks] in foreign exchange, the country buys gold with the lira and then takes the gold to its country. I do not know how Iran transports the gold, but this is the root of the matter. The gold export to Iran in reality becomes a kind of payment for the natural gas we buy from Iran in deed,” Reuters quoted Babacan as saying.

Turkey’s gold sales to Iran in the first seven months of the year were estimated at around $6.2 billion. In August and September, the United Arab Emirates bought around $3.1 billion of gold from Turkey, as many sector sources said this was also going to Iran.

Only the added value of the bullion trade was calculated in the national income and growth figures, Babacan said, adding that the economic growth is not based on gold exports. Gold exports told the Daily News earlier that this did not contribute to the economy since the gold for Iran was mainly imported and the added value was near zero.

Turkey’s Halkbank, which saw a second public offering last week, raising the free floating shares to a little under 50 percent, is responsible for money transfers to Iran.

Criticism from

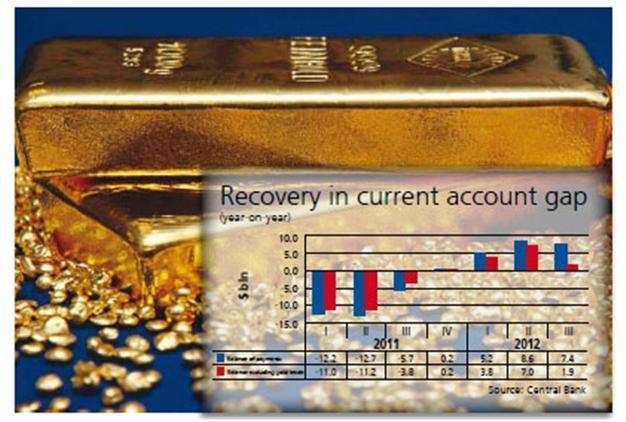

Meanwhile, the current account deficit, a soft spot of the Turkish economy, is receding thanks to rising gold exports, main opposition Republican People’s Party (CHP) Vice President Faik Öztrak said Nov. 23 in his weekly press meeting on Turkey’s economic outlook “The current account gap improved $21.2 billion in the first nine months of the year compared with the same period last year. But it falls down to $12.7 billion when gold exports are excluded,” he said, according to Doğan news agency. Some $8.5 billion of the improvement in the current account deficit comes from gold sales or $40 in every $100 improvement in current account gap stems from gold trade, he said.