Turkey more of a conundrum, Fitch says

LONDON

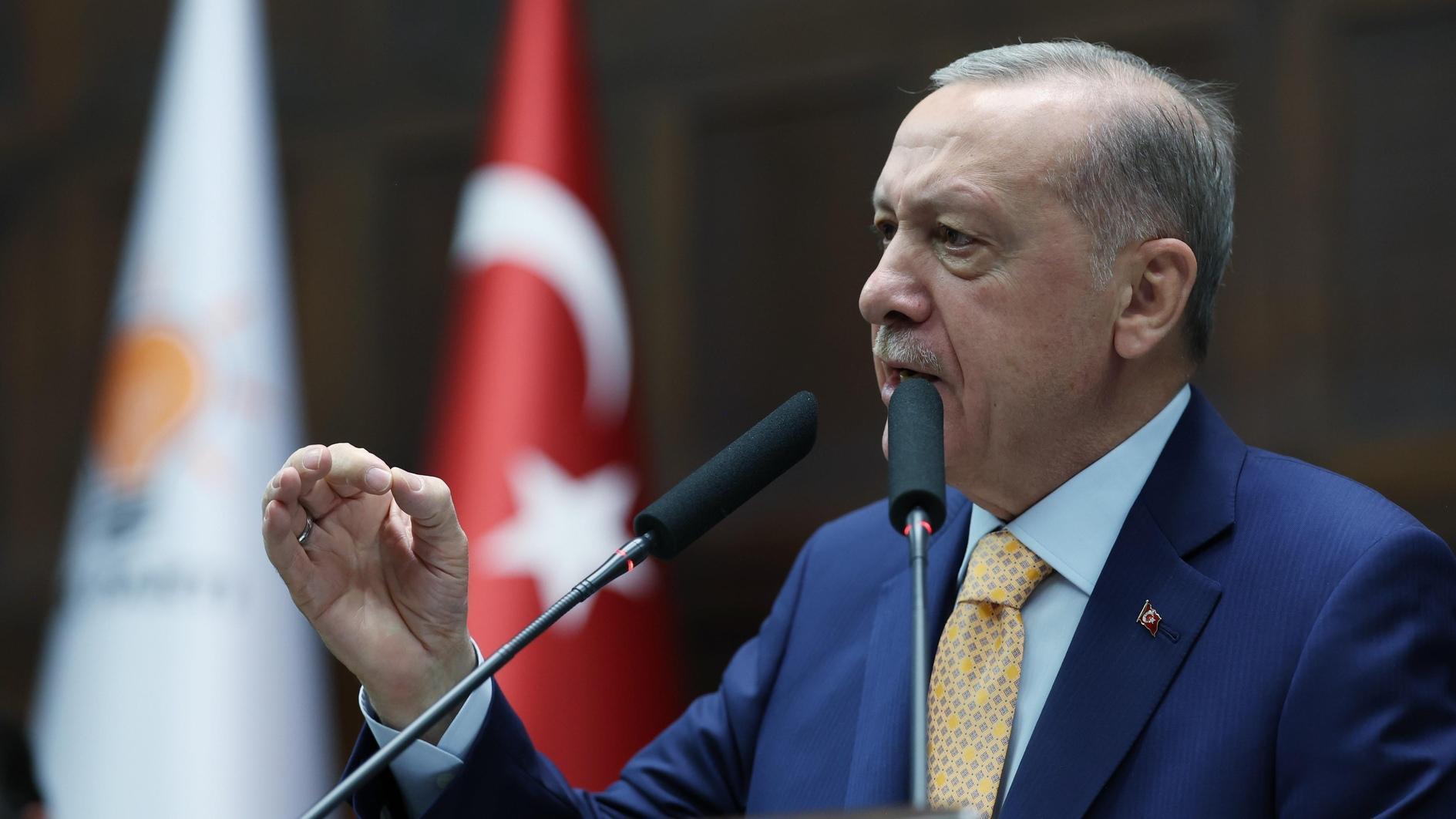

Turkey’s main investment rating under risk, Fitch said July 10. DAILY NEWS photo/ Emrah Gürel

Protracted recession in the eurozone, coupled with a reversal in global risk appetite for emerging market (EM) assets in the second quarter of 2013 following U.S. Federal Reserve (Fed) comments on an exit from quantitative easing (QE), has taken the edge off of economic recovery in emerging Europe, including Russia and Turkey, Fitch Ratings said in a press statement today.Even so, the majority of sovereign ratings in the region kept a stable outlook at the end of June, with two – Poland and Latvia – listed as positive and four – Croatia, Slovenia, Serbia and Ukraine – ranked negative, while Turkey is more of a conundrum, the rating agency said.

With the eurozone set to register a further contraction of 0.6 percent in 2013, growth in emerging Europe is expected to slow for the second year in succession to 2.3 percent in 2013 from 2.5 percent in 2012, with some countries – Croatia and Slovenia – sustaining outright contraction. The downturn in the eurozone has coincided with limited room for domestic policy maneuvering in emerging Europe, Fitch Ratings noted.

Turkey’s sovereign rating potentially at risk

“Increased expectations of a Fed exit from QE coupled with widespread antigovernment protests since April have exposed the country’s chief vulnerability: a current account deficit equivalent to 6.8 percent of GDP, over 90 percent of which is funded by portfolio investors,” Fitch said, adding that Turkish asset prices have come under strong downward pressure, precipitating a sharp fall in the exchange rate and declining international reserves. Fitch elevated Turkey to investment grade in November 2012 and considered these strains within the tolerance of its “BBB-“ rating. However, prolonged social unrest, poorly handled, could deter tourism, exacerbate short-term capital outflows, drive up inflation and damage economic growth, potentially putting Turkey’s sovereign rating at risk.

Poland and the Czech Republic appear much more secure, notwithstanding less resilient growth in the former and continuing recession and increased political instability in the latter, according to Fitch. Fiscal funding needs are well covered in both, while Poland enjoys the additional comfort of an IMF flexible credit line. Russia, with its strong sovereign balance sheet, is also relatively immune to shifts in market sentiment, although Russian corporates and banks have been heavy issuers on the Eurobond market.

Fitch said the Baltics – Estonia, Latvia and Lithuania – continue to buck the broader austerity-bound economic outlook, posting some of the highest growth rates in the region.