The markets’ Cinderella Man

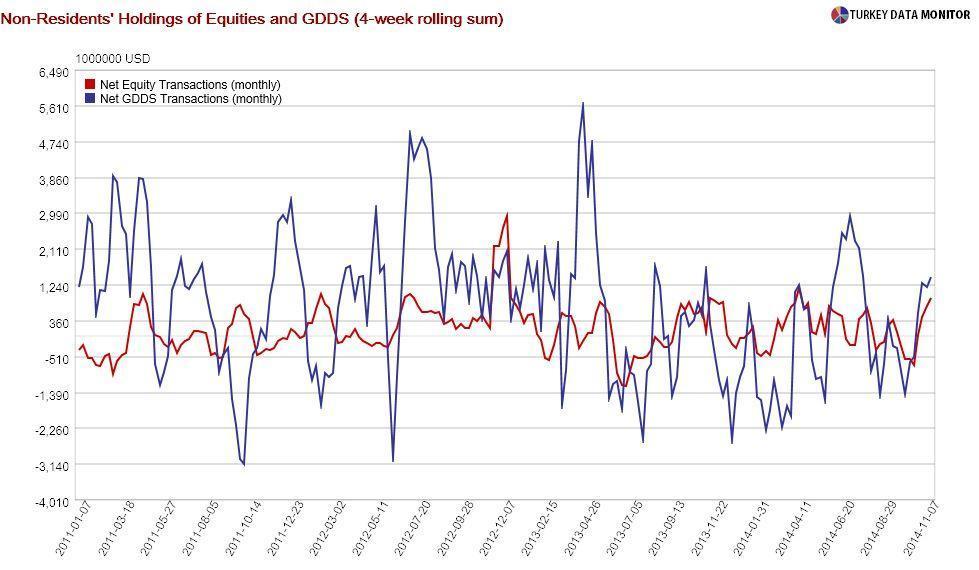

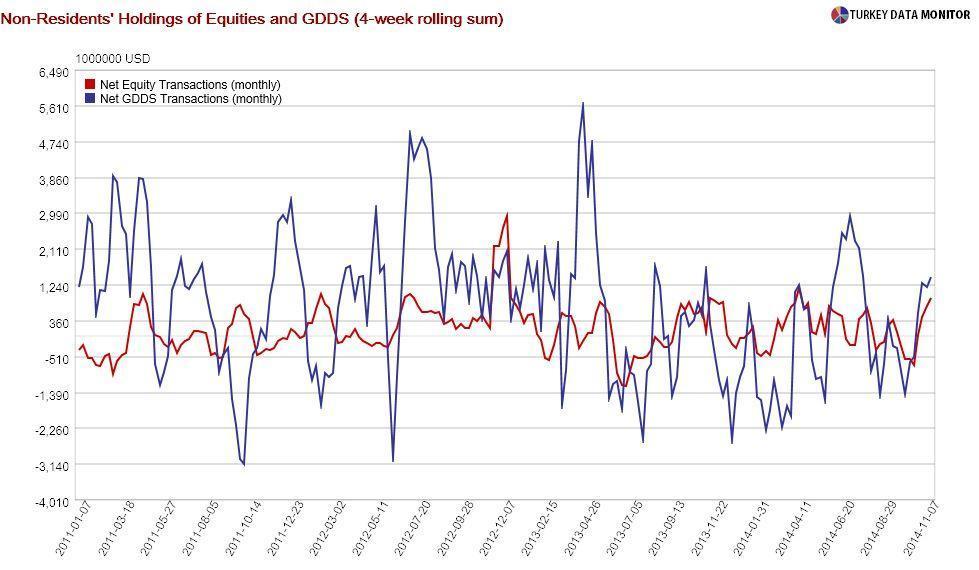

Seen as one of the most vulnerable emerging markets (EMs) not too long ago, Turkey is on a Cinderella run, attracting significant capital inflows. Foreigners’ net equity and bond investments rose by $0.9 and 1.4 billion respectively during the last four weeks.

Seen as one of the most vulnerable emerging markets (EMs) not too long ago, Turkey is on a Cinderella run, attracting significant capital inflows. Foreigners’ net equity and bond investments rose by $0.9 and 1.4 billion respectively during the last four weeks.

Unsurprisingly, Turkish assets have been outperforming their peers. Even though it is the third most depreciated major EM currency on an annual basis, the Turkish Lira is the only one that did not lose value against the dollar in the last month. Similarly, the Turkish stock market beat Morgan Stanley’s EM index by around 10 percent during this period.

There are global and domestic factors at play. Turkey could be attracting money from troubled countries in the region, such as Russia and Ukraine, as well as Iraq and Syria. But the main international developments affecting the country are truly global. According to Işık Ökte, strategist at TEB Investment, the key dates for Turkish assets are the Nov. 27 OPEC meeting in Vienna, where an output target will be discussed, and the Dec. 17 Fed rates meeting.

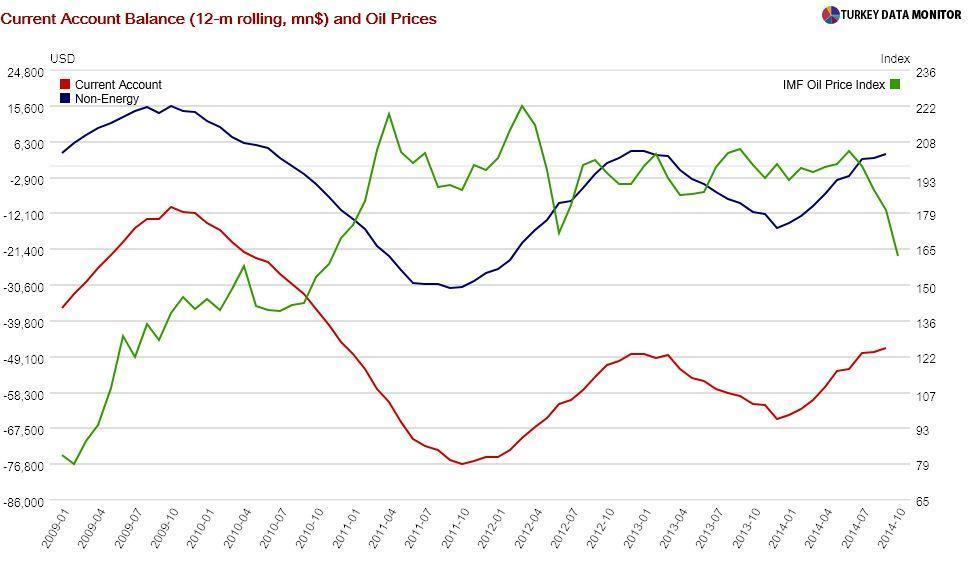

As Murat Üçer from Turkey Data Monitor, a platform for tracking the Turkish economy, recently wrote, “When only miracles can save a country, Turks relax in the certitude that one will surely happen.” The new miracle is the collapsing oil price. Turkey is seen as one of the countries set to benefit most from lower oil prices, which are expected to significantly reduce the country’s current account deficit and inflation, the two Achilles’ heels of the economy. However, as I discussed in my Oct. 20 column, most analysts are overestimating the impact of oil prices on both.

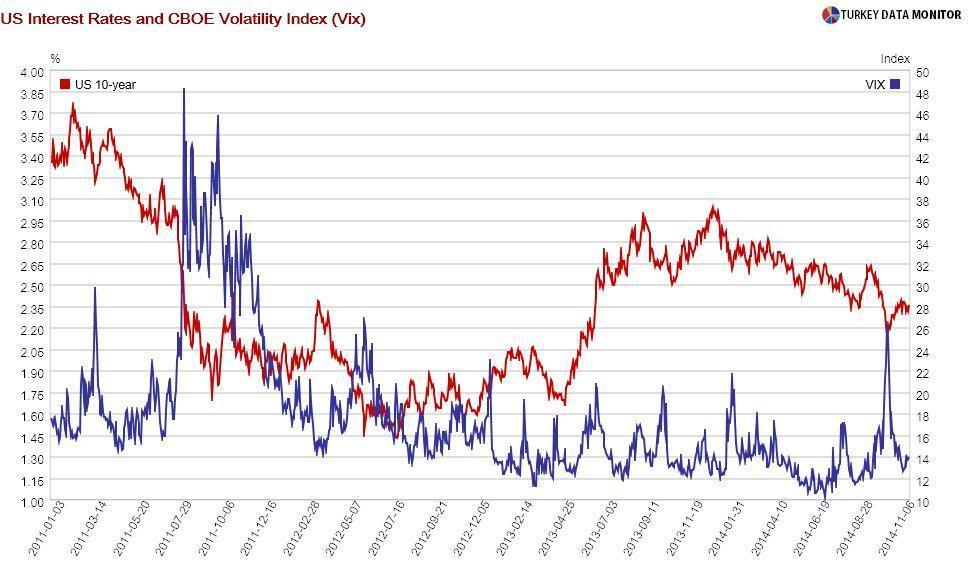

As for the Fed, I argued in the same column that that it is not as simple as, “Turkey and other EMs will continue to attract money as long as global interest rates stay low.” The missing factor in this equation is global risk aversion, which is again low after the panic of early October. We saw significant outflows from Turkish equities and bonds then.

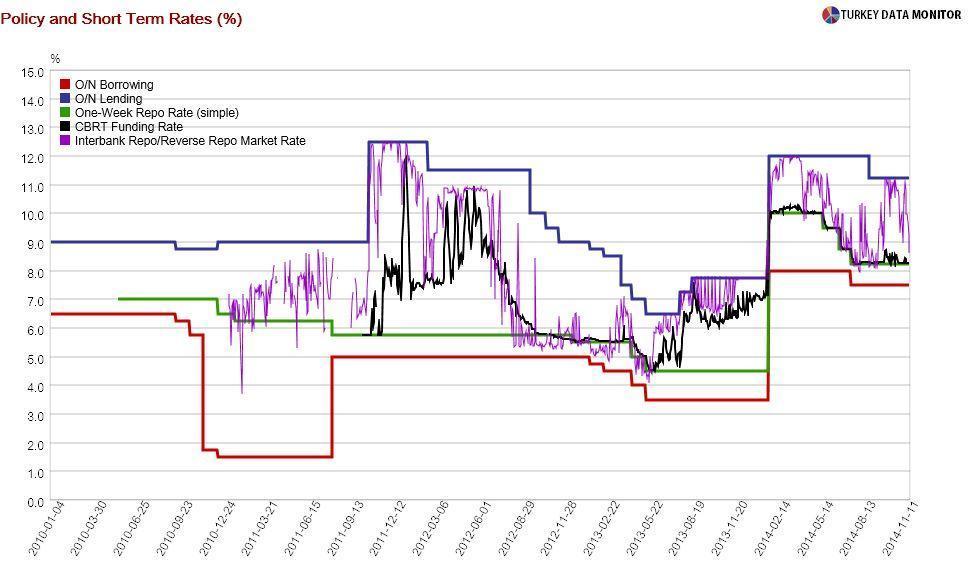

As for domestic developments, the inflows to Turkey were also being driven, especially during the last few days, by expectations of a rate cut from the Central Bank. That’s probably why the two-year benchmark, which is more sensitive to changes in policy rates, rallied much more than the 10-year government bond.

It seems that the Bank’s recent emphasis on inflation is not being taken seriously by markets, and I have to say that I agree with them. I argued in my Oct. 24 column that I see the Bank’s recent moves as preparations for a rate cut. Even though they did not touch policy rates at yesterday’s rate-setting meeting, the Bank will probably seize the opportunity provided by global developments soon.

But even Turkey will eventually run out of miracles, when markets notice that lower oil prices will not reduce the country’s structural vulnerabilities, or when the Fed starts raising rates – or when global markets are hit with another bout of risk aversion. Then, as in 2011 and more recently at the end of January, the Bank will regret the rate cuts and end up raising rates considerably.

After all, heavyweight boxing champion James Braddock, the original Cinderella Man who was portrayed by Russell Crowe in the Ron Howard movie, was knocked out by Joe Louis in his first title defense. All Cinderella runs eventually come to end.