The last central bank bender

Eight of the 23 analysts surveyed by business channel CNBC-e expect the Central Bank of Turkey (CBT) to cut its policy rate of 8.25 percent at the monetary policy committee’s rate-setting meeting on Jan. 20.

Similarly, while almost none of those polled by the CBT for its monthly survey of expectations expected a rate cut at last month’s meeting, or in the next three months for that matter, some do now, as reflected in the mean of policy rate expectations: 8.13 percent at the end of current month and 7.81 percent three months thereafter. The respective figures were 8.25 and 8.20 percent last month.

So what happened in one month? For one thing, inflation came in lower than expected. But if you look at research reports, you’ll see that almost no economist who expects a rate cut gave favorable price developments as a rationale, listing last week’s global economic developments instead.

U.S. economists surveyed regularly by the Wall Street Journal pulled back their expectations of the timing of the Fed’s first rate increase last week, but the real eye-catchers were in Europe. An adviser to the European Court of Justice said on Jan. 14 that the European Central Bank (ECB) could legally buy eurozone government debt to stabilize the currency area’s economy, in effect giving the green light for the next round of stimulus expected to be announced on Jan. 22.

It would still have been too risky for the CBT to bet on the ECB decision two days after its own rate-setting meeting, but the Swiss National Bank (SNB) sealed the deal, at least in the eyes of markets. The SNB’s decision to unexpectedly scrap its policy of capping the franc against the euro on Jan. 15 was perceived as preparation for the ECB’s quantitative easing.

Some analysts have mentioned rate cuts by other emerging market central banks last week, especially those from Peru and India, to justify their CBT rate cut expectation. Never mind that both countries are in strong disinflationary episodes- or that central banks of other EMs such as Korea, Indonesia and Poland are on hold for now.

But most of all, economists referred to market conditions: The lira has been one of the best performing EM currencies of late, and currency volatility has been low. In addition, with short-term government bond yields about 0.5 to 1 percentage point higher than longer maturities, the Central Bank’s commitment to keep the yield curve flat is fueling expectations of a rate cut.

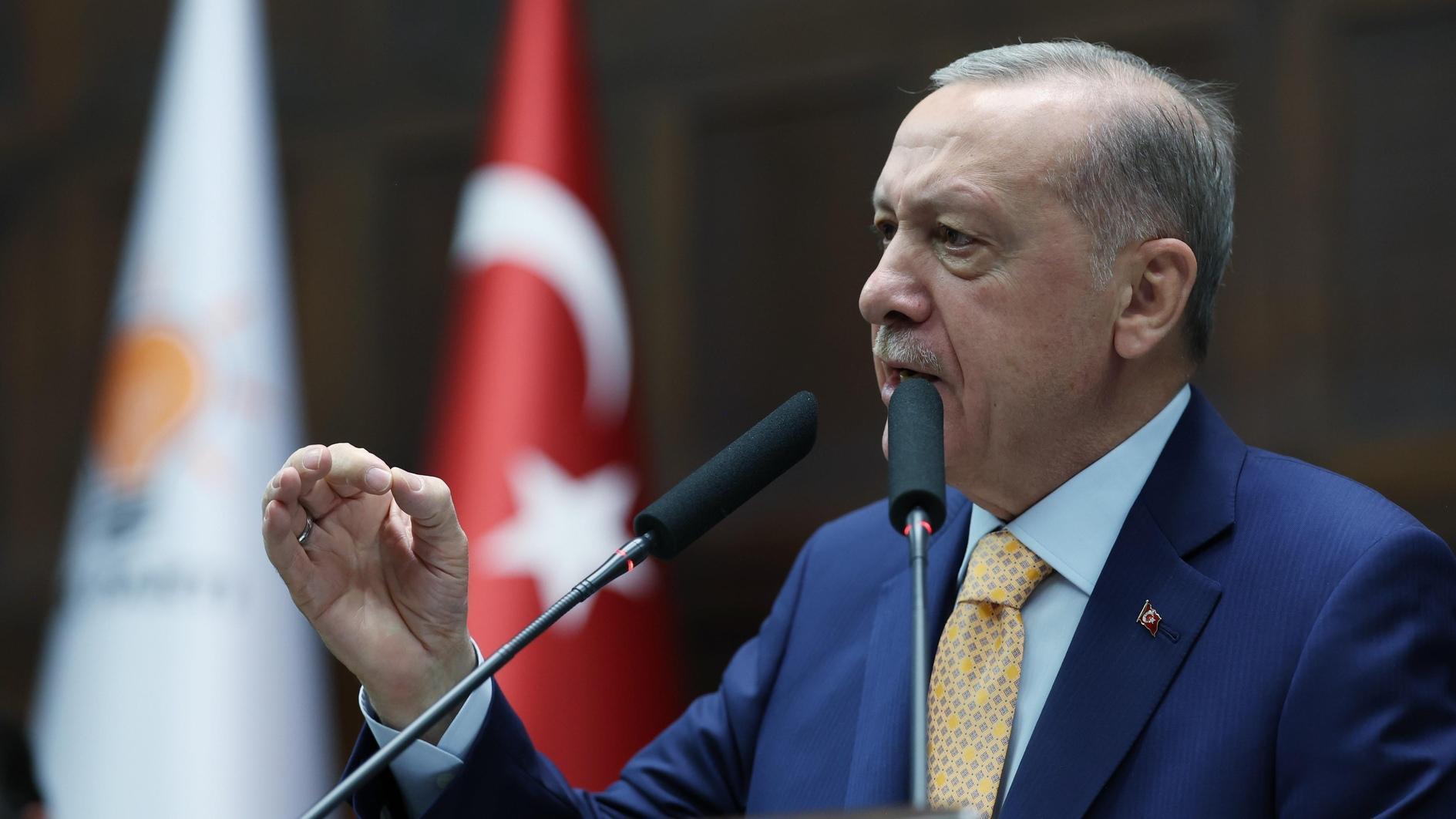

These rationalizations have led me to believe that markets see, whether true or not, the Bank as trigger-happy, itching to cut rates at the first opportunity. President Recep Tayyip Erdoğan’s pressure on the CBT for lower rates is not helping, either. On Jan. 16, he grilled the Bank again. In that respect, a hold or symbolic cut in the lower bound of the interest rate corridor would signal markets that they are doing their best not to bow to political pressure.

But thanks to the CBT’s prior actions and statements, markets also seem to think that they feel they can bend monetary policy at their will – rather than being bent by it. That may be even more dangerous than Erdoğan’s monetary policy antics in the longer run.