Teams skyrocket or dive after Mideast investment

James M. Dorsey ISTANBUL - Hürriyet Daily News

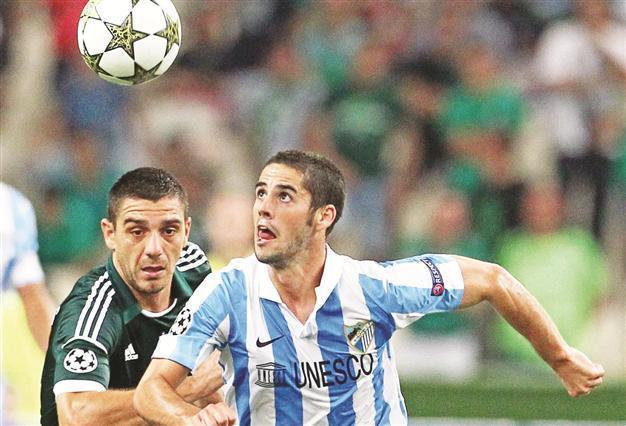

Malaga forward Isco dribbles past Kostas Katsouranis (L) of Panathinaikos during the UEFA Champions League playoffs. The Spanish club advanced to the Champions League for the first time in its history but it is having severe administration problems. EPA photo

When the going is good, it’s really good. Just witness Manchester City’s rise from the doldrums to win the Premier League on the back of Middle Eastern oil dollars and Paris Saint Germain’s (PSG) steady march toward regained glory. But when it’s bad, it’s really bad as evident from the struggles of Portsmouth FC, Malaga SC and Servette FC trying to cope with the aftermath of a Middle Eastern investment gone wrong.Portsmouth, financially bankrupt and relegated from the Premiership to the third league after two acquisitions by Arab owners with little real interest in the club, is facing the question whether it wishes to give Middle East investors a third chance.

The club’s administrators, PKF (UK) LLP, announced this week that a group of unidentified Middle Eastern investors had become the third bidder for debt-laden Portsmouth in competition with the Portsmouth Supporters Trust and former club owner Balram Chainrai’s Portpin. PKF said bidders had until today to submit their final offers.

“We have received an initial offer from a Middle East-based group and are currently awaiting clarification of financial issues,” Reuters news agency quoted a PKF spokesman as saying.

Dubai-based magazine Arabian Business said the investors put $20.4 million into an escrow account held by Dubai Bank on Aug. 30.

A winner of the English Football Association Cup in 2008, Portsmouth was relegated in 2010 after it was slapped with a 10-point penalty for going into administration.

Prestigious moves

These football investments by Qatar and the UAE serve to increase the small Gulf states’ international prestige, enable them to punch internationally above their weight, build sports as an economic sector that enhances tourism and makes them key nodes in the world’s sports infrastructure and provides leverage for further business opportunities. Qatar, moreover, has identified sports as a key pillar of a national identity it is trying to forge. The strategy is long-term and is reflected in the two states’ approach toward their sport investments.

By contrast, United Arab Emirates businessman Sulaiman al-Fahim, upset by having been pushed aside by the Abu Dhabi royals, moved swiftly in April 2009 to take control of Portsmouth after beating a rival bid by the club’s CEO, Peter Storrie, who was backed by Saudi property tycoon Ali al-Faraj. Barely five months later, al-Fahim sold 90 percent of his stake to al-Faraj whose equally brief reign effectively put the company definitively on the road to humiliation and administration.

Malaga is experiencing the travails of a businessman who has taken on more than he has wanted or is able to bite even if it is in better shape than Pompey. Malaga bought numerous players after it was acquired in 2010 by Sheikh Abdullah al-Thani, a member of the Qatari royal family. The transfers helped the club qualify for the Champions League for the first time in its history.

The writing was, nonetheless, on the wall, as soon after its qualification, players were failing to receive their wages, and the club was forced to start selling some of its most valuable assets. With a debt of 90 million euros, Malaga too could be relegated and may have to forfeit competing in the Champions League.

Servette woes

Geneva’s Swiss Super League club Servette FC and Austria’s Admira Wacker haven’t fared much better. Servette is on the brink of collapse after Iranian businessman Majid Pishyar acquired the club in 2008.

It filed for bankruptcy earlier this year. Pishyar, who managed the club on a shoestring, tried unsuccessfully to attract government funding by last year appointing Robert Hensler, a former top civil servant for the canton of Geneva, as vice-president. His earlier efforts to salvage Admira, his first European acquisition, failed too.

The lesson is obvious: Middle Eastern investors can be an enormous asset but make sure they have a long-term strategic view, rather than one that is driven by individual vanity or personal satisfaction.