Spain, Italy find no quick relief after Greek elections

MILAN/MADRID - Reuters

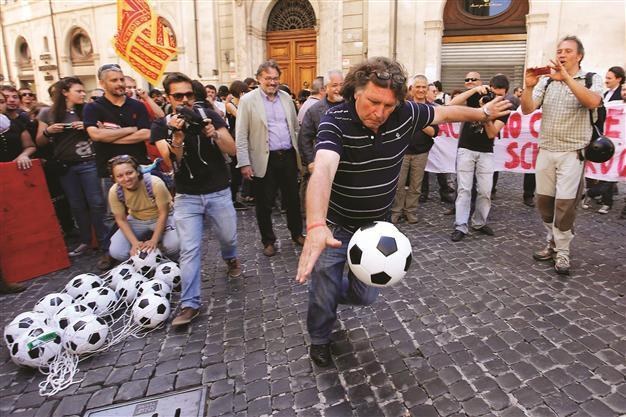

A demonstrator is seen in this photo while kicking balls toward police during a protest last week against labor reforms and EU and IMF policies to fight the economic crisis, near Chigi Palace in Rome. AP photo

Any hopes Italy and Spain may have had that the Greek election result would ease pressure on their own debt crises were dashed early yesterday when financial markets reacted as if nothing had changed.The cost of borrowing rose for both countries, the two big eurozone economies under fire for poor finances, widening the gap between what they have to pay and what Germany pays.

The yield on Spain’s 10-year bond went above the 7 percent widely viewed as unsustainable.

The moves underlined the essential dilemma facing the eurozone; short-term improvements to the climate do not address the root problem that finances are perilously tight in the middle of an economic downturn.

“The Greek elections have not solved the problems of the eurozone,” one Italian bond trader said bluntly.

Even so, a meltdown at the prospect of a Greek government pledged to reneging on its commitments and possibly forcing Greece out of the euro zone was averted.

So the leaders of Italy and Spain welcomed the narrow victory for Greek parties committed to the terms of the European Union/International Monetary Fund bailout. “This allows us to have a more serene vision for the future of the European Union and for the eurozone,” Italian Prime Minster Mario Monti told reporters in Mexico upon arriving for a G-20 summit.

Also speaking before the same meeting, Spanish Prime Minister Mariano Rajoy greeted the election outcome as “good news for Greece, very good news for the European Union, for the euro and also for Spain.”

Shares flat

But for Italy and Spain, the bond market reaction to the Greek vote suggested that the eurozone crisis needs a comprehensive solution before markets can start to build confidence.

The share and currency markets were also underwhelmed by the Greek results. After an initial spike, Europe’s top shares and the euro were flat within a couple of hours of opening yesterday.

Sceptics don’t have to look far to see why; Spanish banks’ bad loans rose to the highest percentage of their outstanding portfolios since April 1994, according to the Bank of Spain.

An audit later this week is supposed to show Spanish banks needing between 60 billion and 70 billion euros ($75-88 billion) in capital. There were mixed signals from Germany about whether it would tolerate a slight easing of demands on Greece.

It is also unclear how deep the divisions will be between German Chancellor Angela Merkel and French President François Hollande over easing back on austerity programs in favor of growth.

These questions are the kind that keep markets on edge and drive investors away from what they see as riskier assets.