Sleepless in Istanbul, listening to Central Bank BS

Sleep deprivation can have different consequences on different people. I have difficulty concentrating and become surprisingly hyperactive. I found out about another effect last week.

Sleep deprivation can have different consequences on different people. I have difficulty concentrating and become surprisingly hyperactive. I found out about another effect last week.I spent the whole day in Bodrum on Sept. 10, waiting for, and testifying in, the first hearing of my friend Esther’s murder trial. I had to drive back to Marmaris, pack up and then rush to Dalaman Airport for my 4 a.m. flight to Istanbul, in time for credit rating agency Fitch’s conference “Turkey: More Challenges Ahead” at Le Meridien.

When Paul Rawkins from Fitch kicked off the conference with his presentation titled “Turkey: Steering a Fragile Course,” I was trying to stay awake. To make a long story short, I do not think Fitch will lower Turkey’s investment grade rating at the next formal review on Oct. 3, but I found the agency ever more concerned about the Turkish economy, rendering an outlook cut possible.

Rawkins’ presentation was a summary of the points Fitch has made in recent weeks. In line with the short note they published on Aug. 11, where they had underlined President Recep Tayyip Erdoğan’s “perceived authoritarian tendencies,” he noted “the outcome of the presidential election had done little to ameliorate political risk.” He emphasized Erdoğan’s desire to extend his powers was a breach of the Constitution.

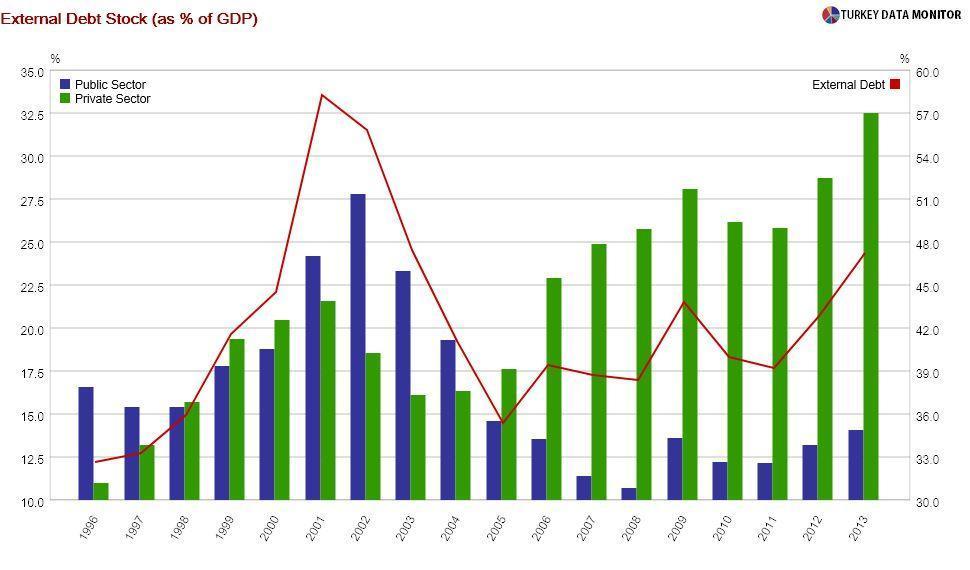

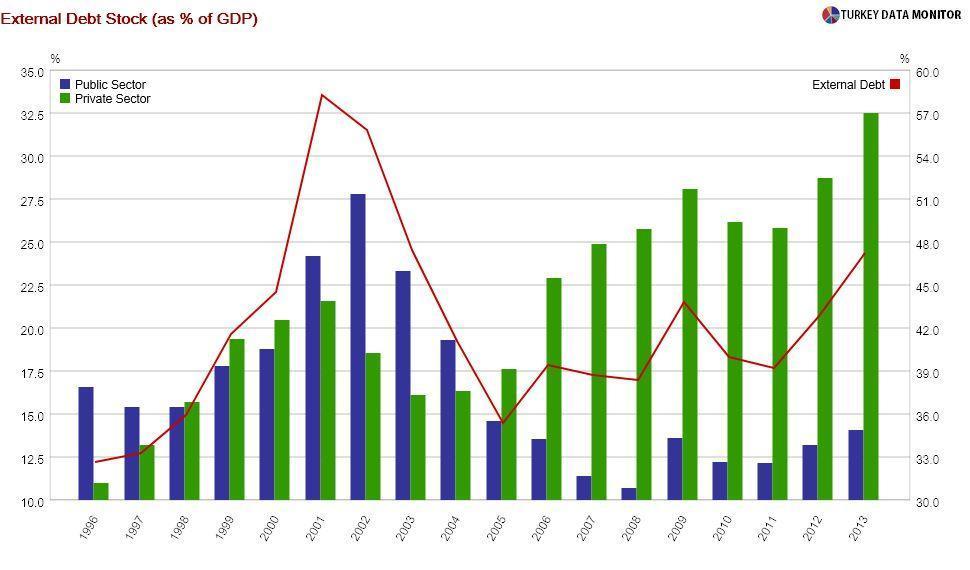

Rawkins also repeated the concerns Fitch had raised in a report published on Sept. 3. He noted Turkey’s net external debt to GDP ratio had doubled since 2009 and was now more than twice of its peers’ with the same sovereign ratings. Moreover, nearly all of this increase has been accounted for by banks, and most of it is short-term borrowing, “raising roll-over risks in a crisis.”

Given the external vulnerabilities Rawkins outlined, as well as the challenging inflation outlook, Fitch is worried that monetary and fiscal policies are loose. Because of the pressure by Erdoğan and his inner circle on the Central Bank to cut rates further, they do not expect any tightening soon. On the contrary, in a short note published on Sept. 11, they said they “believe such pressure may intensify following this week’s second quarter GDP release.”

In the same note, Fitch also emphasized the “predilection for higher growth, but without structural reforms” that I had written about in my Sept. 12 column right before Fitch’s conference in the hotel’s “business center,” which turned out to be a large desk with a computer and printer behind the reception.

But according to Deputy Governor Turalay Kenç, who presented after Rawkins, the Turkish monetary policy is tight and the priority of the Central Bank is inflation. Turkey Data Monitor’s Murat Üçer, one of the discussants in the panel following Kenç’s presentation, noted that market economists do not feel that way. By the way, the first slide of Kenç’s presentation was on growth. Probably a Freudian slip.

Surprisingly, I could barely bring myself to listen to Kenç’s affable voice. That’s when I found out that I am completely intolerant to B.S. when deprived of much-needed sleep.