Saving Private Savings III

Last week, I linked Turkey’s current account deficit to its low savings rate and summarized a recent World Bank report’s findings on the causes of the low savings.

Last week, I linked Turkey’s current account deficit to its low savings rate and summarized a recent World Bank report’s findings on the causes of the low savings.In this case, studying the roots of the problem is much more than an intellectual exercise. Some of the policy recommendations to boost savings come right out of that analysis. For example, education and women’s labor force participation have turned out to be associated with higher household savings, even after adjusting for income.

Besides, as I have reported in earlier columns, a low level of education is a binding constraint on growth, and it is also one of the main culprits behind the low “sophistication” level of the country’s exports. My “International Women’s Day” column argued how working could literally save women’s lives, and how the rise in savings would be a secondary goal under these circumstances. The World Bank has organized the rest of its policy recommendations under two broad categories.

Demand-side polices are supposed to affect household saving decisions. Interviews conducted as part of the report have revealed that Turkish households do not plan for saving and are not fully aware of their investment options. Therefore, there might be immense value in policies that raise awareness on the importance of saving and enhance financial literacy. The Bank is planning a nationwide financial literacy survey, which would be central to determining the right strategies.

On the supply side, the report concentrates on increasing the role of financial markets in pooling savings. The Turkish market is small compared to its peers and not as well-diversified, so policies that jumpstart the use of existing instruments such as corporate bonds and boost enrollment in the private pension system would help. So would mandatory or tax-preferred saving accounts, which have proven successful in Southeastern Asia and the United Kingdom.

A deeper financial market would also make it easier to channel savings into growth-enhancing investments. While I concentrated on reducing external vulnerabilities by increasing savings last week, sustainable long-term growth is an even nobler objective.

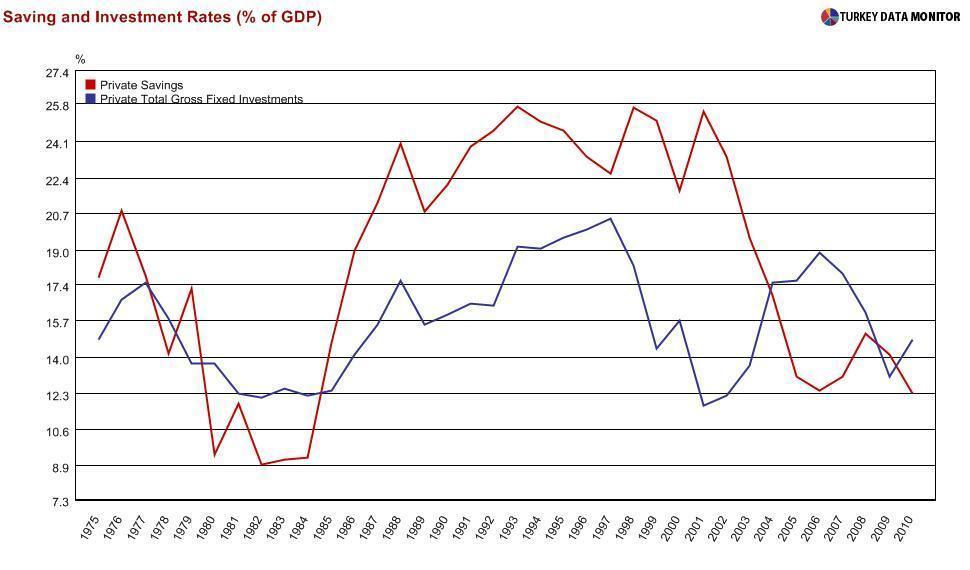

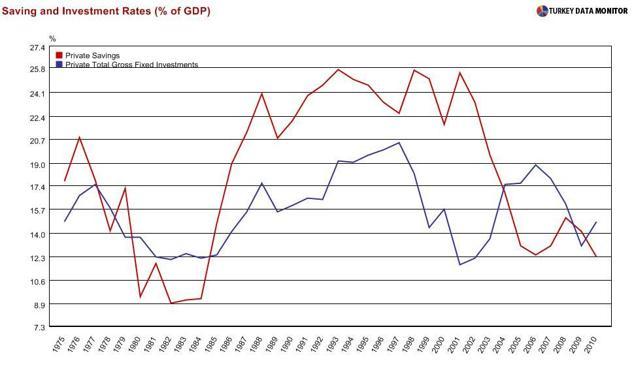

As a more general point, it is important to note that saving will not magically turn into investment. Private saving was continually higher than private investment for nearly two decades, starting in the mid 80s. A good business climate is essential, but unfortunately the micro reforms needed to ensure it have not been forthcoming.

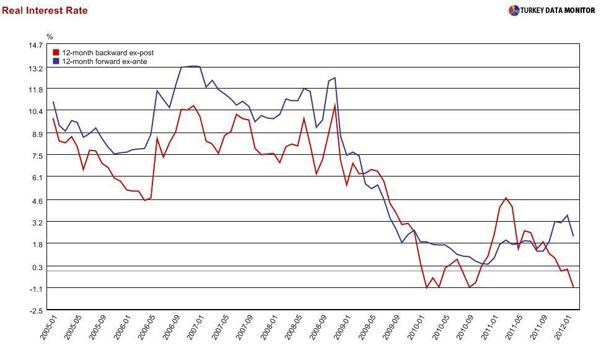

One particular point that is smartly absent (they would have been labeled as part of the “interest rate lobby” by pro-government daily Sabah otherwise) from the World Bank report is interest rate policy, although they note that lower rates have contributed to the decrease in savings. As ex-Central Bank Governor Durmuş Yılmaz noted, at the knockoff “Turkish Davos” at the Uludağ ski resort the Friday before last, we should reevaluate Prime Minister Erdoğan’s zero interest rate target given the low savings.

But just as he explained how higher interest rates beget higher inflation, I am sure the PM will revolutionize economics once more by teaching us how zero rates will boost savings.