Privatized firms to energize bourse

Gökhan Kurtaran ISTANBUL - Hürriyet Daily News

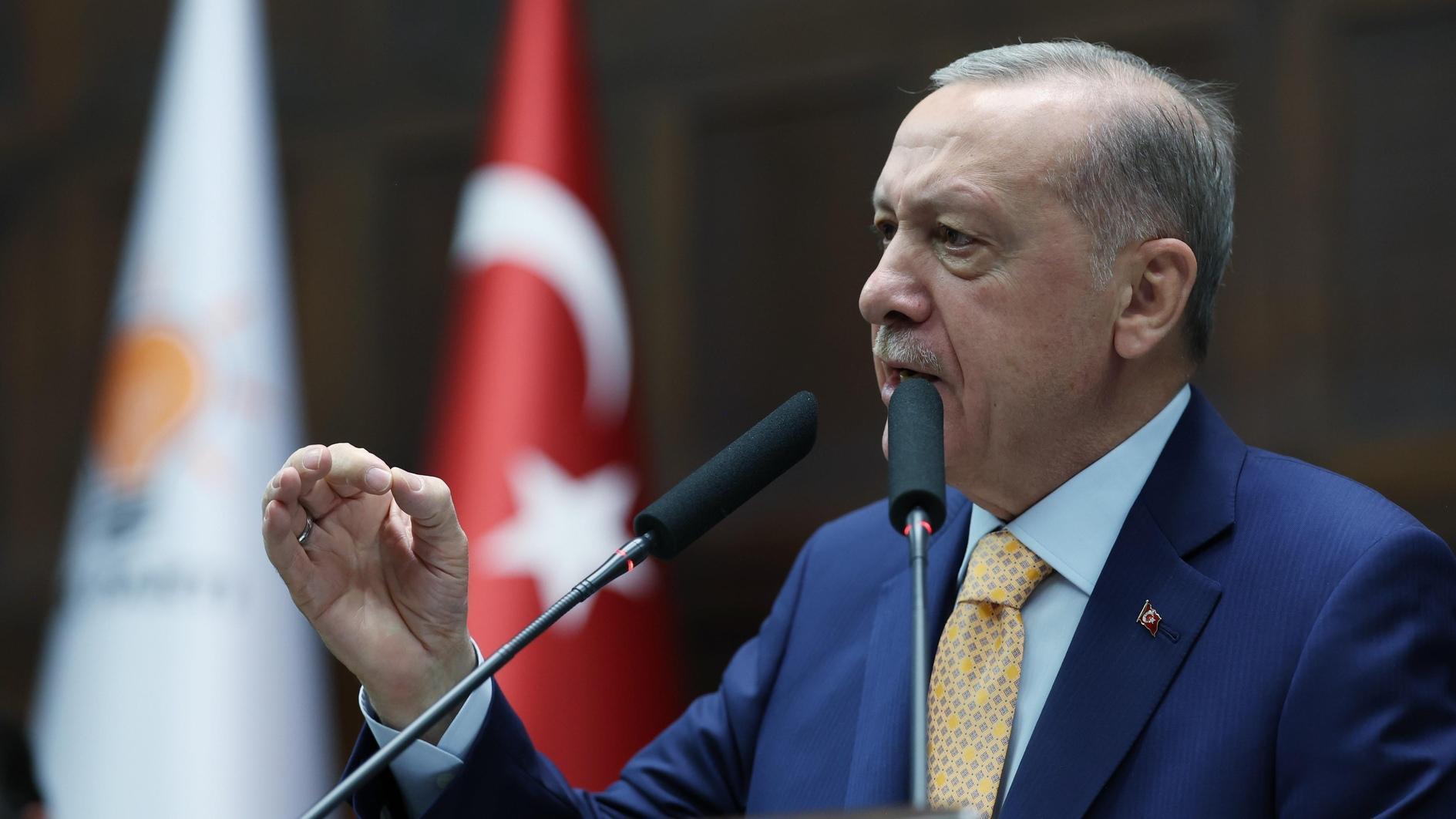

Foreign investors’ interest in the Turkish market has been rising in recent years, however, they still lack sufficient indexes picturing the risks, says Hüsnü Özyeğin. AA photo

Turkey’s privatized energy firms, including energy grids and privatized ports, should be opened to the public, a Turkish business tycoon said yesterday. He emphasized that such initial public offerings would contribute to Turkey’s bid to turn Istanbul into a global financial center.“If Turkey’s privatized energy firms were to be listed on the Istanbul Stock Exchange (İMKB), the bourse would grow by nearly 25 percent,” said Hüsnü Özyeğin, chairman of Fiba Holding, speaking on the sidelines of a press meeting held in Istanbul.

“If Turkey aims to make Istanbul a regional financial center, the İMKB needs to be bigger and stronger,” he said.

The Brazilian bourse has a volume equal to 80 percent of Brazil’s gross domestic product, but the İMKB only represents nearly 40 percent of Turkey’s GDP. “If the privatized energy firms and harbors were to be listed on the İMKB, we would narrow the gap between Turkey and Brazil.” Moreover, “initial public offering of firms in the future could bring new funds for new privatizations,” Özyeğin said.

Turkey’s privatization of energy grids in 2010 netted the government approximately $15.8 billion, according to Turkey’s Privatization Administration (OIB). Recently, Turkey rescheduled the deadline for the tender regarding the privatization of 80 percent of the shares in Başkent Natural Gas, the second largest natural gas company in Turkey, to Jan. 27, 2012.

Turkey had planned to raise nearly $15 billion by the end of 2011 to bolster public finances and increase capacity.

The İskenderun Port was also privatized through the method of transfer of operation rights for 36 years by Limak Investment Energy Sept. 28 last year for $372 billion. Limak delayed its planned public offering of a 30 percent stake in the construction and power plant units in May to the first quarter of next year, citing worsening conditions in global markets.

Talking about the banking sector in Turkey, Özyeğin said, “Comparing Turkish banks and foreign banks, I realize that Turkish banks have great advantages.” Foreign banks operating in Turkey also prefer recruiting Turkish executives as those banks “become more successful.”

He said foreign investors’ interest in investing in the Turkish market has been rising in recent years, and foreign investors still the lack sufficient indexes picturing the potential risks and outlook of the financial market in Turkey, relying heavily on foreign sources and directories.

Speaking to journalists, he said the university had agreed with Turkey’s Central Securities Depository (CDS) to form an “Investors Risk Appetite Index” to be distributed on a monthly and quarterly basis. “It will enable both local and foreign investors to benefit from the vast sources of the CDS and have a better insight and understanding of the local market.”