A brief history of Central Bank independence in Turkey

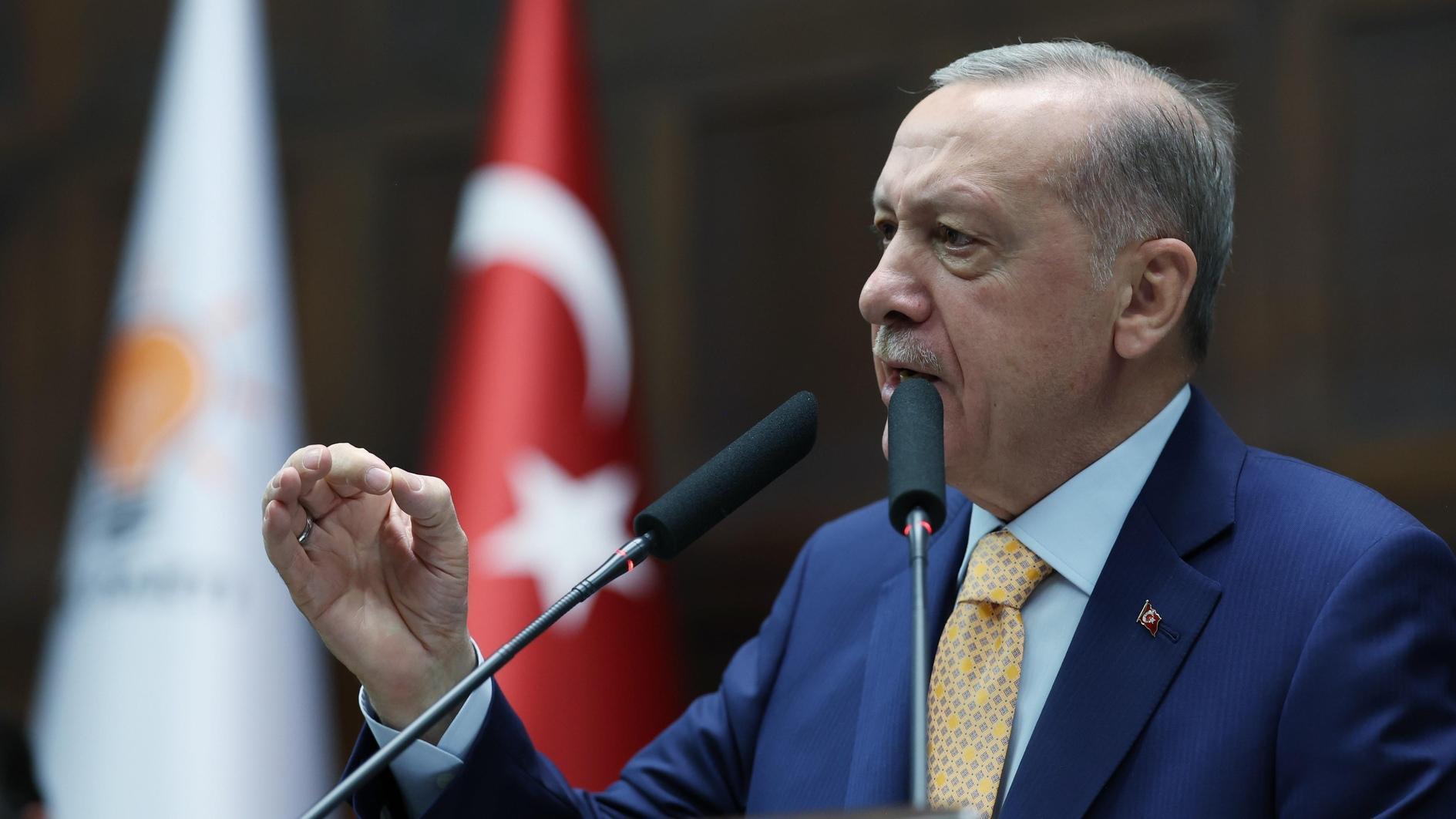

The recent tug of war between President Recep Tayyip Erdoğan and Central Bank Governor Erdem Başçı over Turkey’s monetary policy has inflamed debate on the independence of the Bank. The struggle has been interpreted as the latest battleground in Erdoğan’s bid to bring all decision making into his own hands, but it should also be considered as part of a longer-term process – as the prudent economic policies followed during the AKP’s early years are jettisoned in favor of short-term populist measures.

While nominally independent since its establishment in 1931, Turkey’s Central Bank was only granted formal “instrument independence” in 2001. The move was part of root and branch institutional reforms passed after the meltdown of the Turkish banking system in 2001, when the country’s economy shrank by 5.3 percent and GDP per capita declined by 6.5 percent. The massive crisis clearly signaled that Turkey’s economic institutions needed radical overhaul, and the former vice president of the World Bank, Kemal Derviş, was parachuted in to oversee a sweeping consolidation of the financial system. The Banking Regulation and Supervision Agency’s (BDDK) reforms included stringent new regulations and the legalization of Central Bank independence. Henceforth the Central Bank’s primary objective was to achieve and maintain price stability, while the Bank would determine at its own discretion the monetary policy it would implement and the monetary policy instruments it would use. A new law also prohibited the Central Bank from granting credits to the Treasury and other public institutions.

The overall reform process was very painful and led to the liquidation of half of all Turkish banks. One of the primary aims of the changes was to achieve financial stability by limiting the scope for discretionary interventions by feckless politicians, which had proven so damaging in recent memory. The severity of the economic catastrophe was perhaps the single most important cause of the AKP’s success in the 2002 general election, when voters turfed out the tired old coalition parties that they blamed for leading Turkey to the precipice. The Derviş-led reforms began to be implemented before the AKP came to office, but the AKP pledged to continue them in the name of long-term economic stability. However, the government has steadily lost its enthusiasm for these reforms over the course of its time in power, focusing instead on cultivating clientistic relations determined by nepotism, eagerly assisting the accumulation of capital in the hands of loyal, privileged business people.

In an important book published last year, “New Capitalism in Turkey: The Relationship Between Politics, Religion and Business” economists Ayşe Buğra and Osman Savaşkan slay a number of shibboleths in perceptions of the AKP’s economic management since 2002. One of these is that Turkey has become a free market system protected from ill-disciplined and arbitrary government intervention, largely thanks to the AKP’s support for the 2000-01 reforms. In fact, the book argues that Turkey increasingly resembles a crony capitalist system in which particular economic actors - at the expense of others - are supported by the ruling authorities in a mutually beneficial power grab. Unlike the simplistic narrative of yesteryear, the AKP’s economic program has clearly not been to stand back and allow the potential of private sector players in Anatolia to thrive without political impediments. In fact, those “Anatolian Tigers” remain a relatively small part of Turkey’s overall GDP, and the ones that have flourished have relied heavily on government support.

Buğra and Savaşkan refer specifically to changes in the Public Procurement Law. The Law was prepared in 2002 to monitor and maintain transparency in public tenders, but it has been changed over 30 times in the years since, with over 100 amendments to its scope and applications. In particular, the authority of the Public Procurement Agency, which had the power to investigate controversial public tenders, was significantly curbed with a government-led amendment in 2008. Many other independent regulatory agencies similarly lost their autonomy in 2011, when another decree placed them under the authority of the ministries in their respective areas. The results are obvious. The scope for the government to tilt the playing field in favor of friendly business groups has broadened significantly.

Viewed in this light, the recent salvos fired by President Erdoğan against the Central Bank’s “traitorous” reluctance to lower interest rates should not be surprising. Economic reforms that emphasized stability and fiscal responsibility have been steadily whittled away over the last decade in favor of short-sighted policies that give the government short-term advantages. The targeting of the Central Bank is perhaps only the next logical step in this cycle. If, as some are predicting, Erdoğan takes steps in the coming months to curb the Central Bank’s independence to bring it in line with the elected “national will,” it would amount to a final nail in the coffin of the 2000-01 reforms. The president may well succeed in tightening his grip on power, but this move could also herald a period of severe economic turbulence for Turkey.