Erdoğan’s interest rate fetish resurfaces

On his way to Azerbaijan, to ask President İlham Aliyev to close down schools of the Gülen movement – according to the Azerbaijani press – Prime Minister Recep Tayyip Erdoğan called on the Central Bank to cut interest rates.

On his way to Azerbaijan, to ask President İlham Aliyev to close down schools of the Gülen movement – according to the Azerbaijani press – Prime Minister Recep Tayyip Erdoğan called on the Central Bank to cut interest rates. “The Central Bank should hold an extraordinary meeting to cut [interest rates] ... just as they met previously to raise them,” Erdoğan said in an airport press conference on April 4, right before he scolded a journalist for asking him about one of Egemen Bağış’s leaked phone conversations. The ex-EU minister was making fun of a surah in the Quran, among other things.

In a way, this is the good news: Threats to journalists and the obsession with interest rates are signs that Erdoğan, if not the country, is normalizing. After all, these are his modi operandi. But the timing of his remarks was meaningful (“manidar” in Turkish), to say the very least.

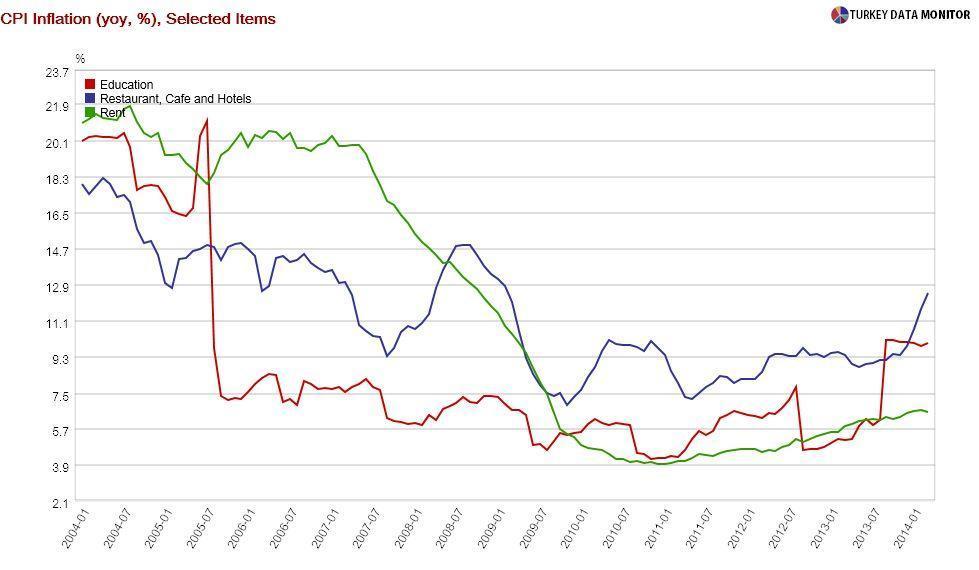

According to official statistics released just a day before, prices rose 1.1 percent in March, higher than expectations of 0.9 percent. Annual inflation increased to 8.4 from 7.9 percent. Although food inflation was again high, probably due to the ongoing drought, it wasn’t solely responsible for the headline figure this time around: Core inflation, which excludes food among other things, hit 9.3 percent – its peak over almost seven years.

Most economists attributed the high turnout to the lagged effect of the lira depreciation, but there may be more to it: Prices have also risen in sectors insensitive to the exchange rate, suggesting that pricing behavior might be changing. Moreover, the increase in inflation in certain service items, where prices are not revised often, hints at credibility problems.

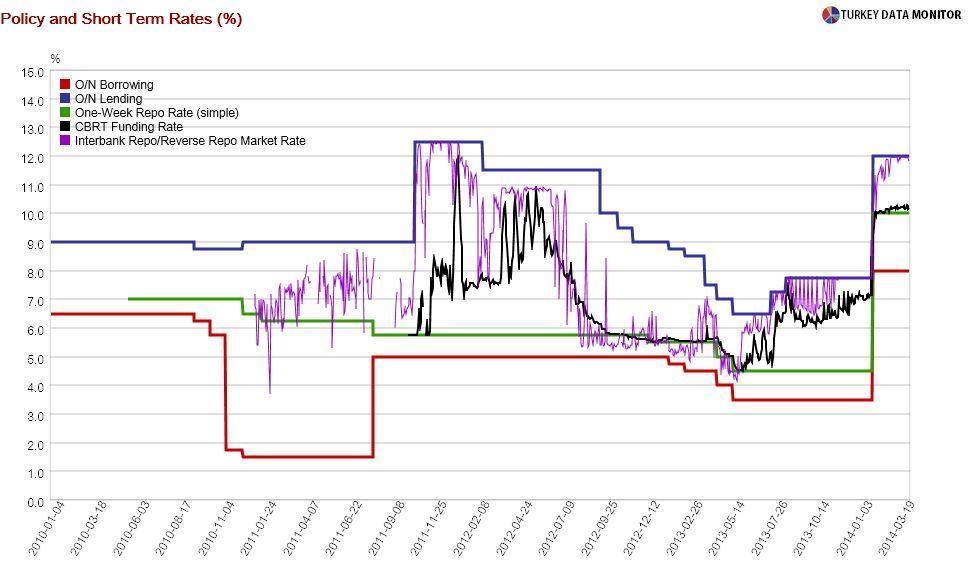

The figures were so bad that DenizInvest’s Özlem Derici titled her research note on inflation “Somebody said rate cut?” Most market economists remarked that rate cuts were out of the equation for a while. During a planned meeting with investors in London shortly after the release of the inflation statistics, Central Bank Gov. Erdem Başçı unsurprisingly did not sound dovish – although he did imply some easing in liquidity and reserve requirement policies.

The Central Bank will probably cut lira reserve requirement ratios at the upcoming rate-setting meeting on April 24. They will also soon start paying interest on reserves. They may begin implementing “easing by stealth” even before the meeting – by providing more liquidity through the one-week repo at 10 percent. Market rates, currently right below their 12 percent ceiling, would fall as a result. Such a move could backfire, and I doubt it would help the economy much.

Besides, I am not sure these would be enough to satisfy Erdoğan, who needs significantly lower rates to boost the economy. He is aware that his votes in the local elections may not be enough to win him the presidency, especially if the economy slows down in the second half of the year.

By the way, this topic was requested by a reader, who told me that he was making it a point to #RememberBerkin.