Volatility targeting by the Central Bank

With a light economic calendar, I was hoping to spend the last days of the year in tranquility. It was not to be.

With a light economic calendar, I was hoping to spend the last days of the year in tranquility. It was not to be.I dealt with a lot of legal stuff for our family business this week. I will detail my experiences in a later column, but suffice it to say that I have a newly found admiration for Bleak House, where Charles Dickens illustrates the shortcomings of the judiciary. As if going through boring text and wandering in courts were not enough, I managed to get confused by the Central Bank again.

During his presentation of the bank’s 2013 Monetary and Exchange Rate Policy on Dec. 25, Gov. Erdem Başçı noted that “short-term capital flows could disrupt price and financial stability by causing excess volatility in lending and exchange rates.” Therefore, the bank would not allow sharp moves in either.

There is much more to this seemingly simple statement than meets the eye. First, it is assumed that hot money causes volatility in credit and exchange rates. Moreover, this volatility is presumed to unsettle financial and price stability.

Starting with the second assumption, every student of economics knows that fast credit growth may result in inflation. Likewise, the transmission from the exchange rate to prices is referred to as exchange rate pass-through in the literature. It is quite common in emerging markets, including Turkey. But these concepts are for changes in levels, not volatility.

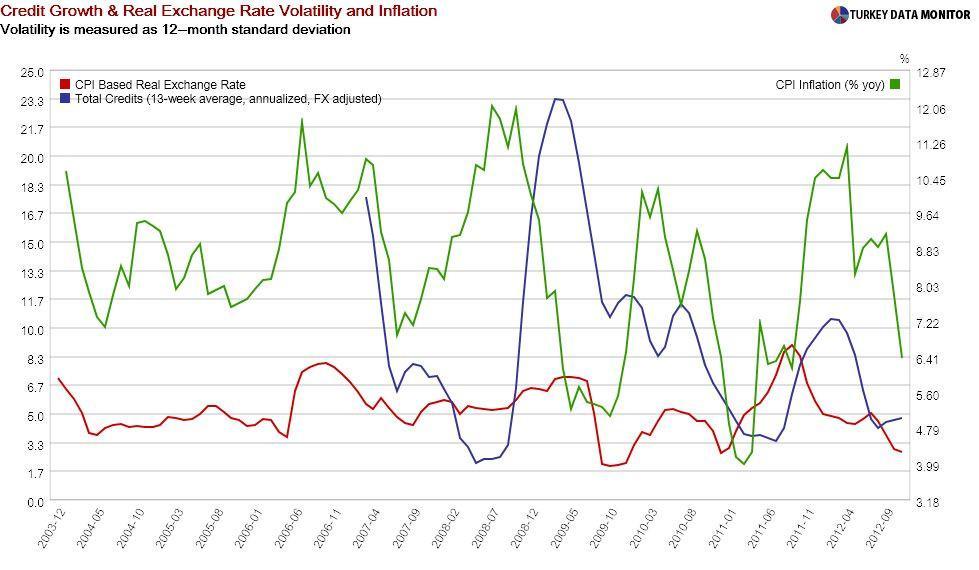

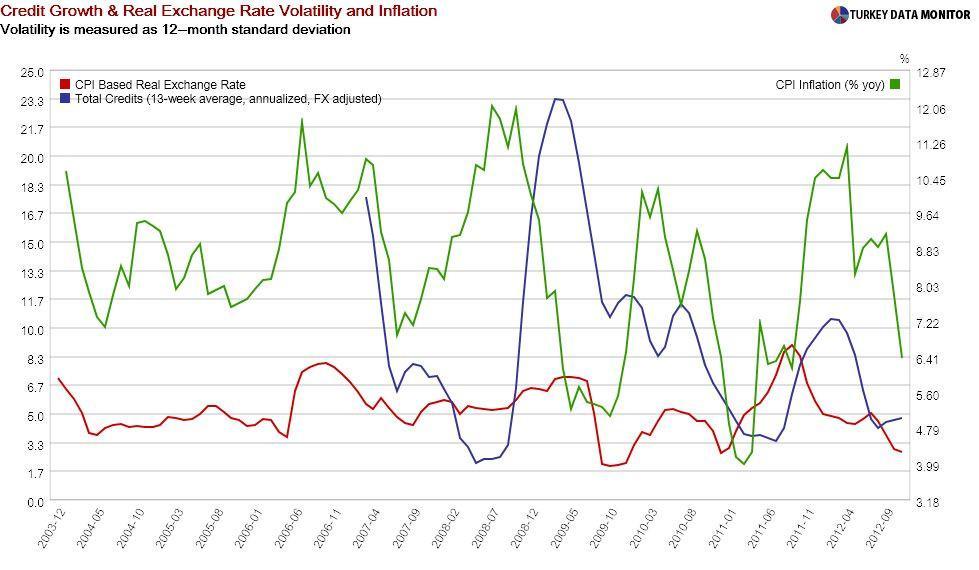

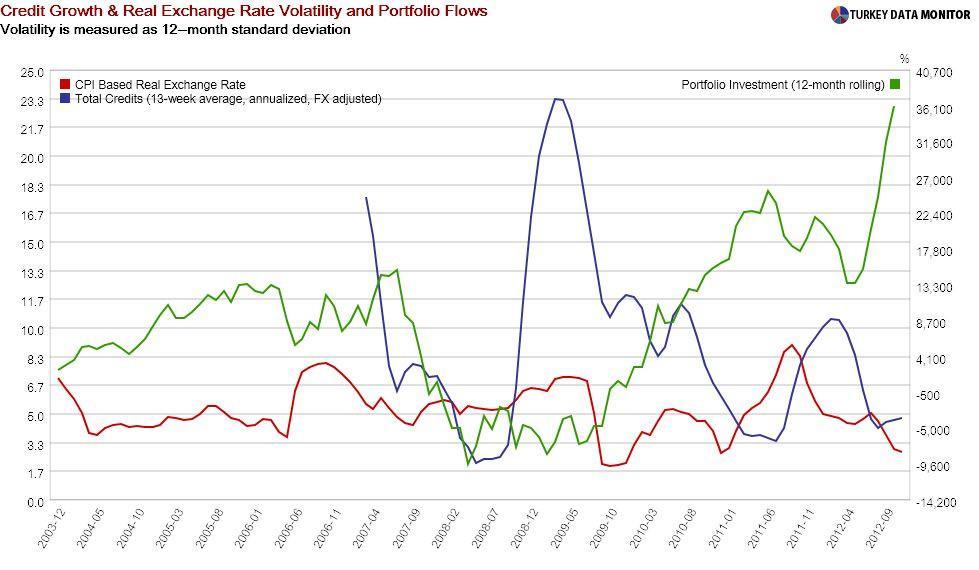

I am not aware of any study that has actually demonstrated a link between these volatilities and inflation. And neither are the several monetary economists I contacted before writing this column. Graphing the relationships surprisingly shows quite a bit of correlation. But formal statistical tests reveal there is no causality, and the relationship disappears once you take into account credit growth and exchange rate depreciation.

I would also want to see some proof that a rise in capital flows actually causes more volatility in credit and exchange rates in the first place. My statistical tests were more successful this time around, and my graphical ones less so, but the relationship is still less than perfect.

It is possible that the Central Bank is right. After all, they have a very qualified research department and access to lots of data. But without any backing, this seems like yet another attempt by the bank to justify their moves by “forcefully fitting” them into their inflation targeting framework.

I am actually not sure what the bank is targeting anymore. Until Dec. 25, I thought it was the level of the real exchange rate. Now, it seems its volatility, as well as that of credit growth, is on the bank’s agenda. But I know for sure that they are not targeting inflation anymore, and many analysts agree with me.

But the bank is vehemently claiming it is. I really don’t see the point. I would prefer they stuck with inflation even if they would like to widen their objectives. But if they won’t, they should just admit it and come clean.