Turkey’s trio of economic challenges

Last week’s data exposed the economy’s “trio of challenges.” For one thing, Markit’s purchasing managers’ index (PMI), which was released on September 1, fell below the critical 50 threshold in August, “signaling an overall deterioration in business conditions at Turkish manufacturers.”

Last week’s data exposed the economy’s “trio of challenges.” For one thing, Markit’s purchasing managers’ index (PMI), which was released on September 1, fell below the critical 50 threshold in August, “signaling an overall deterioration in business conditions at Turkish manufacturers.”

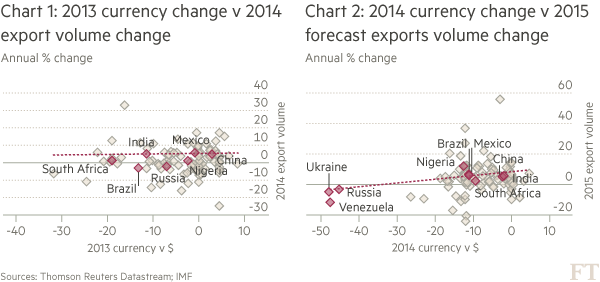

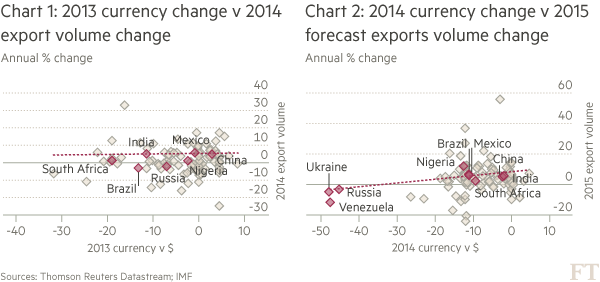

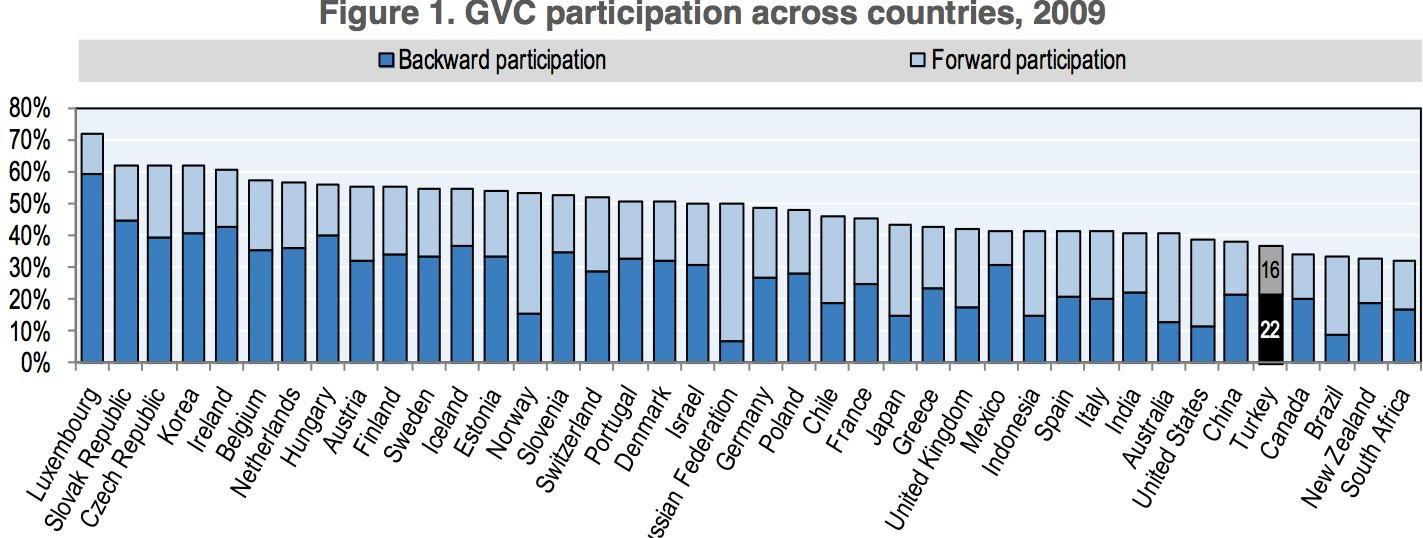

In fact, exports usually respond more to income (of receiving countries) than prices (exchange rate). The impact of the latter may have fallen through time: A recent World Bank paper shows that between 2004 and 2012, currency depreciations were only half as effective in boosting exports as they had been between 1996 and 2003. A similar study by the Financial Times, using data from 2013 to the present, finds no effect of exchange rates on exports.

The authors of the World Bank paper attribute their result to the rise of global value chains (GVCs): “As countries are more integrated in global production processes, a currency depreciation only improves the competitiveness of a fraction of the value of final goods exports.” Turkey is not part of GVCs, but Turkish exporters import quite a bit of machinery and intermediate inputs. A weaker lira would make these goods more expensive.

Lower growth, persistent inflation and a stubborn trade deficit would be the worst combination for any country. Turkey is heading to elections amidst terrorism threats in this challenging economic landscape.