‘The Return of the Consumer’

One of the most confusing and puzzling, or confuzzling, aspects of the Turkish economy of late has been the paths taken by the producer and the consumer, which were diverging until recently.

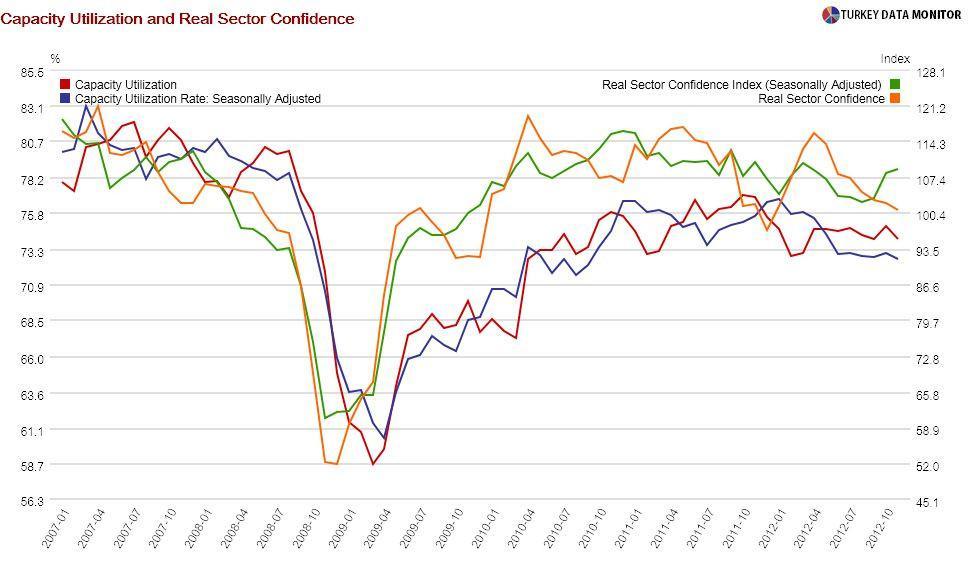

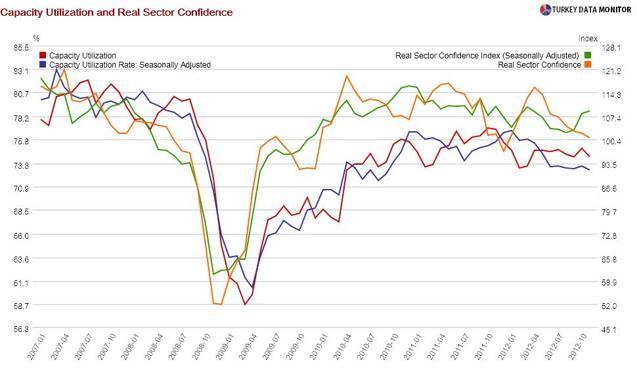

One of the most confusing and puzzling, or confuzzling, aspects of the Turkish economy of late has been the paths taken by the producer and the consumer, which were diverging until recently.The former has been showing some signs of recovery since October. Early gauges for production, such as the Central Bank’s capacity utilization rate and real sector confidence index, recovered somewhat in October.

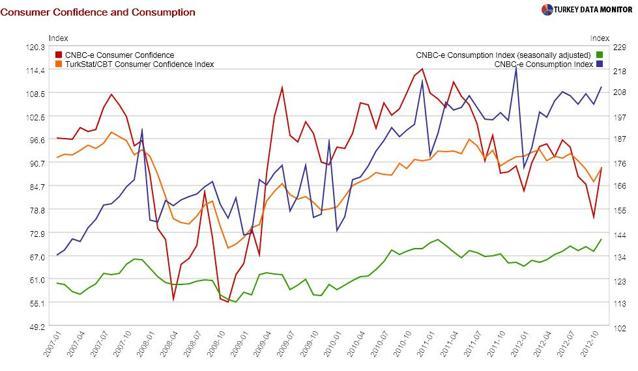

Consumption leading indicators, on the other hand, were very weak until December. You could argue that exports were helping production out, but the Turkish economy is mainly domestic-demand driven. Besides, headline export figures are in fact deceptively strong: Once you take out gold shipments to Iran, exports look less impressive.

This divergence between the producer and the consumer had to be resolved one way or the other. After all, if they cannot find someone to sell their goods to, firms cannot continue producing into their inventories forever. At the time, I thought that given the ultra-low interest rates and signs of a pick-up in credit, it would be domestic demand rising rather than production falling. I made that call to investors when I met with them in London in early November.

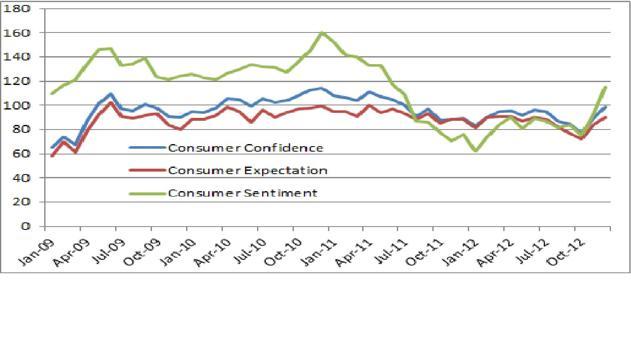

At first, it seemed I was wrong yet again. October consumer confidence, released on Nov. 16 by Turkish Statistical Institute and the Central Bank, was the index’s lowest value since March 2010. October industrial production turned out to be very low on Dec. 10, but as I argued in my Dec. 14 column, that weak figure was mainly because of the fewer working days that month. The data since then have vindicated my belief that consumption would pick up.

Business channel CNBC-e’s consumption index, which was released yesterday, rose 4 percent in November. This should not have been a huge shocker. After all, the network’s consumer confidence index had registered a comparable increase on Dec 1. The official version of the same index, which was released on Dec. 17, similarly surged.

It is too early to form a definitive judgment, but it seems that the rise in consumption will continue: CNBC-e’s preliminary consumer confidence index, which was released on Dec. 14, rose sharply in December. Similarly, there is a marked increase in consumer credit. In the one-pager accompanying its Dec. 18 rate decision, the Central Bank noted that the “contribution of domestic demand to economic growth is expected to increase” on the back of these factors.

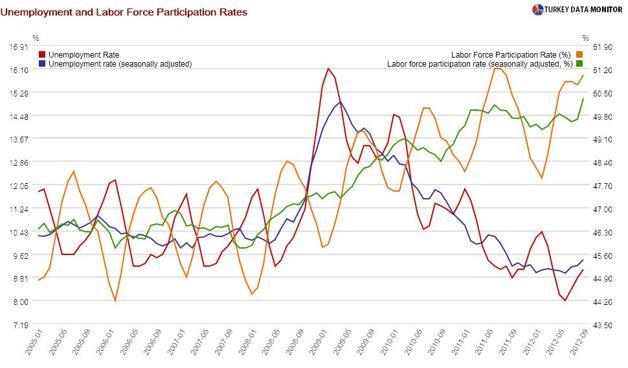

Skeptics could point at some seemingly contradicting indicators. For example, Dec. 17’s labor statistics show an increase in unemployment. But that data is from September, and unemployment is usually a lagging indicator rather than a leading one. Even then, it is important to note that part of the rise in unemployment is due to an increase in the labor force, which means more people are looking for jobs.

But maybe the world will come to an end today, as the Mayans predicted, and so we’ll never know if consumption would really have picked up.