My warning to all ‘IstanBulls’

The markets’ mood regarding Turkey took a decisive turn for the better last week.

The markets’ mood regarding Turkey took a decisive turn for the better last week.

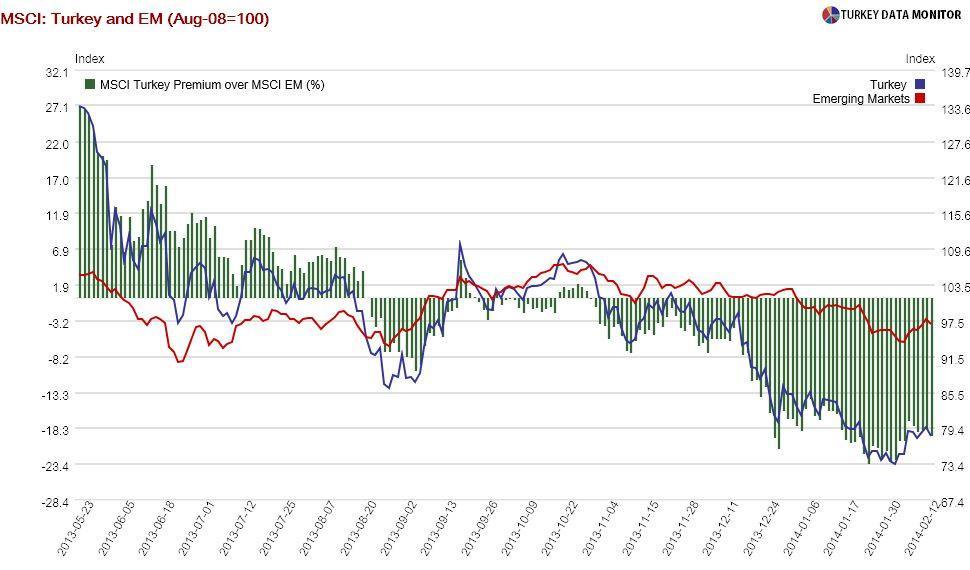

Turkish assets have, in fact, been recuperating from previous losses since the Central Bank’s emergency rate hike Jan. 28. The positive sentiment toward emerging markets during the last couple of weeks has helped and Turkey has been outperforming most peers. There were several events that brightened the country’s prospects this past week.

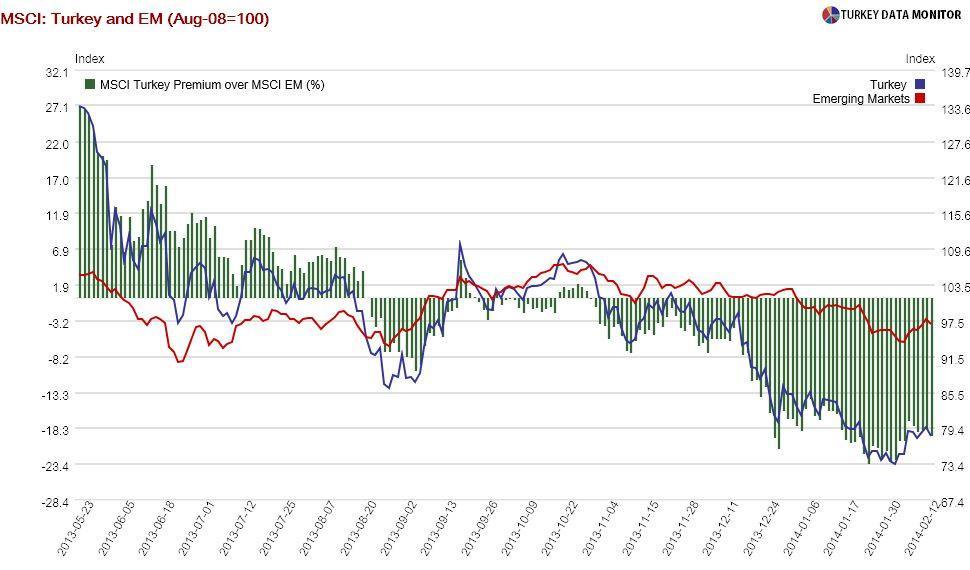

First, industrial production rose 6.9 percent annually, higher than the expected 4.9 percent. The strong figure is partly due to a base-year effect, as working day and seasonality-adjusted industrial production was unchanged over the previous month. And machinery and equipment production, which Turkish economists use as a leading indicator of investment, was very strong.

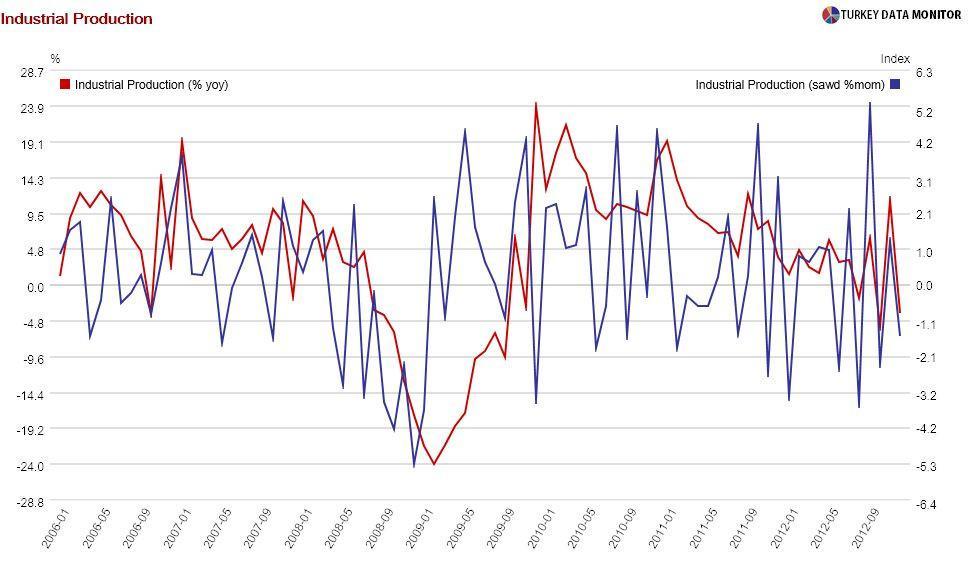

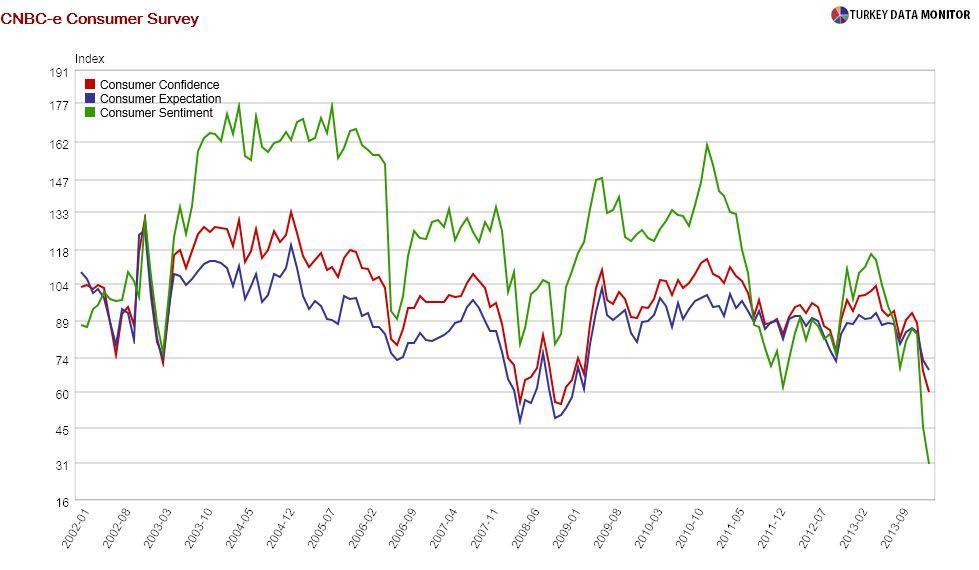

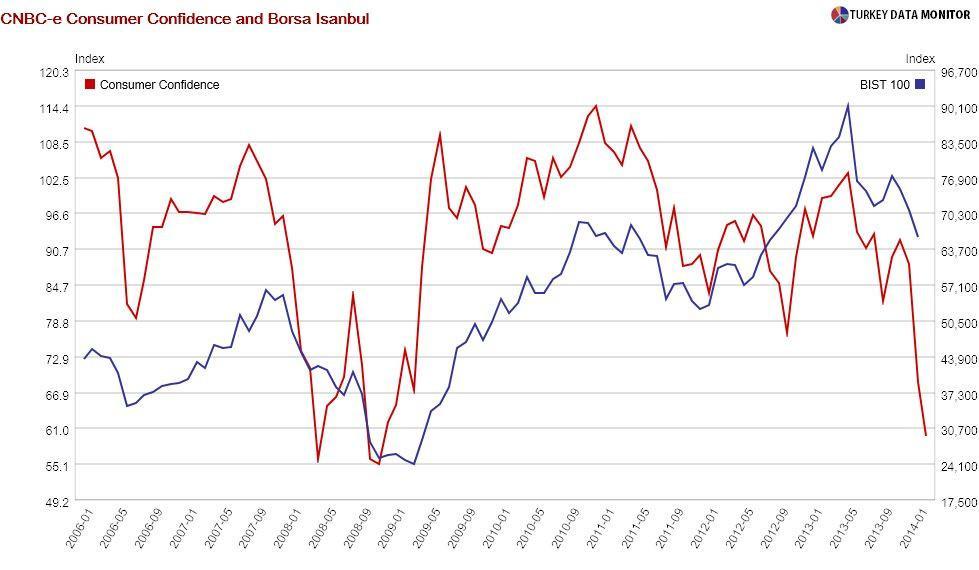

I don’t want to be a party pooper, but according to preliminary figures released Feb. 14, the business channel CNBC-e’s consumer confidence index fell to its lowest figure since November 2008. Consumer sentiment, a sub-index that measures the appetite to buy durable goods, dove again after last month’s sharp fall.

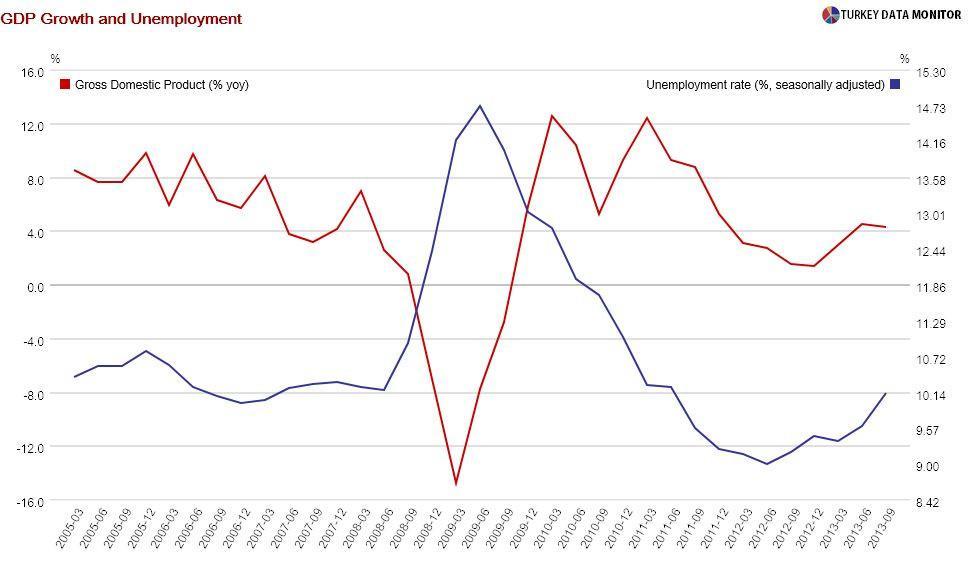

It is worth remembering the Turkish economy hit rock-bottom in March 2009, with growth bottoming out and unemployment peaking. It might also be worth noting, for all the equity bulls out there, consumer confidence has been a decent leading indicator of stock market performance, especially during the 2008-2009 contraction.

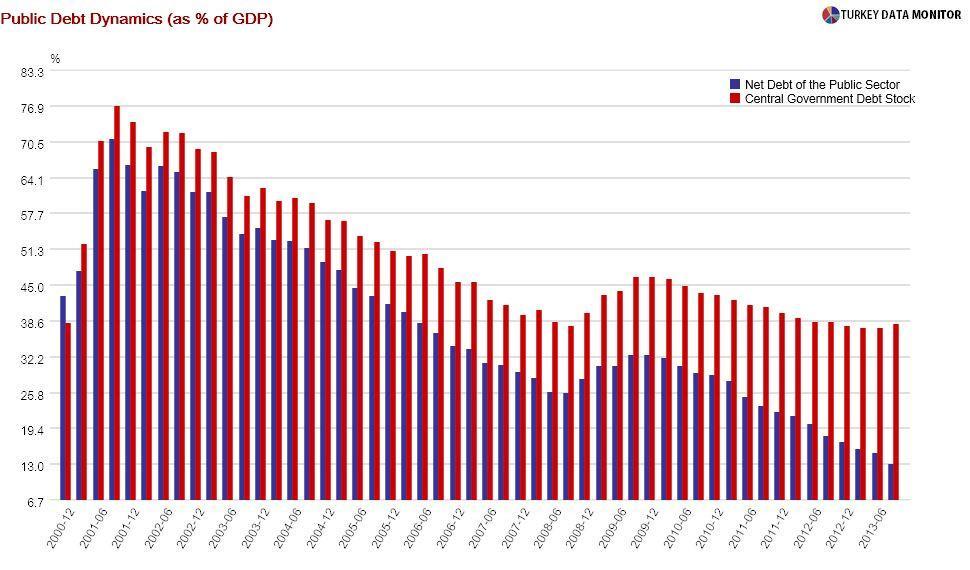

Markets were also impressed by the strong demand for Turkey’s 31-year dollar bonds on Feb. 12. In fact, Turkey is no exception: hard currency bonds offering high return are attractive for those seeking yields. In addition, Turkey’s public debt dynamics, which sovereign debt investors care about, are strong.

But I think the main drivers of the mini-rally were political: according to a trader friend, the release of Halkbank’s former manager Süleyman “Shoebox” Aslan and five others on Feb. 14 boosted sentiment.

Markets could be thinking Prime Minister Recep Tayyip Erdoğan is putting the graft scandal behind on his way to a decisive victory, not only in the upcoming elections, but also over Fethullah Gülen.

I beg to disagree. If nothing else, the local elections are far from being in the bag for Erdoğan. As I argued before, the graft scandal will likely not cost him more than a couple of percentage points, but if the economy does not manage to hold on until the end of March, his votes are likely to suffer, just like in the 2009 local elections.

In any case, we could also see a shift in emerging market sentiment around that time once, with the rite of spring, we find out the weakness of the U.S. economy this quarter was due to bad weather, thereby rekindling faster-tapering worries. The Fed’s winding-down of its bond purchases are also likely to raise Treasury yields more as the U.S. economy recovers.

I am not telling you to short Turkey right now. On the contrary, enjoy the ride while it lasts. Just make sure you are not in the coach when it falls off the cliff.