Data explain the AKP’s election performance

In my April 4 column, I noted that the ruling Justice and Development Party’s (AKP) performance in the local elections should not have been a surprise.

In my April 4 column, I noted that the ruling Justice and Development Party’s (AKP) performance in the local elections should not have been a surprise.After all, as I explained in my Jan. 3 column as well, voters do not punish graft in countries where corruption is prevalent as long as the economy is doing well. And although I continue to expect a significant slowdown in the second half of the year, the Turkish economy did manage to hold up until the local elections.

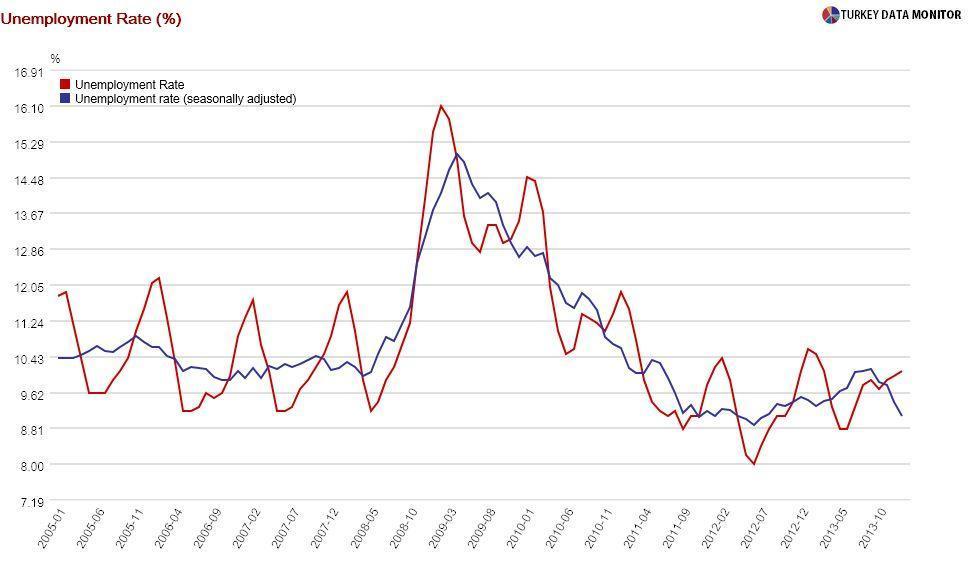

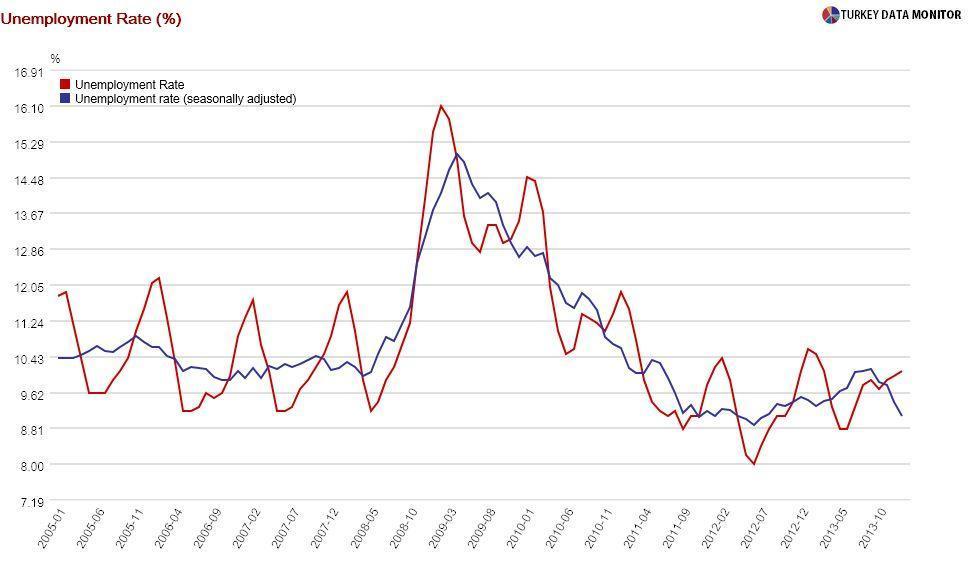

We got more evidence of this unforeseen economic performance before the elections this week. Unemployment fell to 10.1 percent in January from 10.6 percent in the same month the previous year. Similarly, the seasonally adjusted unemployment rate decreased to 9.1 from 9.4 percent in December 2013.

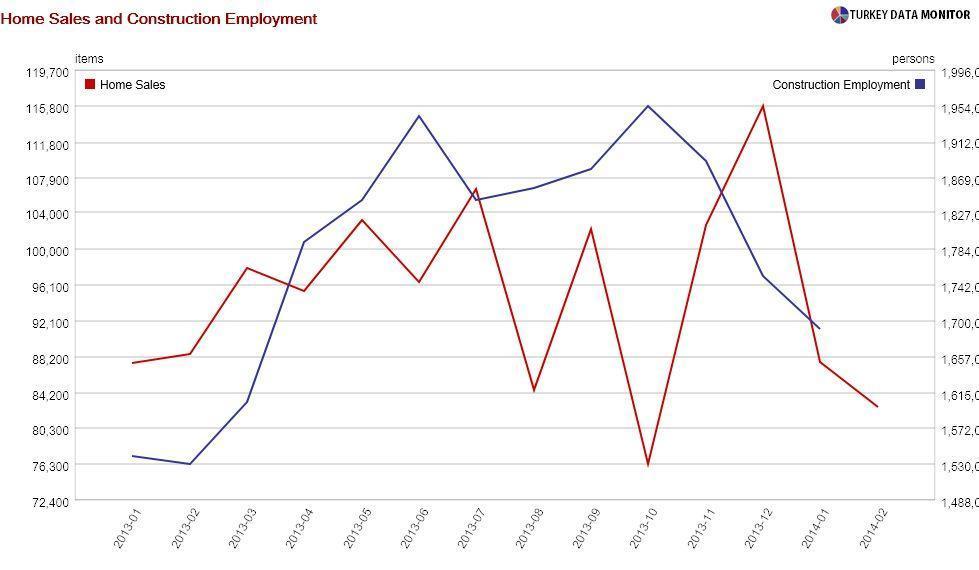

Although sectoral data adjusted for seasonality by Istanbul think tank Betam shows that employment increased in all sectors, the surge in construction was especially noteworthy: There were 100,000 new jobs in January alone. The increase in the last six months is nearly 20 percent. I have yet to explain this phenomenon, especially since home sales were not particularly strong during this period.

On a more general level, it seems that the employment generation capacity of growth has increased. As Betam’s Gökçe Uysal noted in a phone conversation, the increase in employment is more than what could have been accounted for by the 4.4 percent annual rise in growth in the last quarter of 2013. She believes that the increase in the state contribution to social security premiums from 5 to 11 percent could have played a role.

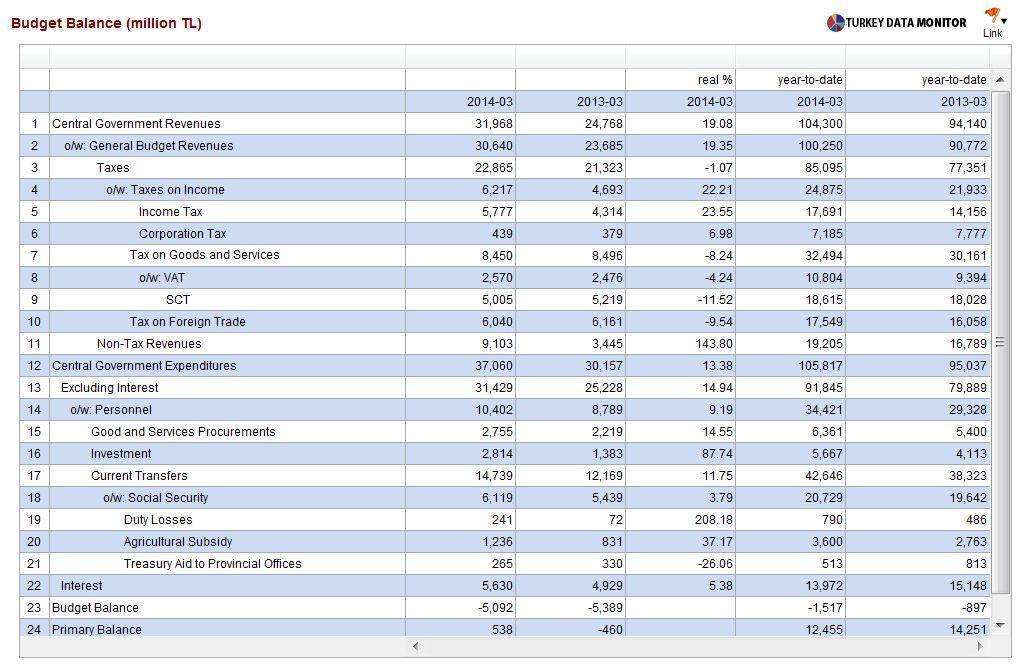

The March budget, on the other hand, is a typical case of pork-barrel spending. The 37.7 percent annual rise (in real terms, i.e., after accounting for inflation) in agricultural subsidies looked quite modest compared to other items under current transfers: Social transfers and other transfers surged 327.2 and 245.9 (no typo!) percent, respectively.

And it wasn’t only handouts: Investment rose 87.7 percent annually. I had written before that I was surprised not to find strong evidence of election economics in the January and February budget data. I think the government decided to wait until right before the elections to engage in all-out spending. This last-minute big-bang approach seems to have worked.

The revenue side of the budget, on the other hand, corroborates my expectation of an economic slowdown during the remainder of the year. Taxes on goods and services and import VATs fell 8.2 and 11.2 percent, respectively. We need more data before ascertaining that this weak revenue performance was because of a permanent decline in economic activity rather than a temporary halt owing to the uncertain environment before the elections.

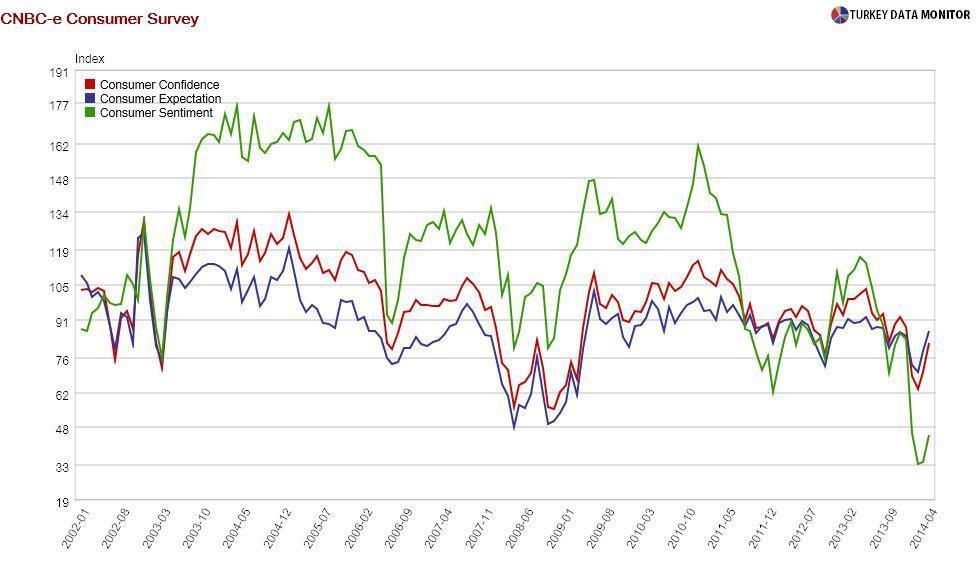

However, I would take any indicators pointing to economic recovery with a grain of salt – and certainly not jubilate over April’s preliminary CNBC-e consumer confidence indices, which rose strongly across the board. And please #RememberBerkin and #RememberEsther.