Confidence indicators raise confidence in economy

The latest data have been hinting that the Turkish economy could grow more than expected in the last quarter of 2013. However, I will argue that these figures are creating a false sense of “confidence.”

The latest data have been hinting that the Turkish economy could grow more than expected in the last quarter of 2013. However, I will argue that these figures are creating a false sense of “confidence.”Not that we have lots of data to choose from. Industrial production, one of the most reliable predictors of growth, comes with a lag of more than one month. We will be getting the September numbers on Nov. 8. In fact, the only leading indicators of fourth quarter growth yet available are real sector and consumer confidence indices, which were released on Oct. 25 and 30 respectively. Both paint a rather rosy picture.

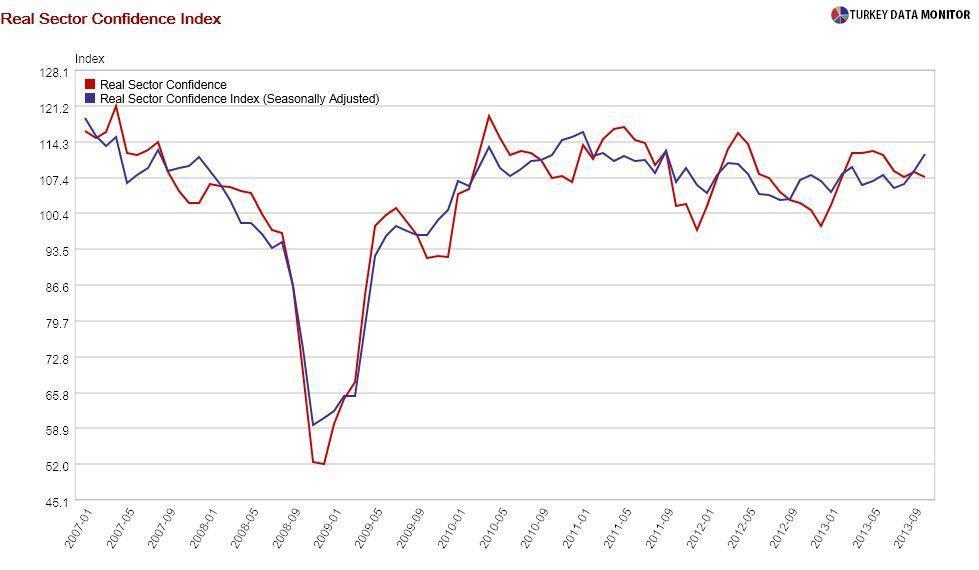

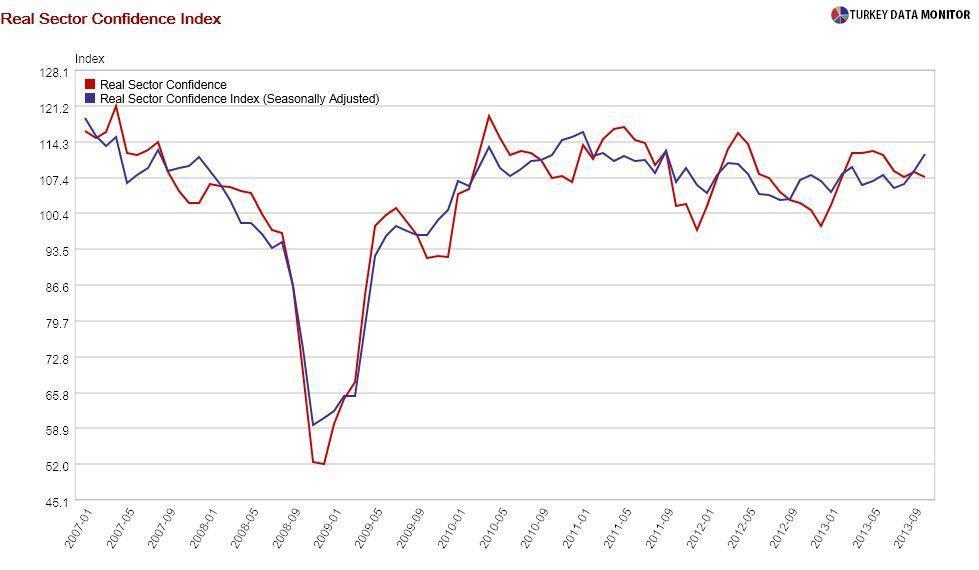

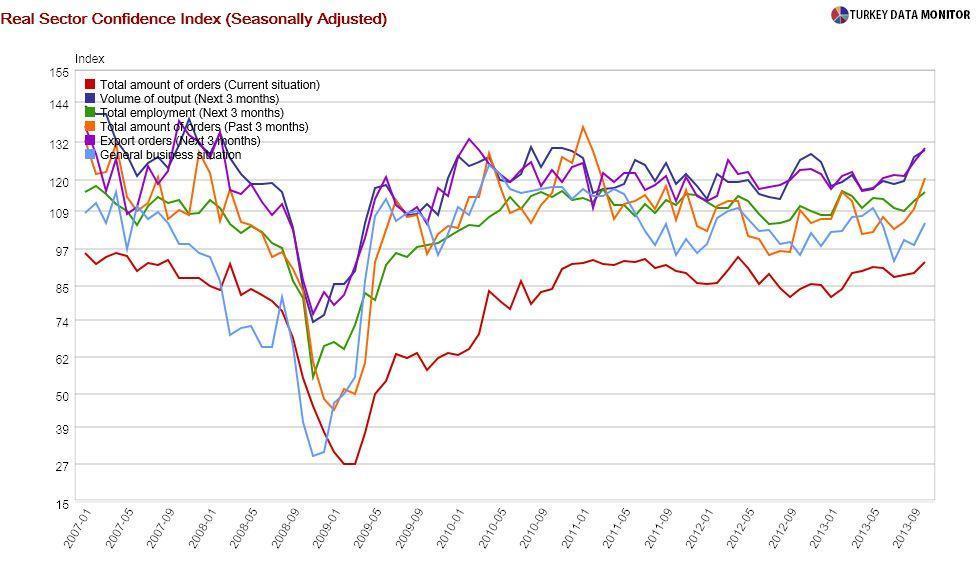

The seasonally adjusted real sector confidence index (RSCI), derived by the Central Bank of Turkey from its Business Tendency Survey, rose to 111.9 in October from 108.6 in the previous month. Almost all the subcomponents of the index were strong: Not only both past and current orders increased, but companies were also more upbeat on output, exports and employment over the next three months.

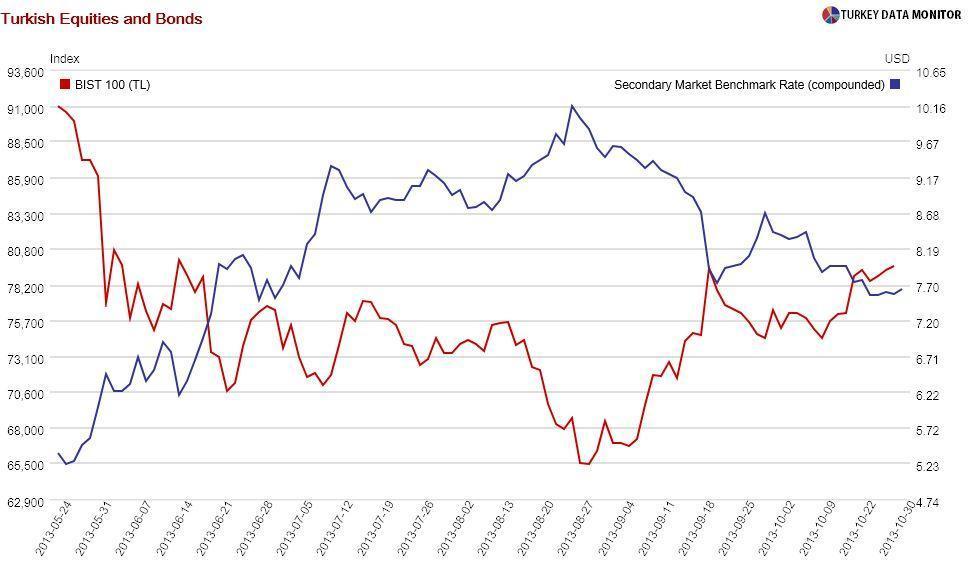

The most obvious explanation for the optimism is that the Federal Reserve (Fed) is now widely expected to delay tapering its bond purchases until at least spring of next year. Their latest policy meeting on Oct. 30 did not have any new information to refute this view. But the rise in the index has been going on since July, which is quite counterintuitive for me: Not only were Turkish markets volatile during this time, but interest rates rose quite a bit before dropping in the fall.

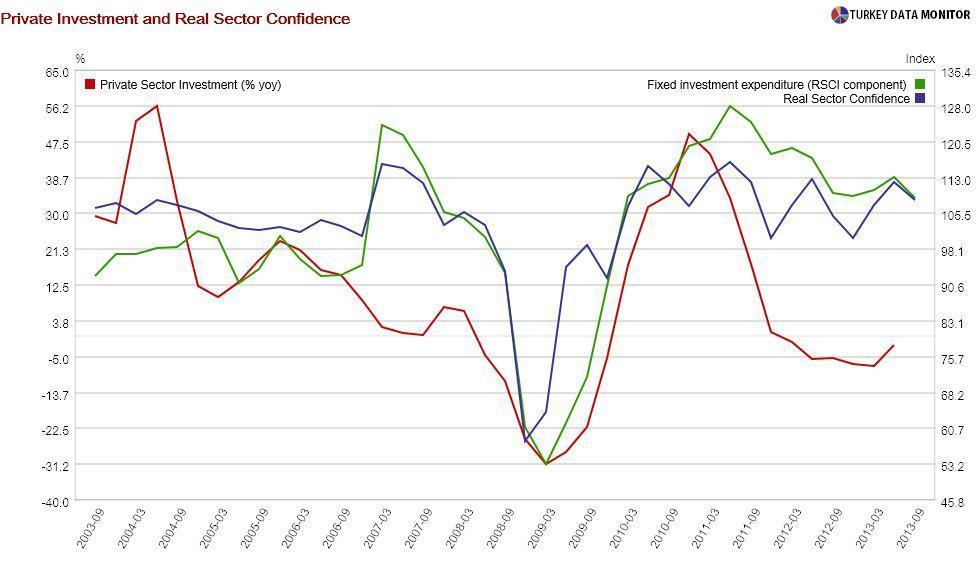

The RSCI used to be a reliable indicator of the private investment component of GDP, which has been extremely weak so far this year. Could the improvement in the index mean that we will see a sharp rebound in investment this quarter? I doubt it. For one thing, the relationship recently broke down. The fixed investment expenditure subcomponent of RSCI has been a better predictor of private investment of late. Along with current stocks of finished goods, it was the only sub-index that fell.

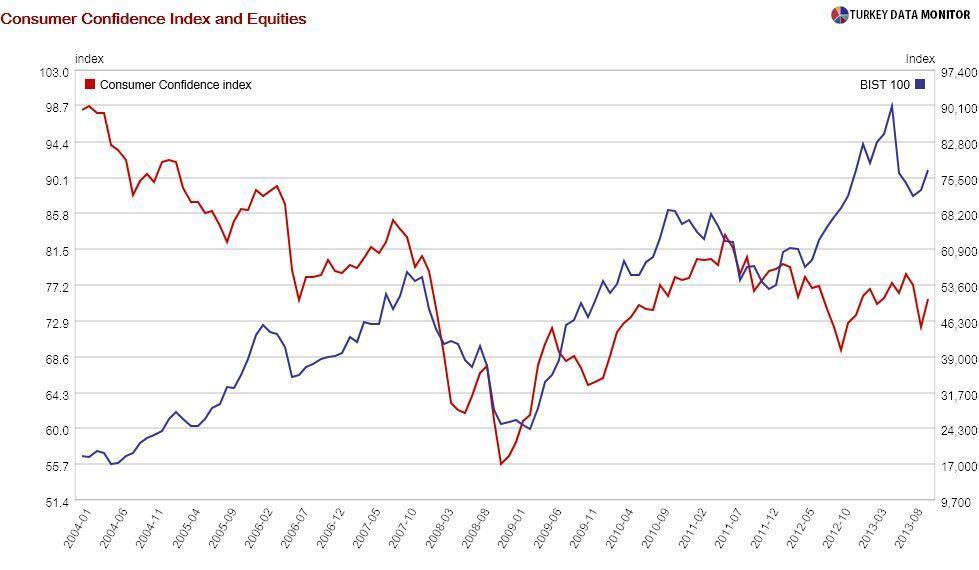

Another indicator encouraging optimism is the consumer confidence index. The October figure, which was released on Oct. 30, turned out to be 75.5, visibly higher than September’s 72.1. However, the index had been hovering in the 75-78 territory before sharply falling in September, so I am more inclined to see this month’s rise as a correction rather than start of an upward trend - at least until I have more data.

Besides, academic research has shown that Turkish consumer confidence is highly correlated with asset prices. Therefore, the sharp rebound of the index in October could also be reflecting the recovery in Turkish assets at the end of the summer, when hopes of the delay to tapering had first sprouted.

Although I still don’t feel very upbeat on the economy, Turkey will likely grow 3.5 percent this year, as predicted by many economists as well as government officials. Next year is another matter, especially if tapering finally starts and capital flows to Turkey decrease.