Monetary Policy juggling worthy of Cirque de Soleil

The outcomes of the Turkish Central Bank’s rate-setting meeting on July 23 show how the Bank is juggling several objectives.

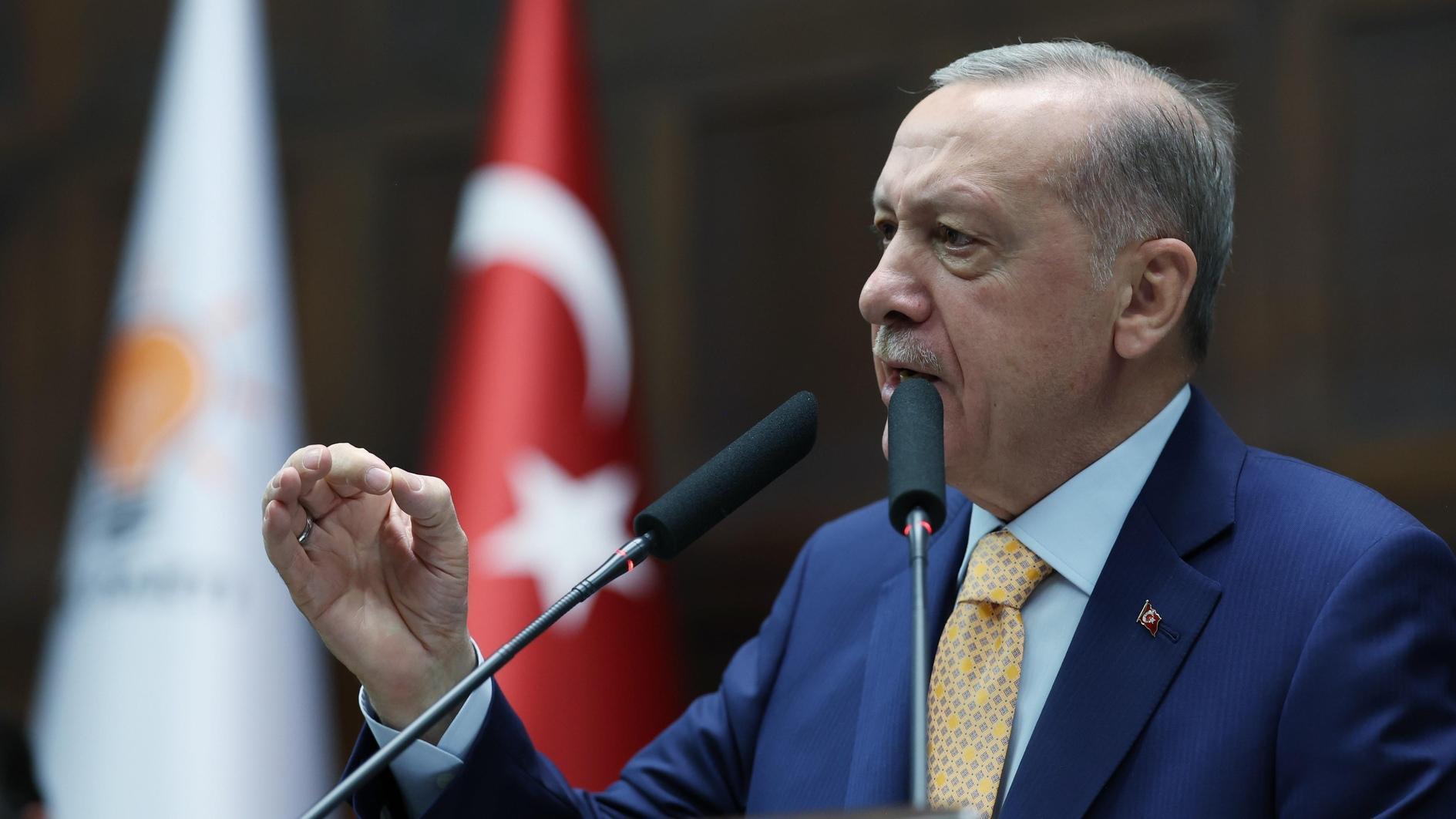

The outcomes of the Turkish Central Bank’s rate-setting meeting on July 23 show how the Bank is juggling several objectives.The rate decision should not have come as a surprise. After all, Governor Erdem Başçı released a short statement on July 15, noting that “a measured step to widen the interest rate corridor will be on the agenda of the next Monetary Policy Committee meeting.” He acted after economy tsar Ali Babacan probably got permission from Prime Minister Recep Tayyip Erdoğan to hike rates at the emergency economy policymaking meeting the day before.

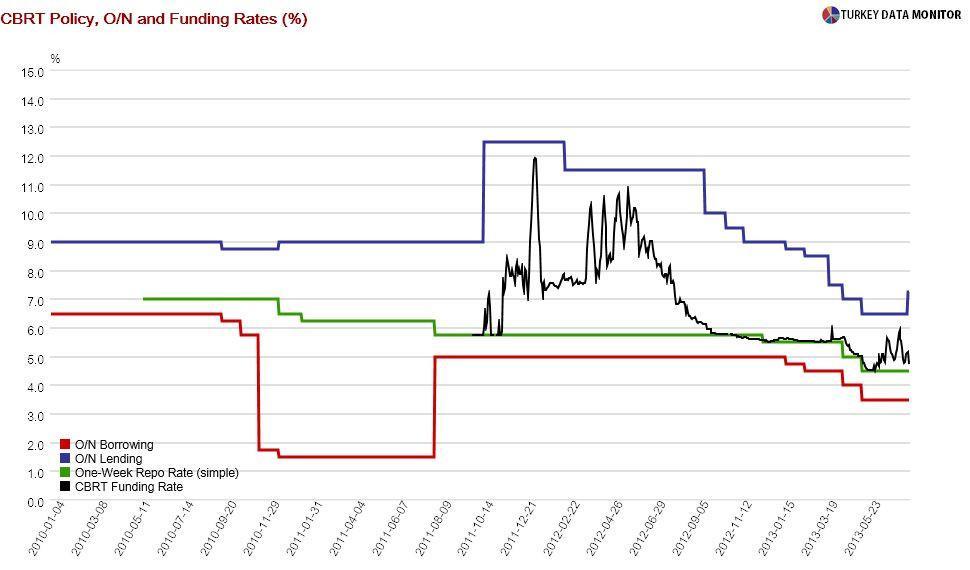

Since cutting the floor of the interest rate corridor (the overnight borrowing rate) would not make sense, it was clear that the corridor would be widened by raising the ceiling (the overnight lending rate). And since a measured step meant 0.50 percentage points in the Bank’s lingo, the amount of the hike was certain as well. Or was it?

Expectations were evenly spread between 50 and 100 basis points, with a couple of economists expecting a higher increase. Not only were markets not taking Başçı at his word, they also felt that 0.50 percentage points would not be adequate. The Central Bank did not want to a sell-off because of disappointment in the decision, and a hike at the midpoint of expectations prevented that.

While even a 0.75 percentage point increase would not be sufficient if the lira came under pressure, a larger hike could irk Erdoğan or his new chief adviser Yiğit Bulut. So the Bank managed to pull off a stealthy increase by announcing that primary dealers would not be able to borrow at 0.50 percentage points lower than the overnight lending rate on additional tightening days like yesterday. In effect, the ceiling of money market rates rose from 6 to 7.25 percent.

The Bank would want to be able to lower market rates quickly after additional tightening days, and so it lifted the upper limits for funding markets at the cheaper one-week and one-month repo auctions. But we’ll have to wait and see if the increased possibility of volatility in interest rates will make hot money more reluctant.

The Bank also announced that there would be no foreign currency sales on additional tightening days. While the Bank seems to be giving up one of primary weapons against lira depreciation, it has been using up reserves without much success and providing markets a free lunch. Traders were buying dollars on normal days and then selling on additional tightening days at the Bank’s auctions. As a result, the lira did not appreciate even when the Bank sold $2.25 billion on July 8.

Finally, for those who have been grumbling that the inflation-targeting Central Bank is not caring about inflation, the Bank stated that the hike was a move against inflation as well. However, I don’t think much has changed in practice. Inflation will continue to play second fiddle to the exchange rate and growth in terms of the Bank’s priorities.

Even for skeptics like me, this juggling performance is worthy of the Cirque de Soleil.