Merger volume hits record $28 billion in 2012

Zehra Aydoğan ISTANBUL - Hürriyet Daily News

Turkey’s mergers and acquisitions (M&A) volume reached $28 billion in 2012, the highest level since the 2007-2008 economic crisis, with small and medium-sized enterprises (SMEs) taking the major share, according to a report released by Deloitte yesterday. The research company also sees further potential for increased M&A activities this year.

Turkey’s mergers and acquisitions (M&A) volume reached $28 billion in 2012, the highest level since the 2007-2008 economic crisis, with small and medium-sized enterprises (SMEs) taking the major share, according to a report released by Deloitte yesterday. The research company also sees further potential for increased M&A activities this year.While the total value of M&A deals last year hit one of its highest figures of the past 10 years, the number of deals also hit an all-time record with 259 total transactions, the report said.

Privatizations in the last quarter of 2012 represented a considerable part of the annual volume, with 19 transactions worth $12.1 billion, corresponding to 43 percent of the total deal value. The privatization of toll roads and the two bridges over the Bosphorus also made up 20 percent of the total.

Energy, manufacturing and financial services were the sectors in which the number of transactions was highest.

Russia the top investor

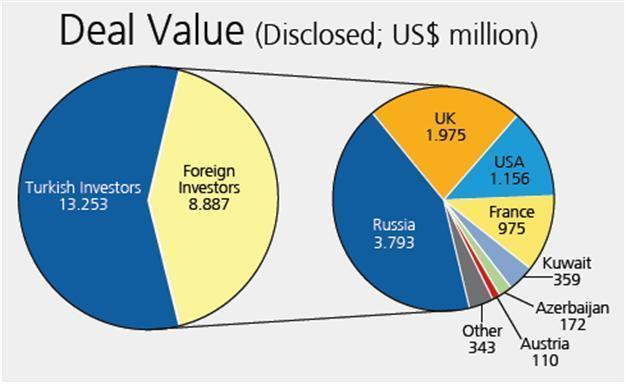

In terms of M&A deal value in Turkey, Russia ranked first with $3.8 billion, followed by the United Kingdom, the United States and France. Russian Sberbank acquired Denizbank for $3.5 billion last year, which accounted for almost the total share of Russia’s M&A activities in Turkey.

The report draws attention to the fact that the deal volume of financial services generally came from this single large transaction, which was also the case in the medical, food and infrastructure services.

Deloitte corporate finance partner Başak Vardar said M&A activities in Turkey had spread to the bottom.

This is because the report indicates that SMEs had become the main source of the transaction number with 214 deals, or 83 percent of the total number, worth below $50 million, which made up 9 percent of the total deal volume.

The top 10 transactions on the list made up 75 percent of the total volume. While the average transaction was $108 million, the average of the deals, excluding the top 10, was only $28 million.

M&A activities are progressing well in Turkey and this year will be favorable for finding the partners and financial resources that are necessary for “company marriages,” Deloitte M&A advisory head Mehmet Sami said.

Sami explained that finding a partner and financial resources depended on Turkey’s relative growth and foreign companies’ decisions to relocate to Turkey, adding that the foreign investors would not only be from Western Europe but also from Russia, the Asia-Pacific and the Gulf. However, he criticized the lack of corporate governance in Turkey that could promote M&A activities.

The ratio of M&A deal value to the national income is a determinant for developing countries to understand the share of foreign investment in the economy, said Sami. While this ratio was 3.5 percent in Turkey last year, it is expected to be around 3 percent in 2013.

He also said that the retail, service, entertainment, manufacturing, food, financial services and infrastructure sectors would be the most active in M&A activities this year.