InDebted by the Exchange Rate

Government officials have been emphasizing stock prices and bond yields to highlight the economic cost of the graft scandal, while ignoring the asset that could affect the economy the most; the exchange rate. For example, they have made it a habit to mention that the difference between Turkish firms’ foreign currency liabilities and assets is only $14 billion, much less than the total so-called open positions of $165 billion.

Government officials have been emphasizing stock prices and bond yields to highlight the economic cost of the graft scandal, while ignoring the asset that could affect the economy the most; the exchange rate. For example, they have made it a habit to mention that the difference between Turkish firms’ foreign currency liabilities and assets is only $14 billion, much less than the total so-called open positions of $165 billion.

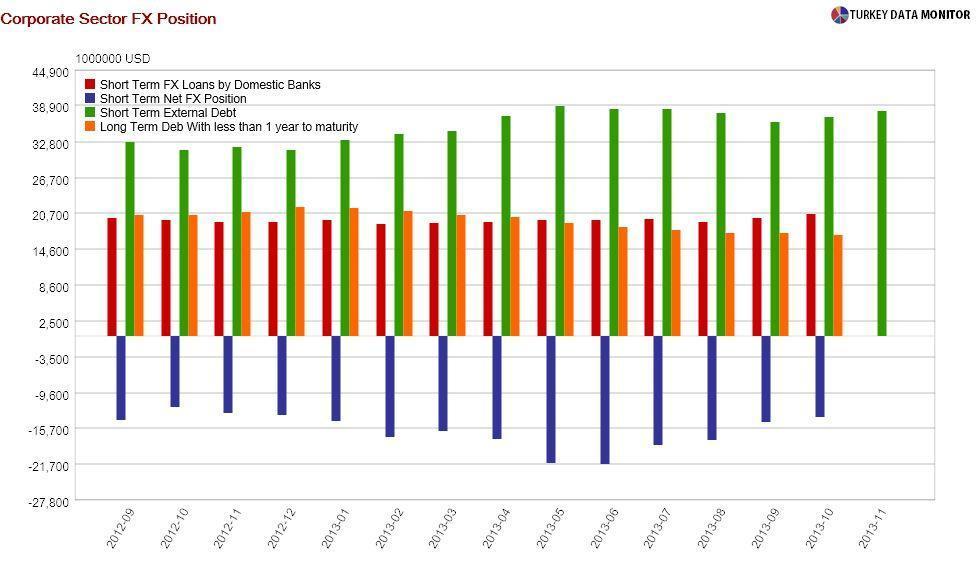

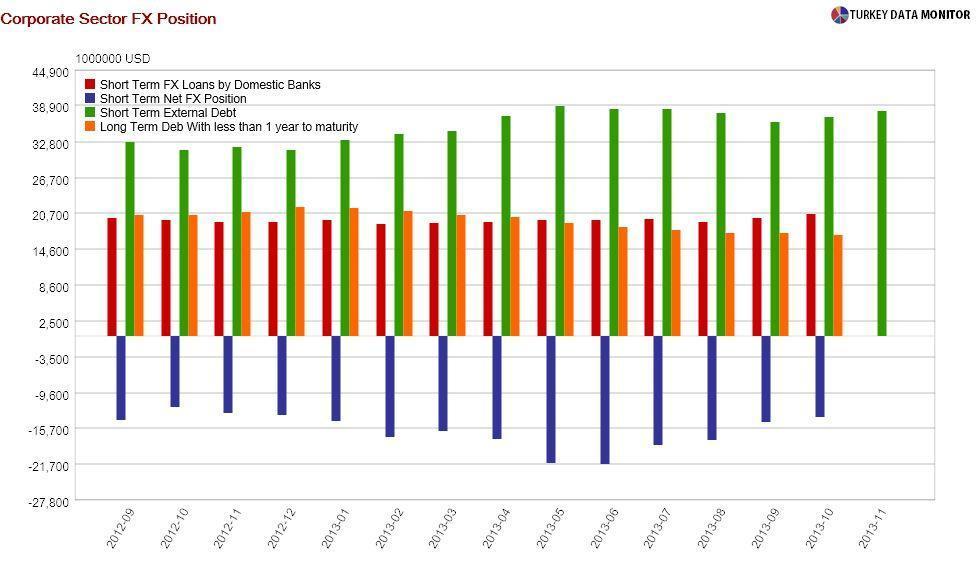

Similarly, they would tell you that of the $122 billion of companies’ external debt, “only” $37 billion is short-term, and of this amount, $30 billion is made up of trade credits, concluding that Turkish firms do not face rollover risk. They “forget” to mention the $17 billion of the long-term external debt with less than one-year maturity- as well as the at least $20 billion of short-term foreign currency (FX) and $27 billion FX-indexed credit from domestic banks. Süleyman Onatça, chairman of the Turkish Enterprise and Business Confederation (Türkonfed) recently told Bloomberg that local banks were not rolling over the FX loans of their members.

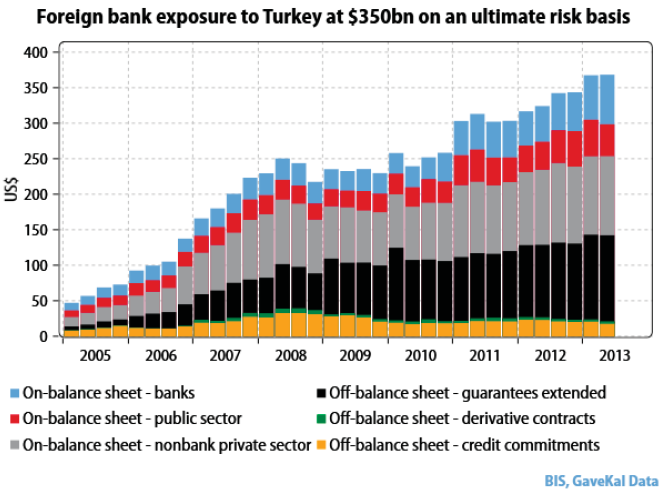

In any case, I would agree that the real rollover risk is not in firms. In contrast to corporates, banks have more short-term than long-term external debt. Rolling over has never been a problem in the past, but economic consultancy GaveKal calculates foreign banks’ overall exposure to Turkey at $350 billion. They may want to cut some of that exposure, and loans would be the easiest way.

As for firms, the lira depreciation is destroying the balance sheets of all these companies with long-term FX open positions and debt as well. In fact, there is a large literature on “balance sheet crises,” which developed after academics noticed the disruption through this channel during the Asian crisis.

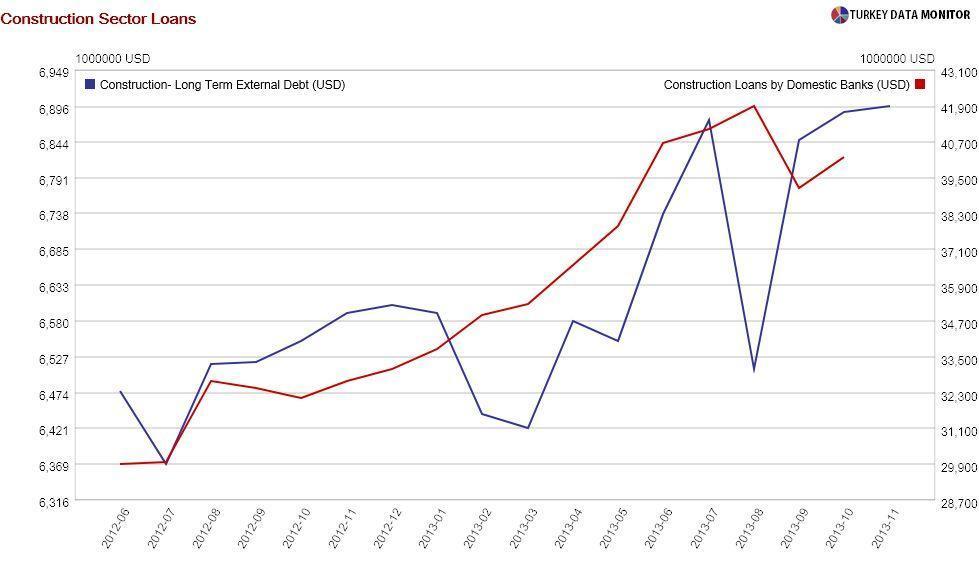

These effects are likely to be felt most in the construction sector, the government’s engine of growth for the last few years. A Central Bank study based on survey data found that 56 percent of total debt in the sector is in FX. Since total credit to the sector is $40 billion, that would make total FX debt $22 billion, of which $7 billion is external long-term debt. I would expect most of the remaining to be short-term, as construction loans are usually for working capital needs.

Perhaps even more important than balance sheet effects, the presence of the long-term positions and FX debt has been the driving force behind the demand for FX. Companies have been using any strengthening of the lira as an opportunity to close open positions, making a lasting appreciation impossible. Governor Erdem Başçı advised firms not to do that at the end of August to break this chain, forecasting a lira dollar exchange rate of 1.92 at year-end. Those who believed in him paid the price.

And I haven’t even got to mentioning the impact of the exchange rate on inflation and business/real sector confidence. Maybe, government officials do not want to bring up the exchange rate and debt not to give us a heart attack.