I’m going slightly mad

Being one of the few Turkish economy pessimists sometimes makes me question my knowledge of economics. Luckily, the International Monetary Fund (IMF)’s annual report on Turkey arrived just in time to confirm my economic sanity- as I found many of the recurrent themes from my columns in the report.

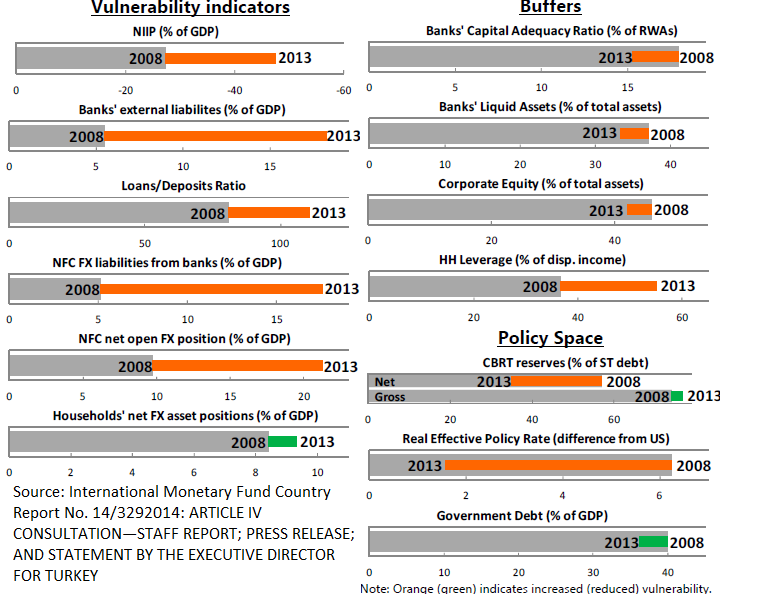

Being one of the few Turkish economy pessimists sometimes makes me question my knowledge of economics. Luckily, the International Monetary Fund (IMF)’s annual report on Turkey arrived just in time to confirm my economic sanity- as I found many of the recurrent themes from my columns in the report.According to the Fund, a reversal in capital flow remains the main short-term risk to the Turkish economy. With external imbalances remaining large, buffers diminishing and policy space more limited than in 2008, the impact of a sharp decrease in inflows “could be more pronounced than the 2009 recession.”

In the medium-term, the IMF notes Turkey is faced with a growth crisis: “Without a change in policies, future economic performance is likely to be weaker than that of the recent past.” On current policies, the IMF sees growth at 3.5 percent in the medium-term, “potentially leaving Turkey in a middle income trap.” I would add that such a growth rate would fail to keep unemployment at bay.

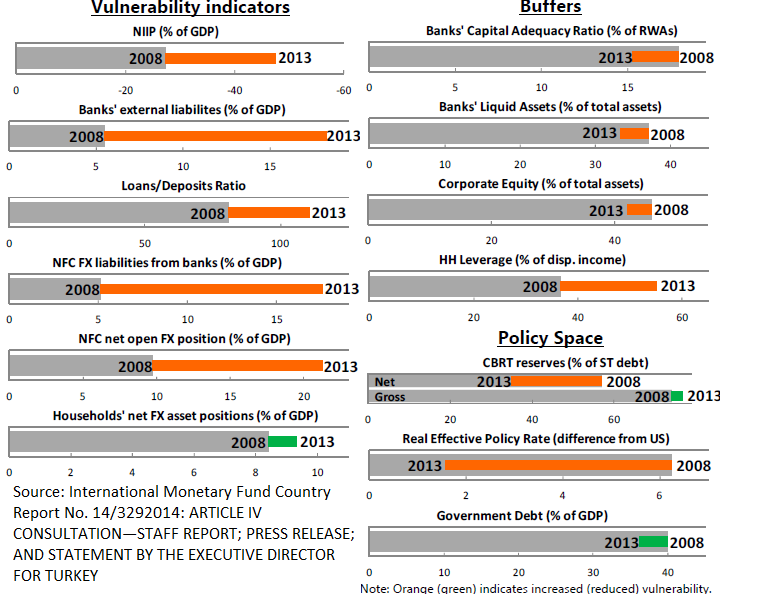

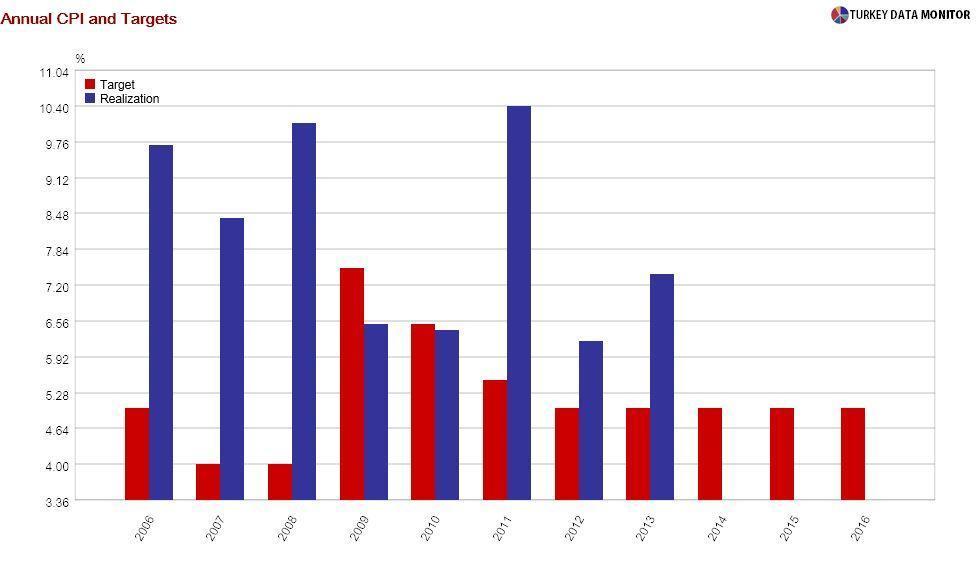

Contrary to what Finance Minister Mehmet “Nominal” Şimşek and Central Bank Governor Erdem Başçı would have you believe, the IMF shows that fiscal and monetary policies have been too loose, as evidenced by public sector expenditures growing faster than GDP and negative real policy rates.

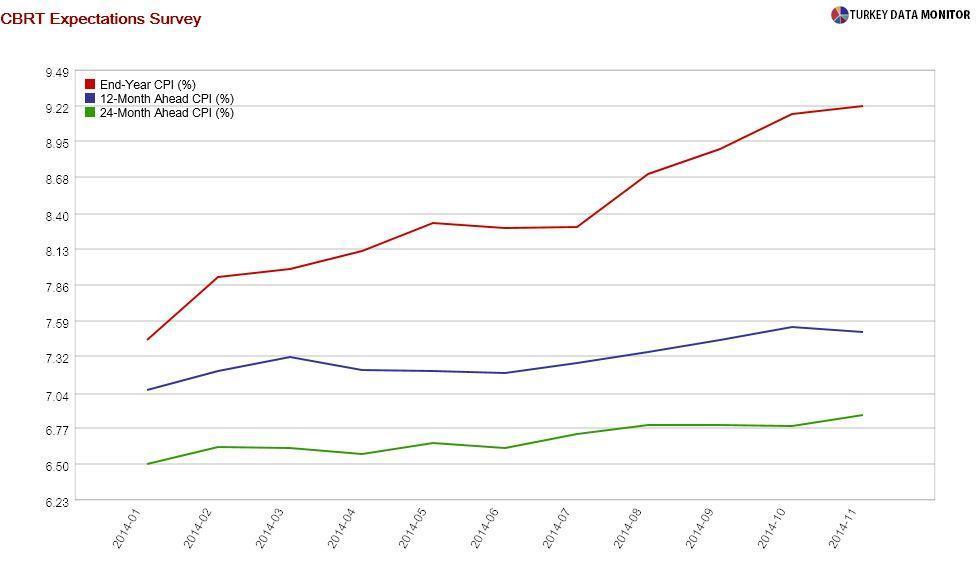

With the Bank having consistently missed its inflation targets, inflation expectations are much higher than the original 2014, 2015 and 2016 targets. Moreover, monetary policy has been rendered ineffective because of its complex framework, so the Bank needs to prioritize inflation and make policy simpler. Interestingly, officials told the Fund that “the simplification of the monetary policy framework helped their communication strategy” when they hiked rates in January.

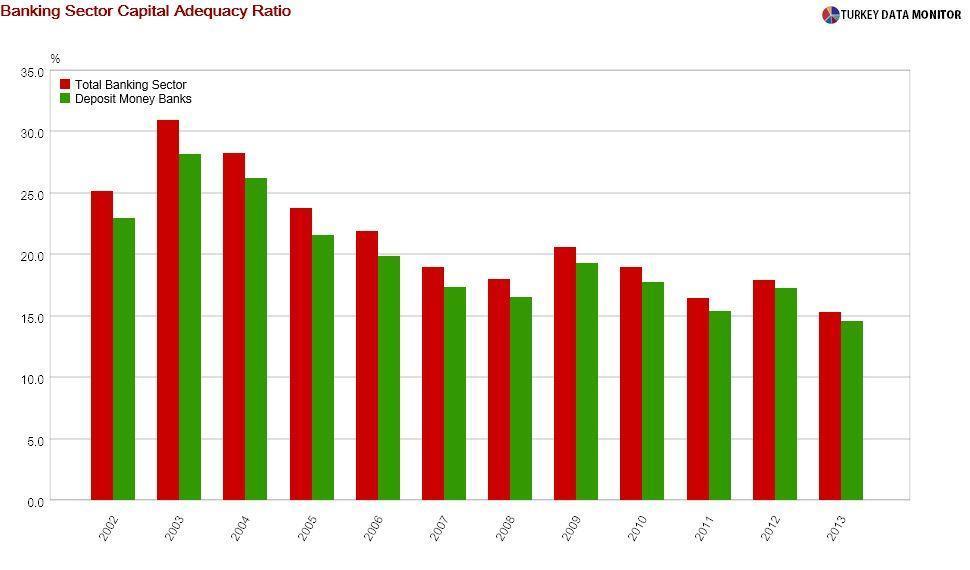

Turkey’s banking sector, the pride and joy of Turkish policymakers, is not that robust after all. Standard health indicators, such as capital adequacy ratios, look fine, but “banks’ wholesale external foreign exchange funding has risen rapidly throughout the banking system, presenting a rollover risk.”

The IMF is also worried about the sharp rise in “loans which flow into the construction sector, partly in foreign currency” over the last year: “Even if rents and purchase prices are indexed to foreign currency, incomes are not, leaving developers exposed to FX risk.”

The Fund commends the government’s desire for structural reform, but they underline that prioritization and implementation are critical - a polite way of saying the reform agenda looks like a grocery or wish list. By the way, officials have admitted “they aim to start implementation of key steps only after the 2015 parliamentary elections.”

My sanity was all but restored until I read the authorities’ responses to the IMF’s arguments, which are also in the same report. There is nothing wrong about the Turkish economy at all they say; there are enough buffers against a sudden stop in capital flows, the reform program will restore high growth, inflation is high because of the recent drought and the banking system is sound.

I wanted to drive to Ankara right away to tell them they were simply not in the pink, and to be honest, they haven’t got a clue. But then it finally happened: I started going slightly mad by their compliance. And there you have it!