How to measure (Turkish) corruption

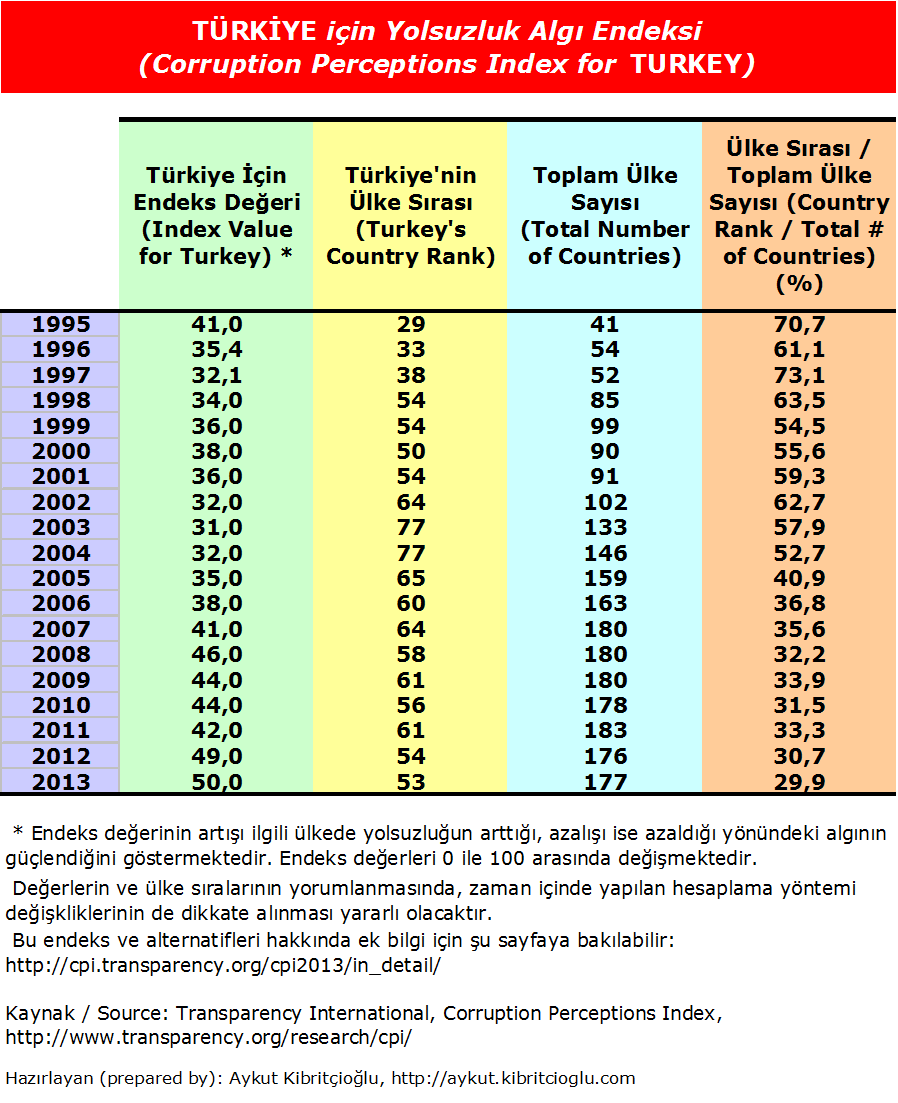

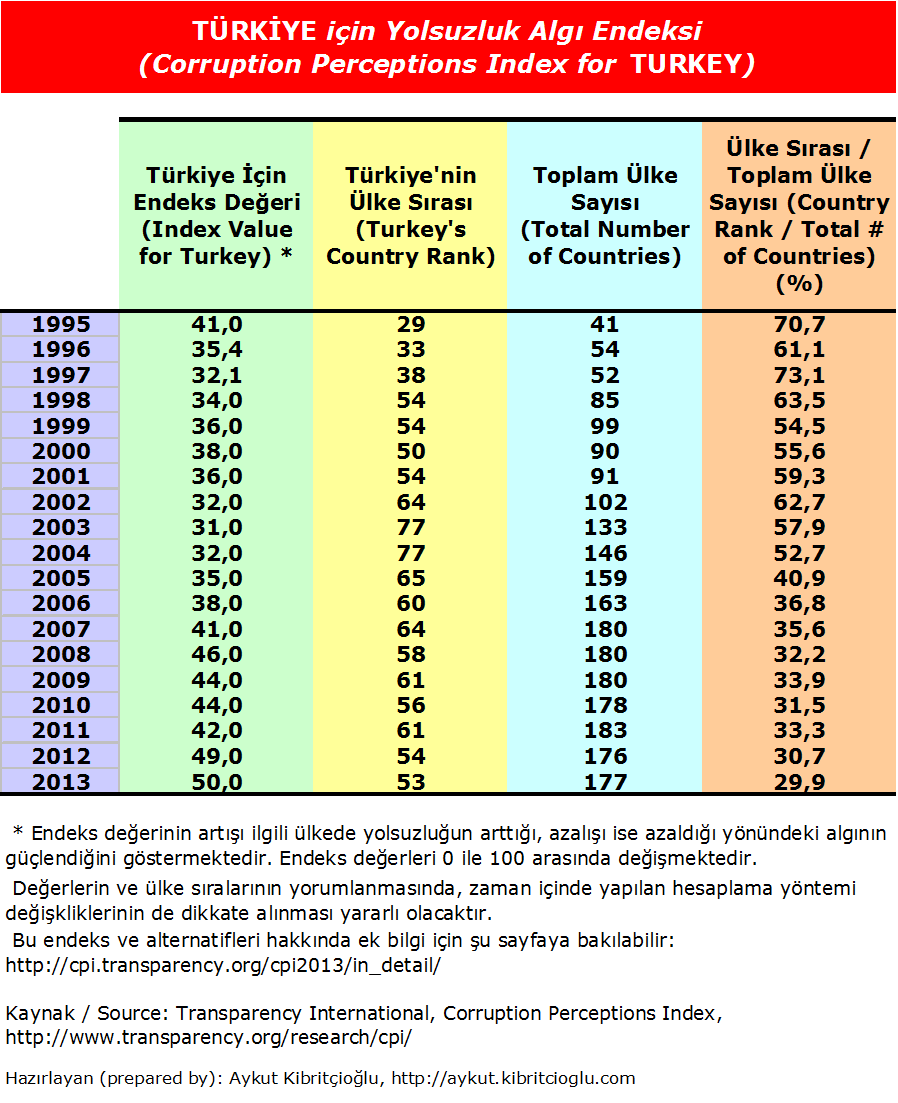

I concluded Friday’s column by noting that Turkey’s rank in the Transparency International Corruption Perceptions Index (CPI) had improved from 77th in 2003 to 53rd in 2013.

I concluded Friday’s column by noting that Turkey’s rank in the Transparency International Corruption Perceptions Index (CPI) had improved from 77th in 2003 to 53rd in 2013. However, if you look at annual data, you’ll immediately notice that Turkey’s CPI rank dropped 10 places in 2002 and 13 places in 2003. Did the country suddenly become more corrupt? Or could it be that the 2001 economic crisis deteriorated Turks’ corruption perceptions? I had a quick look at Argentina, Russia, PIIGS and East Asian countries and saw that almost all had similar declines in CPIs after their crises.

CPI’s main weakness is that it measures how people perceive corruption, which may be different from the reality. For example, as a reader noted in the comments on my Friday column, if politicians get better at hiding graft, citizens will perceive that country as less corrupt. Surveys try to get around this problem by asking firms if they have had to resort to bribes, but not many companies would admit to that.

I am not the only one who is skeptical of perception-based indicators. The United Nations Development Program report I mentioned on Friday concludes, after interviews with more than 30 experts working as researchers, donor officials and policymakers, that corruption perceptions data are not useful at all. But since it is the only thing out there, I should suggest some alternatives for Turkey.

The change in the number of Swiss bank accounts belonging to Turks, as suggested by another reader, would be a great indicator, but I doubt it would be available. How about demand for ultra-luxury goods such as 350,000-euro watches? What if I told you that there are four Louis Vuitton stores in Istanbul, whereas cross-country statistical analysis, taking into account factors like growth, GDP per capita and population, predicts only two?

Or that the number of new entrants to the Istanbul Chamber of Industry’s Top 500 Industrial Enterprises was on average more than twice as much from 2003 to 2012 as from 1993 to 2002? Or that most of the subcontractors working for the state-run Housing Development Administration (TOKİ) were companies that were founded in the last few years?

You could easily come up with non-corruption explanations for each of these observations. But taken together, they should have been ringing alarm bells that something is rotten in the state of Turkey.

Even If I would have to resort to perceptions, I would go for markets’ rather than citizens’: I chose four firms perceived to be close to the ruling Justice and Development Party (AKP) and four to the Gülenists by surveying finance professionals. It turned out that both the AKP and Gülenist firms have underperformed in the stock market since the graft scandal erupted.

I can understand that markets would expect the AKP to go after Gülenist firms. But why would they be worried about companies close to the AKP - unless they thought that those firms were up to something, or that their fortunes were tied to that of the AKP?