High inflation non-event in inflation-targeting country

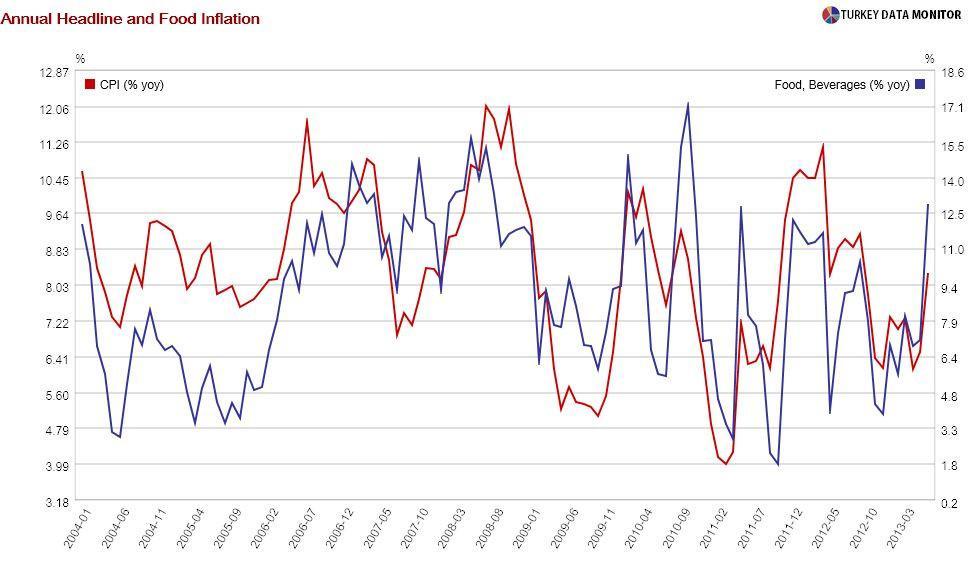

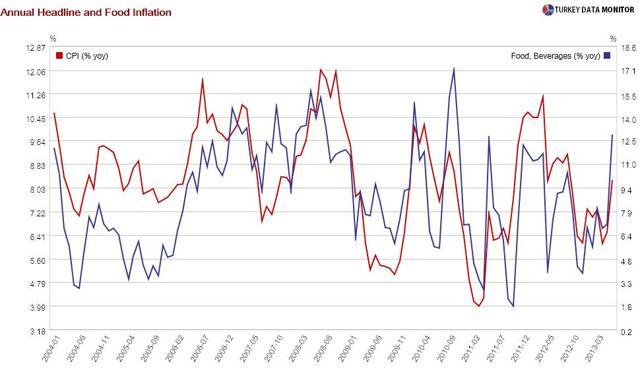

Consumer prices rose 0.8 percent in June, significantly higher than expectations of 0.1 percent. As a result, annual inflation jumped to 8.3 percent from 6.5 percent in May.

Consumer prices rose 0.8 percent in June, significantly higher than expectations of 0.1 percent. As a result, annual inflation jumped to 8.3 percent from 6.5 percent in May.

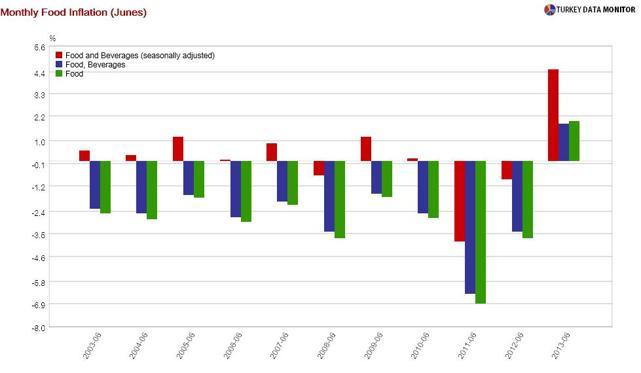

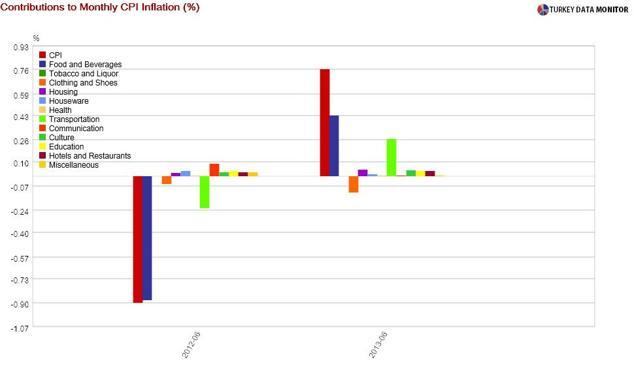

Even the highest forecast of the 17 economists polled by business channel CNBC-e was 0.4 percent. Analysts were way off mainly because of food prices, which increased by a whopping 1.9 percent. Note that food inflation had always been negative in previous Junes.

Transportation prices, which increased 1.5 percent (7.7 percent yearly), also contributed to the high headline figure. The high transportation inflation was mainly because of the rise in gas prices, which have been affected by the recent bout of exchange rate weakness.

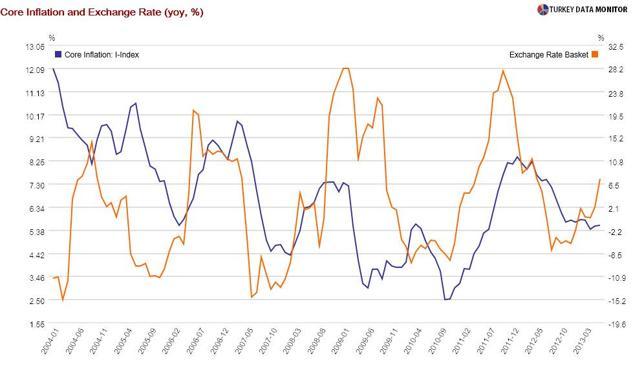

However, there has been limited exchange rate pass-through to inflation so far other than through transportation. For example, prices of housewares, which are usually affected by currency movements, rose only 0.2 percent. Yearly core inflation, which excludes food, alcohol, tobacco and gold, was unchanged at 5.6 percent.

That doesn’t mean prices will not be affected by the May-June currency weakness. We usually see the impact of the currency on inflation over several months. Given its close connection to the exchange rate, core inflation is likely to edge up to 6-6.5 percent in the coming months unless the lira appreciates significantly.

I am pretty confident that the exchange rate will eventually hit inflation, also because of the surge in annual producer inflation from 2.2 to 5.2 percent. While the sharp rise was mainly driven by agricultural prices, there was also a noticeable increase in manufacturing costs, probably because of the lira weakness.

Since demand is still subdued, producers may not be able to pass their costs fully onto consumers. Volatile food prices may surprise on the downside in the coming months. Moreover, we may have seen the peak of inflation this year thanks to base effects. Inflation is likely to decrease gradually during the second half of the year.

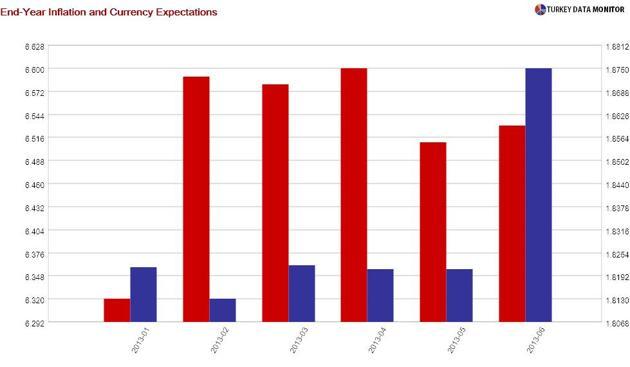

But I just can’t see inflation hitting the Central Bank’s year-end target of 5 percent. In fact, I think that even market expectations of 6.5 percent are a bit too optimistic; I expect year-end inflation to be in the 7 to 7.5 percent range unless the lira appreciates considerably or oil prices fall significantly. Neither of these seems likely in the current global environment.

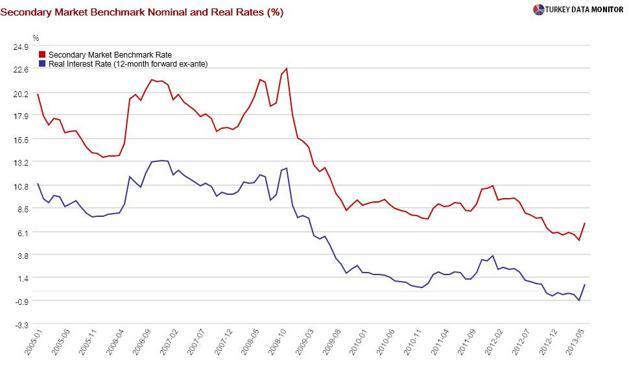

Of course, an inflation-targeting central bank would not just sit back and watch. But while it is one on paper, we all know that inflation is pretty low on the Central Bank of Turkey’s agenda, especially with growth not picking up before an elections year. Especially with a prime minister who would like to see zero interest rates because he believes high rates beget high inflation.

By the way, the Turkish Central Bank is independent. That’s why their only response to the rise in inflation will probably be to revise their year-end forecast of 5.3 percent up when they release their Inflation Report on July 30.