Hey! Erdoğan! Leave them kid(ding) alone!

“I don’t know the key to success, but the key to failure is trying to

please everybody.” The Central Bank of Turkey’s Gov. Erdem Başçı found

out the wisdom in this Bill Cosby quote the hard way this past week.

“I don’t know the key to success, but the key to failure is trying to

please everybody.” The Central Bank of Turkey’s Gov. Erdem Başçı found

out the wisdom in this Bill Cosby quote the hard way this past week.The Bank’s rate cut on May 22 was criticized by several analysts, including your friendly neighborhood economist. Unfortunately, it was not enough for Prime Minister Recep Tayyip Erdoğan, who slammed the Bank to a group of journalists on the way back from his rally in Cologne on May 25: “You raised the interest rate by five points all at once, but now you reduce it by just a half point. Are you kidding?”

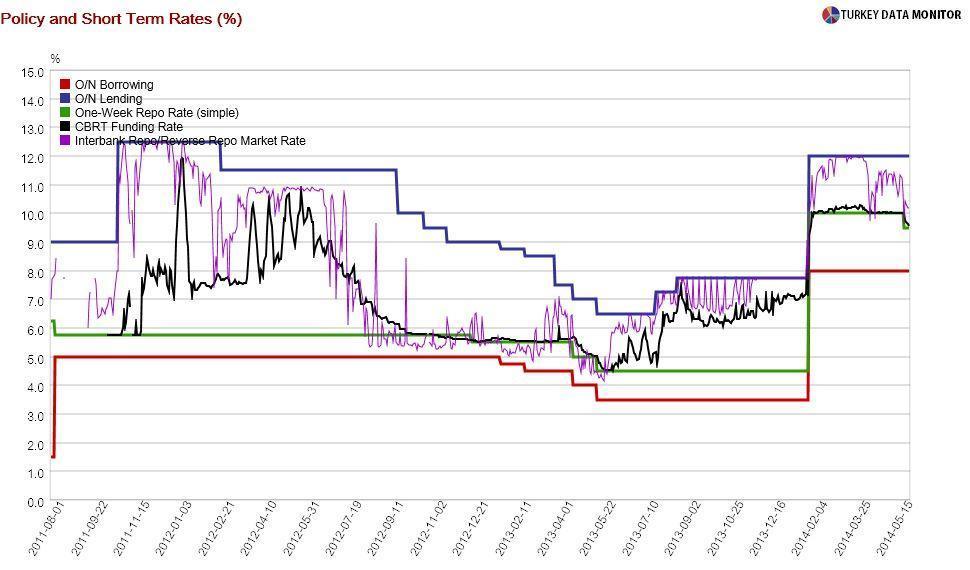

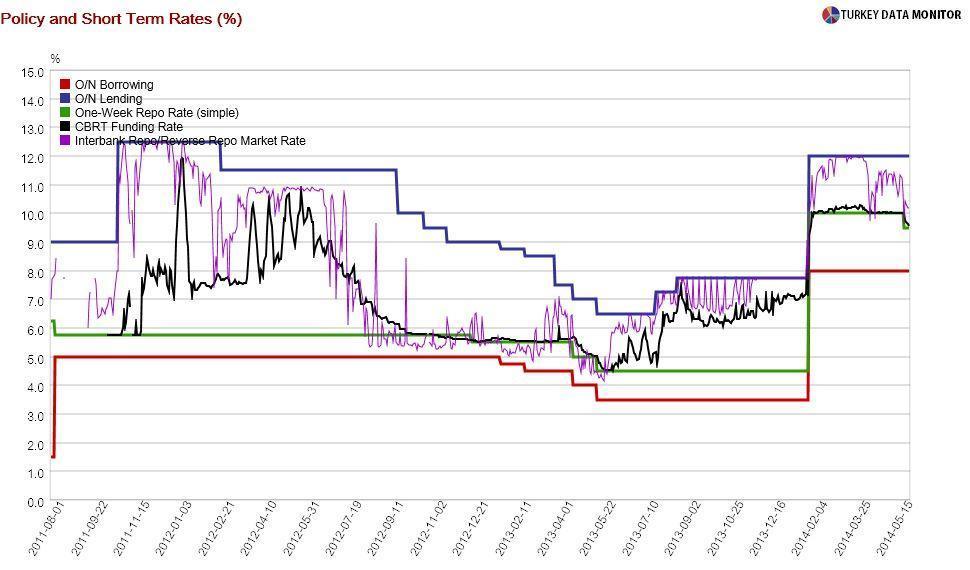

For the record, the effective increase in interest rates at the end of January, as measured by the Bank’s funding and interbank repo rates, was more like 2.5-3 percentage points. Moreover, the Bank probably prevented a financial crisis less than two months before the local elections with its rate hike and literally saved Erdoğan’s derrière.

I did not take Erdoğan’s burst very seriously at first. After all, he had explicitly criticized monetary policy in the past. But he carried on at his party meeting on May 27 by emphasizing that the Bank kept missing its inflation targets. He also implied that he would replace Başçı when the governor’s term was up.

The key question is how the Central Bank will respond. According to DenizInvest’s Özlem Derici, Başçı will “either resign and allow the government to appoint a pro-government governor” or bow to political pressure and continue to cut rates. Both would tarnish the Bank’s already-damaged credibility. Her less likely scenario of the Bank not giving in would mean more tension.

Interestingly enough, that’s exactly what Deputy Prime Minister (and economy czar) Ali Babacan implicitly recommended the Bank do. He noted, during a prescheduled speech a few hours after Erdoğan’s talk, that institutions should continue working on their defined responsibilities without yielding.

He was joined by Finance Minister Mehmet “nominal” Şimşek the next day, who singled out the Bank’s independence as “one of the biggest gains of the last decade.” Economy Minister Nihat Zeybekci, on the other hand, underlined that high interest rates beget high inflation, as Erdoğan has been claiming for a while.

I will address this “interesting” statement in my column on Monday. However, I should emphasize that there would be a bloodbath in Turkish markets if Başçı or Babacan, who seems to have fallen out of favor with Erdoğan, were to resign.

Although the Cabinet row over monetary policy seems to have died down, Başçı’s regular presentation to the Cabinet on June 2, which would normally be a non-event, has gained prominence. Things may get heated up if he does not signal more cuts, as President Abdullah Gül won’t be there to hold Erdoğan’s arm and restrain him.

I would advise Başçı to wear running shoes on Monday. They may look goofy under a dark suit, but running away would beat getting beat up or run over.