Has Turkey fallen out of the G-20 league due to low growth?

Mustafa Sönmez - mustafasnmz@hotmail.com

DHA photo

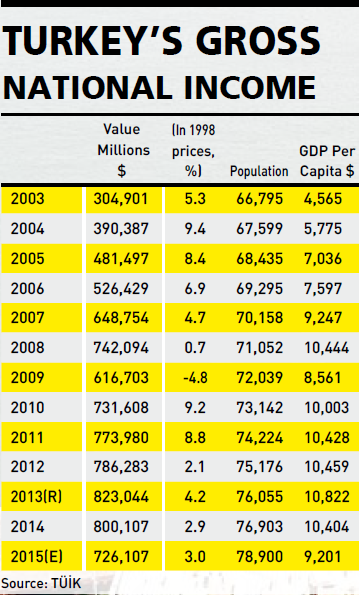

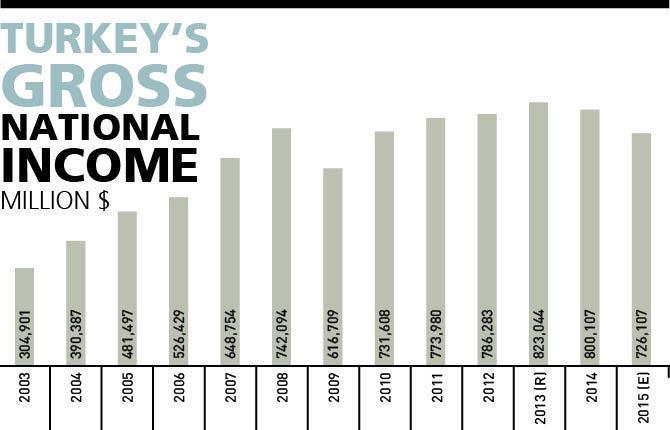

Turkey is unable to escape the low-growth path it has been stuck in since 2012. This situation of low-growth of around 3 percent is expected to continue both due to Turkey’s specific circumstances and the effect of low growth tendencies in the world economy. Another parameter that accompanies Turkey’s low growth has been the significant devaluation of the Turkish Lira against the dollar in 2015. The result of the combination of low growth and a high dollar rate is the decline in national income in dollars and national income per capita – so much so that this situation has raised the question of whether Turkey still belongs to the G-20 league.

Another parameter that accompanies Turkey’s low growth has been the significant devaluation of the Turkish Lira against the dollar in 2015. The result of the combination of low growth and a high dollar rate is the decline in national income in dollars and national income per capita – so much so that this situation has raised the question of whether Turkey still belongs to the G-20 league. Growth rate

Data from the second quarter of 2015 will be released by the Turkish Statistical Institute (TÜİK) on Sept. 10. However, the Center For Economic and Social Research (BETAM) at Bahçeşehir University released in advance its evaluations and expectations for the second quarter.

BETAM has revised the real growth estimate of the second quarter upward to 0.7 percent from 0.5 percent from the first quarter.

Within the framework of these estimates, BETAM guesses that the gross domestic product increase in the first half of the year was 2.8 percent. On an annual basis, a little less than the annual 3 percent growth is expected.

The current account deficit was $3.4 billion in June. Excluding gold, the annual current account deficit is $45.4 billion. Since the new year, the deficit has come to a standstill. Despite declining energy imports at the end of the second quarter, exports have gone down since the beginning of the year, preventing the current account deficit from falling any further. It is estimated that the ratio of the current account deficit to gross domestic product will be 5.8 percent at the end of the second quarter.

Production in industry, the most important sector in terms of growth and development, fell at a rate of 1.9 percent in May. In June, the sector grew 2.4 percent, making up for its losses in May. The increase was not only in the automotive sector, it covered many subsectors, thus increasing industrial production 1.6 percent. The rise in the first quarter was 1.2 percent. The quantum index also increased 6 percent in June, while a limited fall in imports continued.

Contribution to growth

In this year’s growth, net exports are again non-influential and domestic demand is the determinant. In exports, the positive state of affairs in June was not able to compensate for the fall in exports during the entire quarter. As well as the fall in quantum index, the weak course of tourism revenues in the second quarter also curbed the contribution of exports in growth. Net exports are expected to make a negative contribution to growth.

On the other hand, consumption and investment indicators showed a relatively strong outlook in June. The production of durable and non-durable consumer goods increased 2.5 and 6.6 percent respectively in the second quarter. At the same time, the imports of consumption goods increased almost 2 percent. Despite the weak Consumer Confidence Index, we have to remember that there was an increase on that as well in June.

The most important source of growth is investment and consumer spending. The importation of capital goods increased 7.1 percent, recording the highest increase for a long time. We can say that investments and consumption expenditures were the most important sources of growth while public expenditures had a limited contribution on growth during this period. The fall in exports, on the other hand, has negatively affected growth.

In dollars

In 2014, Turkey’s national income was $800 billion. Because of the increase in the price of the dollar (even though the growth of 2015 has reached 3 percent with the fixed prices of 1998) the national income of 2015 will go back to $726 billion.

The G-20 leaders’ summit will be hosted by Turkey in the southern city of Antalya on Nov. 15-16. The G-20 includes the 19 major economies of the world, Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the United Kingdom and the United States, along with the European Union.

The G-20 represents 85 percent of the world economy and accounts for 80 percent of world trade.

Critical November

The date of the Antalya summit is nearing. It is not known yet whether or not the hosting country will hold healthy elections and be on its way to forming a new government. Financial instability in the world is climbing and it is not known what the never-ending story of Fed decision on increasing interest rates would be on that date and how it will affect the dollar-lira exchange rate and where Turkey’s national income will be in terms of dollars at that rate.

For this reason, the Antalya meeting is very important for world leaders. Politicians from around the world have made plans to come to Antalya, but violence in Turkey has begun to climb, creating a serious security issue for world leaders. At the same time, real growth in Turkey’s economy has slowed down as the price of the dollar has gone up rapidly. When the national income calculated in terms of liras was divided in (the new price of) dollars, then the national income in dollars shrank.

Shrinking in dollars

In the national income listing, the Netherlands is in 17th place with $866 billion dollars, Turkey is 18th place with $800 billion, Saudi Arabia is 19th with $750 billion while Switzerland is 20th place with $710 billion.

At the beginning of 2015, the dollar was 2.30 liras. If the dollar finishes the year 2015 at 3 liras, then the rough annual average would be 2.65 liras. If we consider that the economy – even though it is hard – will grow 3 percent and the average inflation will be around 7 percent, then at the end of the year, the national income in liras will be 1.925 trillion liras. If this is divided at an average exchange rate of 2.65 liras, then Turkey’s national income in dollars will roughly be $726 billion. Countries such as Norway and Iran that have a higher national income than this are not in the G-20; if they were, then Turkey would have not made it into the top 20.

In the event that our national income falls to $726 billion in 2015, then Turkey’s income per capita will also fall. With a population of nearly 78 million, Turkey’s per capita income will fall below $10,000, with $9,201. This corresponds to a fall of 11.5 percent in per capita income.

Since 2009

This is happening to Turkey for the first time since 2009. That year, the shrinkage in the economy reached 4.8 percent and when the dollar exchange rate rapidly increased, both the national income in dollars and the per capita income declined compared to previous years. But with the inflow of foreign investors in the following years, the economy and the per capita income grew once more.

It is a very low probability that a similar cycle will be experienced after 2015.

The reason is that both Turkey’s economic, political and geopolitical risks are high and the international circumstances that would bring foreigners back are not in favor of Turkey.