Gold-loving Turks skeptic for last fall

Sefer Levent ISTANBUL/Hürriyet

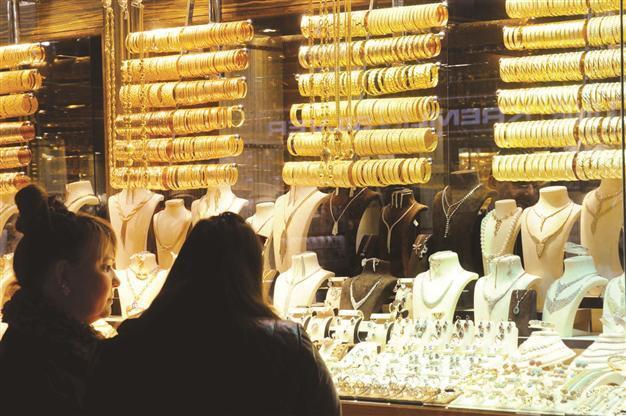

There is no visible demand fall in the market for now since there are a lot of weddings which people buy gold for, but analysts expect a sharp drop with Ramadan. DAILY NEWS photo / Hasan ALTINIŞIK

Turks, who have been seeing gold as a safe investment tool, didn’t rush to benefit from plummeting gold prices this time as they believe the fall of the metal will persist in the long-run.Gold fell below $1,200 to its lowest since August 2010 within the past week, and is on track to post its worst quarter since at least 1968 on persistent worries over the U.S. Federal Reserve’s plan to wind down its monetary stimulus.

The price of one gram of gold plummeted down to 76 Turkish Liras in the meantime.

When the price of one gram gold retreated down to 80 Turkish liras in April, people ran to buy gold, even putting the valuable metal on the black market as the mint couldn’t manage to manufacture enough gold to cover the soaring demand.

However, Turkish consumers, who have been fond of secure and traditional investment tools, seem to remain ignorant to the price fall that came after the Fed remarks.

When looking at what could possibly change in three months, the answer is people’s perception of gold.

Gold is particularly attractive for Turks, seen as a convenient instrument for saving and a real object to show wealth. The traditions also play a part in the Turks’ love of gold, as it is the traditional gift given to newlyweds during weddings or to families of the newborns.

Therefore when the gold price per gram dropped from 94 Turkish Liras to 80 liras on April 15, with a 13-14 percent decrease, people immediately rushed to buy quarter and half gold coins. The demand was high enough to raise the prices back.

In the most recent fall, one cannot observe an unusual demand like that because people believe the price of gold will fall even further.

So, they want to lose money by investing in gold.

After Federal Reserve Chairman Ben Bernanke’s indication that the U.S. central bank would soon wind down its bond-buying program, investors begun pulling money from the slumping raw material markets.

Large funds have also begun selling gold, which decreases the prices even more.

The market analysts and investors’ expectation that gold’s plunge will continue has been accepted by the small investors, citizens, as well.

This limits the demand for the gold for special occasions such as weddings which are much more often in summer season.

Despite the price fall the demand will remain low, according to Anadolu agency finance analyst Mehmet Ali Yıldırımtürk.

The only rise will be sourced by the rising number of weddings until the Ramadan but as the wedding numbers fall during the sacred month, analysts expect the demand to suddenly slow down.

When the impact of Ramadan is added to global estimation that the big investors’ sale will persist, the gold price might even fall down to 60 liras.