Gold demand drops to lowest of 4 years

LONDON - Reuters

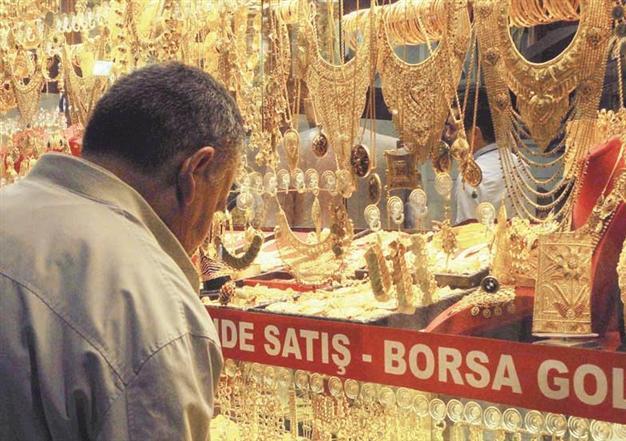

Despite central banks’ lower interest in gold, consumer demand rose. DAILY NEWS photo, Hasan ALTINIŞIK

Gold demand hit a four-year low in the second quarter, despite surging appetite for jewellery, coins and bars, as investors exited bullion funds and central bank buying more than halved, the World Gold Council said.Lower prices following a selloff in April, when spot gold dropped $200 an ounce in two days in its sharpest slide in 30 years, and another retracement in June sent bar and coin demand to record highs and jewellery buying to its strongest in nearly five years.

That consumer demand rose by more than half to 1,083 tons in the three months to end-June from a year earlier, the WGC said.

But a 402.2 tonoutflow from gold-backed exchange-traded funds - popular investment products that issue securities backed by physical gold - and a 93.4 tons drop in central bank purchases knocked overall demand down 12 percent to a net 856.3 tons, its lowest since the second quarter of 2009.

“It’s clear that this will be a down year in tonnage terms for demand,” the WGC’s managing director for investment, Marcus Grubb, said yesterday.

Gold prices have fallen by around a fifth this year, hitting a three-year low in June of $1,180.71 an ounce. They are currently at around $1,320, some $600 below their September 2011 record high of $1,920.30 an ounce.

The WGC said it expected central bank purchases this year to fall to 300-350 tons from 544.4 tonnes in 2012, after a 100-tonne drop in the first half. This year’s price volatility is likely to have affected the timing of central banks’ gold buying, Grubb said.

ETF liquidation and lower central bank demand outweighed a broad-based surge in consumer buying.

Demand in India and China, the largest consumers of physical gold, for jewellery, coins and bars soared by 71 percent to 310.0 tons and 87 percent to 275.7 tons, respectively.

China was the biggest market for gold bars and coins as demand more than doubled in the two countries. Global jewellery demand for gold, which has fallen in recent years as higher bullion prices deterred buyers, rose more than a third in the second quarter to 575.5 tons.

In the Middle East, demand for jewellery increased by a third, and coins and bar offtake by two-thirds. Turkish consumer demand rose 73 percent to 64.3 tons.