Global economy on recovery path, risks remain, IMF says

BEIJING - Reuters

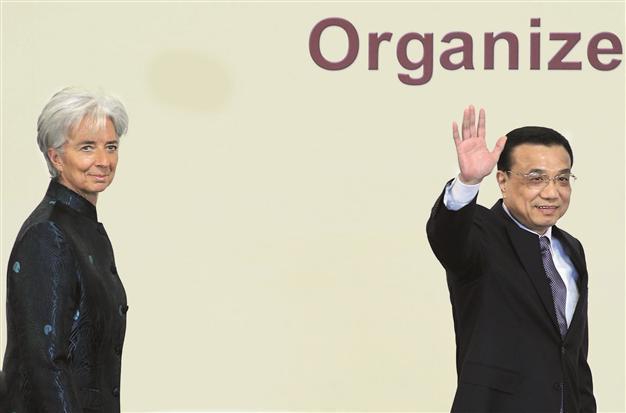

China’s vice premier, Li Keqiang (R) waves as he arrives at the China Development Forum 2012 with Christine Lagarde at the Diaoyutai State Guesthouse in Beijing. Lagarde says she sees potential for the yuan to become a reserve currency. REUTERS photo

The global economy has stepped back from the brink of danger and signs of stabilisation are zone and the United States, but high debt levels in developed markets and rising oil prices are key risks ahead, the IMF said yesterday.“The global economy may be on a path to recovery, but there is not a great deal of room for maneuver and no room for policy mistakes,” International Monetary Fund (IMF) Managing Director, Christine Lagarde, said in a speech in Beijing.

In a separate talk on the same day, Lagarde said that China’s yuan could become a reserve currency in the future, adding that the country needed a roadmap for a stronger, more flexible exchange rate system.

She said signs of stabilization were emerging to show that policy actions taken in the wake of the global financial crisis were paying off, that U.S. economic indicators were looking a little more upbeat and that Europe had taken an important step forward in solving its crisis with the latest efforts on Greece.

“On the back of these collective efforts, the world economy has stepped back from the brink and we have cause to be more optimistic. Still, optimism must not lull us into a false sense of security. There are still major economic and financial vulnerabilities we must confront,” Lagarde said.

The IMF chief cited still fragile financial systems burdened by high public and private debt persists advanced economies as the first of three major risks and said euro zone public sector and bank rollover funding needs in 2012 were equivalent total about 23 percent of GDP.

“Second, the rising price of oil is becoming a threat to global growth. And, third, there is a growing risk that activity in emerging economies will slow over the medium term,” she said.

Youth unemployment

Lagarde also said youth unemployment should be tackled and that all countries must persevere with their policy efforts if the

progress made in stabilising the global economy is to pay off with better prospects ahead.

She said advanced economies must continue with macroeconomic support and a balanced fiscal policy, together with financial sector reforms and structural and institutional reforms to repair the damage done by the crisis and to improve competitiveness.

Meanwhile emerging market economies need to calibrate macroeconomic policies both to guard against fallout from the advanced economies as well as to keep overheating pressures in check.

Lagarde’s comments on the yuan as a reserve currency were the most direct endorsement to date by an IMF official of China’s ambitions for its currency.

“What is needed is a roadmap with a stronger and more flexible exchange rate, more effective liquidity and monetary management, with higher quality supervision and regulation, with a more well-developed financial market, with flexible deposit and lending rates, and finally with the opening up of the capital account,” she told a gathering of leading Chinese policymakers and global business leaders.

“If all that happens, there is no reason why the renminbi will not reach the status of a reserve currency occupying a position on par with China’s economic status.”

Renminbi is another name for the yuan.

China operates a closed capital account system and its yuan currency is tightly controlled, although Beijing has said it wants to increase the international use of the yuan to settle cross border trade and has undertaken a series of reforms in recent years to that end.