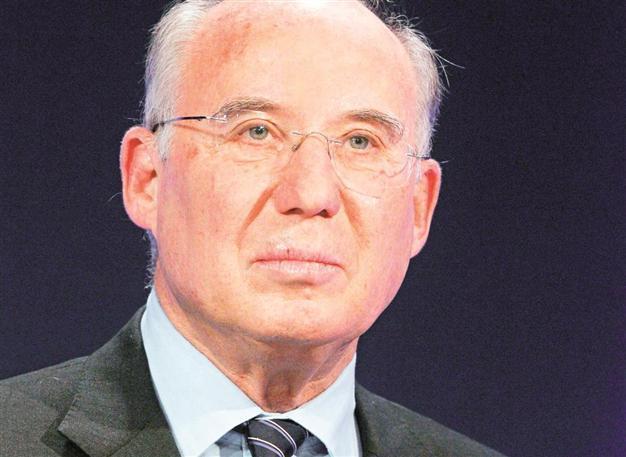

Frenkel returns as Israel’s bank chief

JERUSALEM - Reuters

Former Governor of Bank of Israel will return to its old job after decades, replacing Stanley Fischer who has been at the chair for eight years. REUTERS photo

Jacob Frenkel, an inflation hawk who was Bank of Israel governor in the 1990s, will be returning to the helm of the central bank, Prime Minister Benjamin Netanyahu and Finance Minister Yair Lapid said on June 23.They appointed Frenkel to replace Stanley Fischer, who is stepping down at the end of June after eight years on the job, having guided Israel’s economy through the global financial crisis.

Frenkel, 70, beat deputy governor Karnit Flug, who will likely be acting central bank chief until Frenkel starts. The date of his arrival was not announced.

“He is a world renowned figure, which is what Netanyahu was looking for,” said HSBC economist Jonathan Katz.

As governor between 1991 and 2000, Frenkel was credited with reducing inflation, liberalizing financial markets and removing foreign exchange controls. He is currently chairman of JPMorgan Chase International and also served as vice chairman of insurer American International Group as well as chairman of Merrill Lynch International. Frenkel also is the head of the Group of Thirty, a private consulting group on international and financial issues.

“We are certainly talking about a governor who will act as the responsible adult, who will fill the position of Fischer with quality and authority,” said Joseph Fraiman, chief executive at Prico Risk Management and Investments.

“No less important, Frenkel will benefit from the international credit that is greatly needed for the Israeli economy, especially in the current period,” he added.

Frenkel, whose appointment needs cabinet approval, will face several challenges including continuing Fischer’s insistence that the government stick to responsible policies and working to halt fast-rising home prices.

Israel’s economy grew 3.2 percent in 2012, but is expected to slow to a 2.8 percent this year excluding the start of natural gas production.

Inflation, which ranged between 1.3 and 18 percent in the 1990s, was at an annual rate of 0.9 percent in May.