Farewell rebalancing, welcome growth

Friday’s February budget figures paint a pretty good picture of where the Turkish economy is heading.

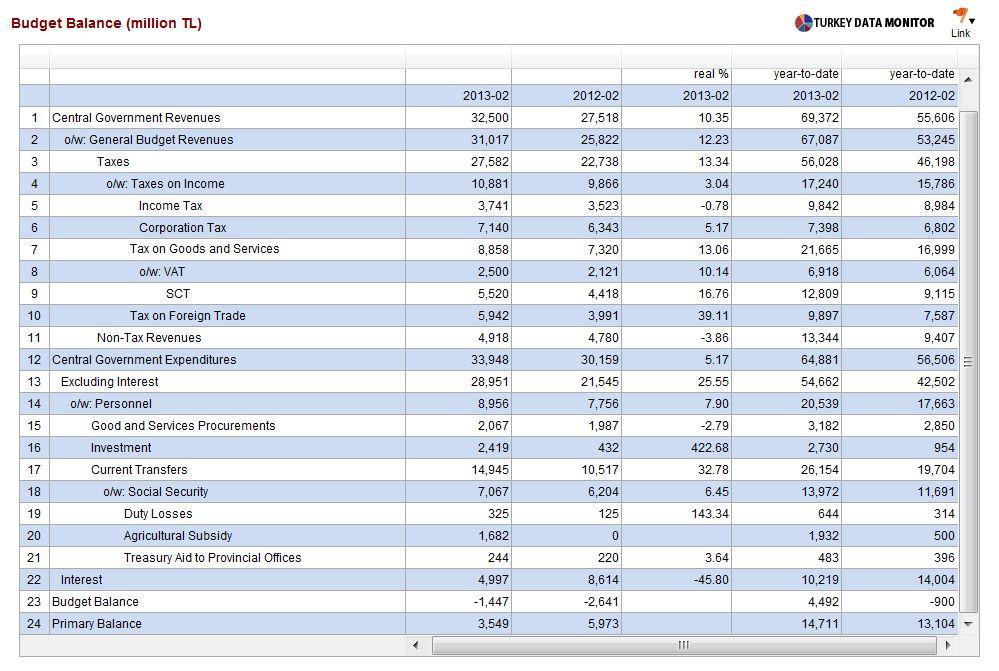

Friday’s February budget figures paint a pretty good picture of where the Turkish economy is heading.At first look, the data seem to be strong. The central government budget deficit turned out to be 1.4 billion Turkish Liras, much better than February 2012’s 2.6 billon liras. But this improvement is mainly due to the fall in interest expenditures. In fact, the primary balance, which excludes interest payments, turned out to be 3.5 billion liras, significantly lower than last February’s 6 billion liras.

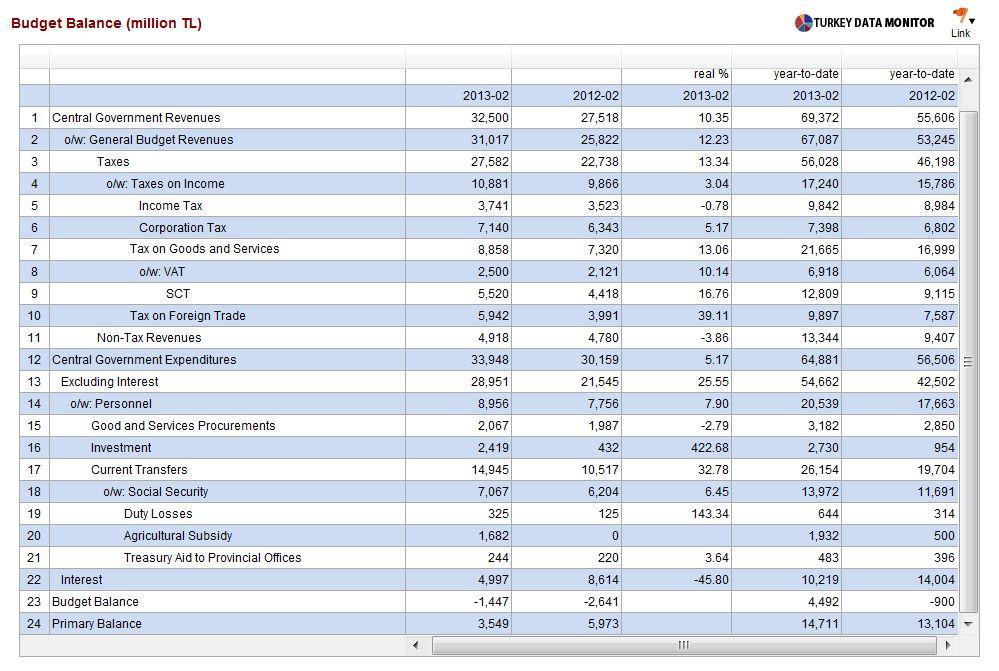

To get a more accurate picture, it is better to look at expenditures and revenues separately. Tax revenues rose 13.3 percent in real terms (taking out inflation) compared to the same month of last year. The rise in noninterest expenditures was 25.6 percent, whereas interest expenditures contracted 45.8 percent.

Monthly budget data could be distorted by several factors. For example, tax revenues sometimes shift from one month to the next. It is therefore useful to look at three-month moving averages. That calculation reveals that taxes and non-interest expenditures are growing almost at the same pace, 19.9 percent versus 19 percent annually.

By looking at the growth of different types of taxes, it is possible to get an idea on the pace of economic recovery. Value added taxes rose 10.1 percent yearly in real terms, and the annual real growth in special consumption taxes turned out to be 16.8 percent. These figures hint at a pickup in economic activity, but they could also be distorted by the tax hikes of October 2012 and January 2013.

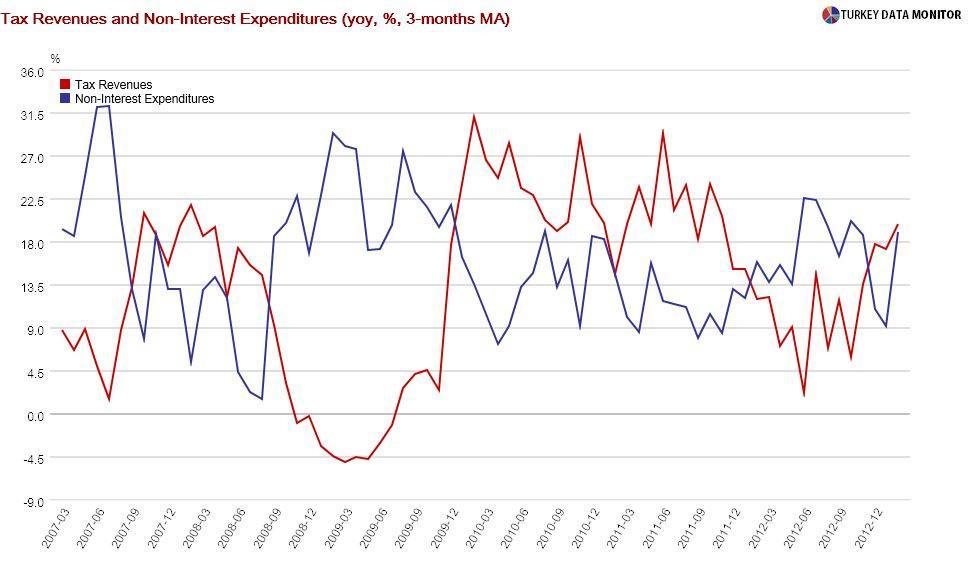

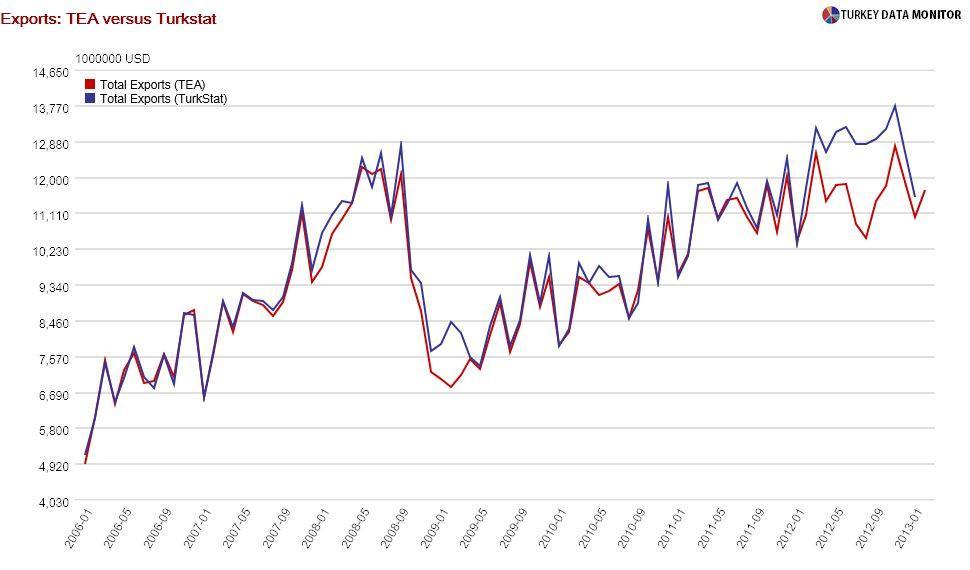

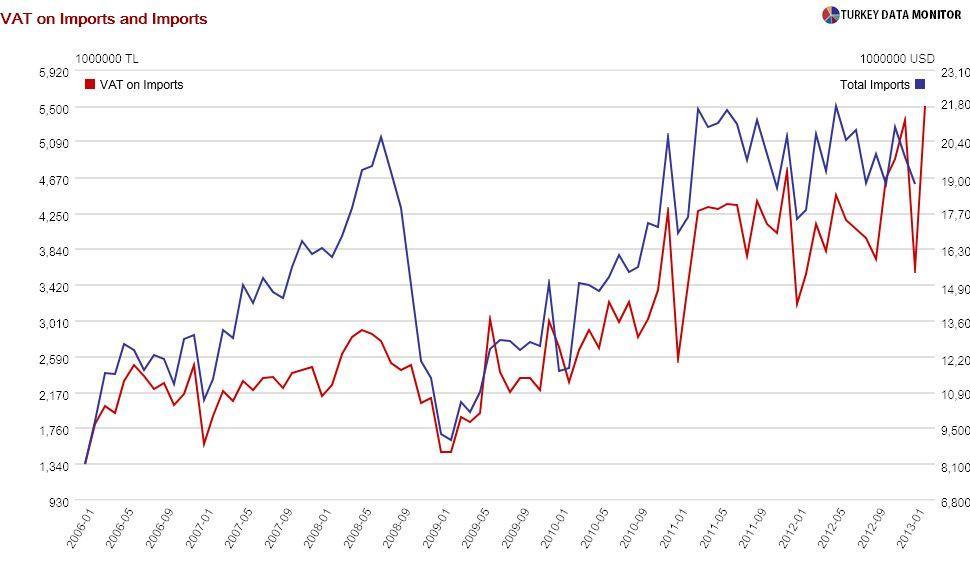

Taxes on foreign trade were not subject to such changes, and value added taxes on imports rose a whopping 44.7 percent, leaving little doubt that the economic recovery is underway. However, they also confirm that the shrinking of the current account deficit, i.e. the well-known rebalancing that has been going on for the past year, has ended.

Preliminary exports data from the Turkish Exporters Association are usually good predictors of the official figures. And while they are not as good leading indicators, import taxes could be used to forecast actual imports. A little econometrics reveals that the monthly trade deficit could turn out to be as high as $10 billion in February, significantly higher than February 2012’s $6 billion, when the official figures are released on March 29.

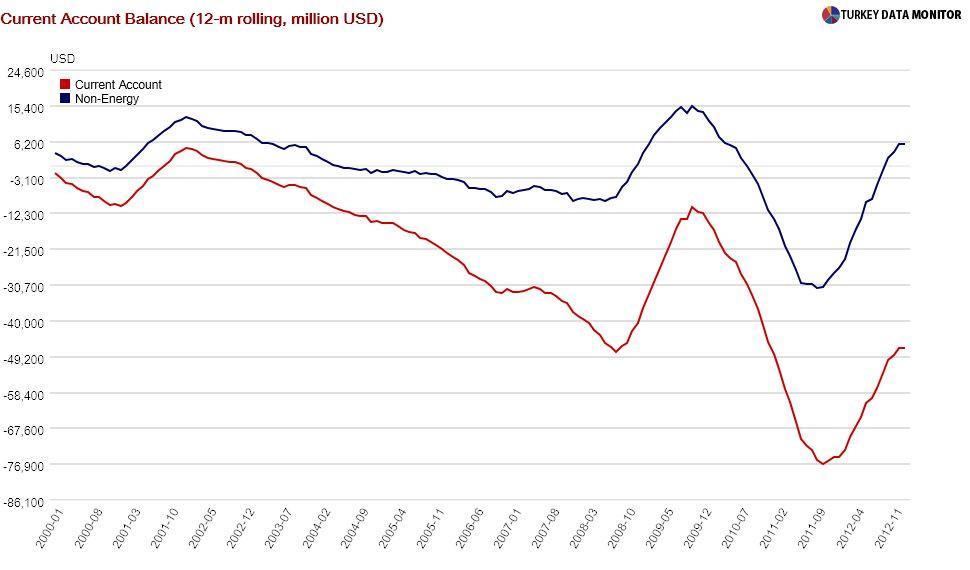

As I mentioned in my last column, tourism revenues are one of the major items in the balance of payments. Therefore I would need the February incoming and outgoing tourist numbers, which will be released on March 26, to forecast the month’s current account deficit, but it is very likely to be higher than February 2012’s $4.3 billon. Then, the rebalancing going on since the end of 2011-beginning of 2012 would officially be over.

It is encouraging to see signs of economic recovery in the budget figures. It is unfortunate that it will be accompanied by a rise in the current account deficit. So much for the rebalancing; it is business as usual in Turkey.