Euro hits two-year low on talks of Greek exit

LONDON - Reuters

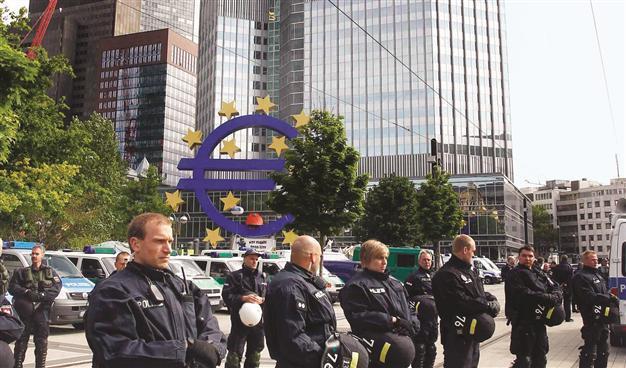

German riot police stand by the headquarters of the European Central Bank (ECB) during an anti-austerity demonstration in Frankfurt May 18. REUTERS photo

The euro hit a fresh 22-month low and European shares gave up early gains yesterday after data showed Europe’s economic slump has worsened, as talk of a Greek exit and a lack of progress in tackling the debt crisis hits business confidence.Germany’s manufacturing sector shrank at the fastest rate in three years in May, the Markit manufacturing Purchasing Managers

Index (PMI) showed, as both exports and new orders coming into factories declined.

“May’s drop in manufacturing production was the steepest in nearly three years and the current period of falling new orders now almost matches the length, though not the depth, of the contraction in 2008/09,” Tim Moore, senior economist at Markit, said.

German business sentiment has also dropped for the first time in seven months, missing even the most conservative forecasts, the Munich-based Ifo think tank said.

PMI data for the whole euro area, showing activity was declining at a faster pace than expected, confirmed the view that a downturn which started in smaller periphery members is taking root in the core countries of Germany and France, whose tepid growth had been keeping the troubled bloc afloat.

Euro at $1.2540

German Bund futures, which have tracked the flight to safety by investors, rose to record highs after data and a rush by investors into dollars pushed the currency’s index against other major currencies to its highest level in 20 months, rising 0.2 percent 82.25.

The euro dropped to $1.2540, its lowest level since July 2010.

German 10- and 30-year bond yields also hit record lows and UK Gilt futures, another safe haven, rose to a contract high of 119.77.

Market sentiment was already fragile ahead of the data after a meeting of European Union

leaders, who have been advised by senior officials to prepare

contingency plans in case Greece decides to quit the single currency, shed no new light on what euro zone nations plan to do, leaving the threat of a Greek exit hanging over markets.

“Rising economic uncertainty in Europe and the lack of a policy response are proving too much for the market to handle,” analysts at Barclays Capital said in a note.

The FTSE Eurofirst index of top European shares, which had opened up 0.5 percent, gave up its gains to be down slightly at 971.90. The wider MSCI world equity index fell 0.1 percent to 299.49.

British recession deepens as GDP shrinks

LONDON – Agence France-Presse

Britain’s recession is worse than previously thought, as revised official figures showed yesterday that the economy shrank by more than expected in the first quarter of this year.

Gross domestic product (GDP) fell 0.3 percent between January and March, which was worse than the previous estimate for a 0.2-percent contraction, Britain’s Office for National Statistics (ONS) revealed in a statement yesterday.

The British economy has now returned to a technical recession, defined as two successive quarters of contraction, after shrinking by 0.3 percent in the final three months of 2011.